Blahous: "The End of Social Security Self-Financing"

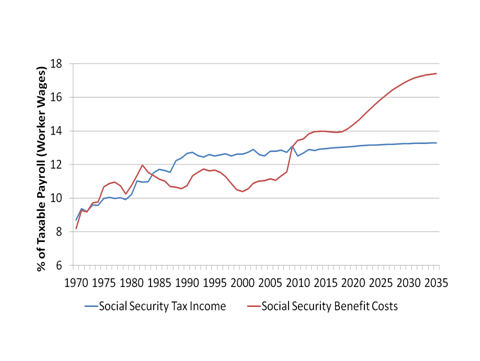

The Mercatus Center has released a new paper by Social Security Trustee Charles Blahous entitled "The End of Social Security Self-Financing." In the paper and an accompanying article, Blahous writes of the challenges faced by Social Security in continuing to finance its benefits with revenues from the payroll tax. Blahous argues that the transfer of general revenues to the Social Security Trust Fund in the payroll tax cut that's been in place for the last two years is a break from the self-financing precedent.

The Social Security Trust Funds will be exhausted by 2033, at which point the program faces an abrupt across-the-board cut in benefits to cover the gap. However, recent transfers from general revenues could blurr the lines between the program's finances and the Treasury's, possibly spelling harm, according to Blahous, for both the program and the federal budget by making reforms more difficult to enact.

Blahous writes about the long history of Social Security self-financing, how it is unlike other elements of the safety net, and how Social Security was intended to be a pension program with funds linked to lifetime contributions. By linking benefits to contributions from the payroll tax, Social Security was never to compete with other spending programs.

Source: Blahous

Social Security solvency can still be achieved, however, but only if lawmakers are willing to make the program's future a priority. We have talked before about some possible combinations of changes, including raising the retirement age, raising the payroll tax cap, or changing benefits to grow by the index of "chained CPI." These might be politically difficult choices, but it is important to recognize that shifting the burden of Social Security to the general budget will force equally difficult choices in other areas.

Whatever combination of policies lawmakers believe is the solution, they need to make the tough choices in a bipartisan way while working to protect the people who rely on the program the most. General fund transfers that are not paid for should be avoided. Social Security can certainly continue to be self-financing, but lawmakers are going to need to put everything on the table.