Reducing Both Tax Rates and the Deficit Is Possible

Over the past few years, bipartisan agreement has begun to form around approaches to tax reform that take a broad approach to reducing or eliminating many tax expenditures and using those savings to both reduce tax rates and the deficit. Proposals from the Domenici-Rivlin Task Force and the Simpson-Bowles Commission were able to bridge the gap between both sides of the aisle on tax reform by following this approach. While everyone may have their own ideal way to solve our fiscal challenges, it's also important to consider what can actually generate bipartisan support and become law.

In recent weeks, however, there have been a few statements about how substantial deficit reduction cannot occur with reductions in actual tax rates. In a speech yesterday, which we summarized in a quick blog post, Senator Charles Schumer (D-NY) argued that since there is a need to reduce deficits and debt, reducing rates cannot be the focus, drawing a contrast with the revenue-neutral tax reforms enacted in 1986 that reduced rates.

So can policymakers actually reduce the deficit and marginal tax rates by a significant amount? Let's take a look.

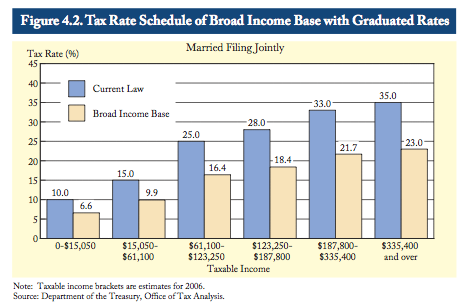

In 2005, Department of Treasury estimates for the President's Advisory Panel on Federal Tax Reform found that eliminating all tax expenditures, which now total more than $1 trillion in lost revenue for the federal government (according to OMB), could reduce marginal tax rates by over one-third. That would mean the bottom rate could fall from 10 percent down to 6.6 percent and the top rate could fall from 35 percent down to 23 percent. The Simpson-Bowles Fiscal Commission also showed in their zero plan, which wiped away all tax expenditures, that the top tax rate could get down to 23 percent.

But the Treasury data above isn't all about reducing tax rates -- it also assumed that some of the revenue raised would pay for the elimination of the AMT, which in today's terms would translate into offsetting the costs of AMT patches for the next decade. By our calculation, doing so would raise over $1 trillion in revenue through 2022, showing that both rate reduction and deficit reduction can go hand in hand.

In addition to the Treasury analysis, the Joint Committee on Taxation has also studied the impact of broad-based tax reforms that reduce rates. The study from 2006 finds that the broad-based reforms JCT looked at were sufficient to reduce the top tax rate down to 27 percent while also raising significant new amounts of revenues. While the overall findings are similar, the assumptions JCT's analysis used were not the same in that it preserved several tax preferences (including preferential rates for capital gains and dividends, the Earned Income Tax Credit, retirement provisions, and other smaller measures) and also raised much more revenue than the tax reform scenario the Treasury Department analyzed.

Lastly, two bipartisan proposals put forward over the last two years would both raise at least $1 trillion in new revenues by reducing tax expenditures and reducing tax rates. The Domenici-Rivlin Task Force raised $2.3 trillion through 2020 through comprehensive reforms combined with a reduction in tax rates to 15 and 29 percent. The Simpson-Bowles Illustrative plan called for $1 trillion in new revenues by 2020 through base-broadening combined with consolidated and reduced tax rates of 12, 22, and 28 percent.

From a review of the past studies and budget proposals, it is certainly possible to reform the tax code to lower tax rates and the deficit. Even though it is technically very feasible, there is no guarantee that we will make the tough choices needed to make these kinds of reforms a reality. But given the interest among so many policymakers to reform the tax code, enact at least $4 trillion in deficit reduction, and reach bipartisan agreement, CRFB is optimistic about the ability of our elected leaders to make the tough decisions. Tax reform that follows approaches already adopted by bipartisan groups of current lawmakers and experts is a very promising route to receiving broader support.