Typical Couple Will Lose $25,000 of Social Security from WEP/GPO Repeal

Lawmakers are considering the repeal of Social Security’s Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). Not only would this repeal unfairly expand windfall benefits by allowing some beneficiaries to effectively double-dip from Social Security and their state or local alternative, but it would also advance Social Security insolvency by roughly half a year and increase the legally required across-the-board cut by about 5 percent. As a result, we estimate WEP/GPO repeal would lead to an additional $25,000 of lifetime benefit cuts for a typical couple retiring in 2033.

WEP and GPO were enacted to prevent Social Security from overpaying individuals that collect state and local pensions – which they paid into in lieu of paying Social Security taxes. If repealed, the expanded windfall benefits for these individuals would cost nearly $200 billion over a decade, boost Social Security’s costs by roughly 1 percent, and advance the program’s insolvency date by about half a year, according to the Congressional Budget Office (CBO).

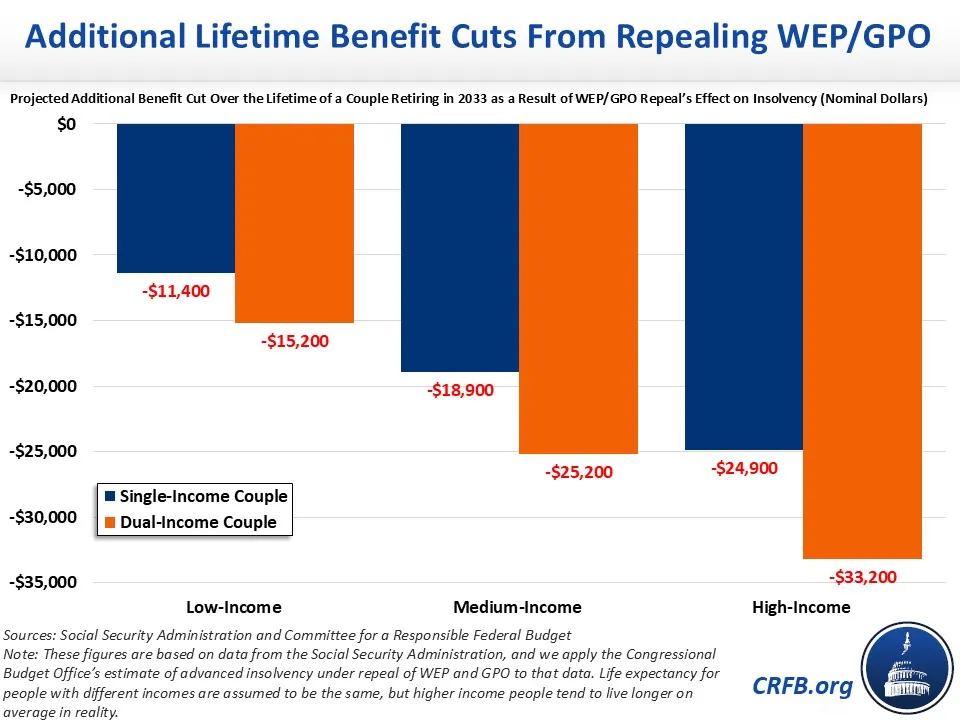

As a result, we estimate a typical dual-income couple retiring in 2033 would see their benefits cut by an additional $25,000 over their lifetime, with over $8,000 of that additional cut coming in the roughly half a year of advanced insolvency. This would bring the total cut resulting from insolvency to roughly $400,000 over the couple’s lifetime. Additional cuts would be larger for higher income couples and a larger share of income for lower income couples.

Importantly, these figures are in nominal dollars, as beneficiaries would experience cuts as they occur. Adjusted for inflation in 2025 dollars, the added lifetime cuts resulting from WEP and GPO repeal would be less than $20,000.

Rather than repealing WEP/GPO and adding roughly $200 billion to Social Security’s shortfall, lawmakers should reform them. The current system overpays some beneficiaries while underpaying others — thoughtful reforms such as those proposed by President Obama or the late Congressman Sam Johnson (R-TX) could fix this while improving trust fund solvency. We encourage lawmakers to pursue solutions to Social Security’s looming insolvency and not further worsen the program’s finances.