What Works and What Doesn't for Deficit Reduction

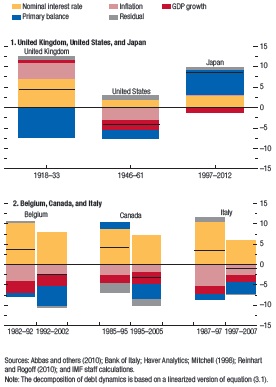

The IMF's most recent World Economic Outlook has a very helpful chapter looking at six case studies on countries who have dealt with a high debt burden. However, unlike our "Fiscal Turnarounds" paper from a few years ago, not all of these cases are success stories (and only one case overlaps with our paper). The six countries the IMF examines are those whose gross debt exceeded the size of its economy at one point: Great Britain post-World War I, the United States post-World War II, Belgium in the 1980s and 1990s, Canada in the 1980s and 1990s, Italy in the 1990s, and Japan in the 1990s and 2000s. From these countries, the IMF draws four lessons for deficit reduction.

Coordination Between the Fiscal and Monetary Authorities

According to the report, the first key to deficit reduction is that fiscal and monetary policy must be coordinated in a way that minimizes harm to economic growth. Specifically, looser monetary policy, within reason, is better during fiscal consolidation than tight monetary policy for two reasons. First, a looser monetary policy can compensate for tighter fiscal policy and improve growth, which is essential to the success of deficit reduction. Second, the channel most often used in monetary policy, interest rates, affects how much interest a country must pay on its debt.

In the U.S.'s case, due to expectations of a dip back into depression after WWII, the Federal Reserve maintained an accomodative monetary policy into the 1950s. The result was higher inflation, which in conjunction with relatively high growth and consistent surpluses helped reduced the debt burden sharply in the years immediately following the war.

On the other hand, Great Britain, and to a lesser extent Japan, maintained a monetary policy that was too tight, which, combined with other factors, led to failure to reduce debt as a percent of GDP. Great Britain returned to its pre-war gold standard, while the Bank of Japan was unable to keep the Japanese economy out of deflation consistently. Both countries stagnated over subsequent years, as debt continued to rise even despite Great Britain's large primary (non-interest) surpluses in the 1920s (Japan stayed in deficit).

Making Deficit Reduction Stick

The second key the report identifies is to ensure that deficit reduction measures are permanent and structural, and a framework is put in place to ensure savings materialize. In this case, Belgium and Canada prove to be good examples. Both moved to reduce structural deficits starting in the 1980s, but neither were initially successful due to unfavorable economic conditions and Canada's cuts being temporary in nature. In the 1990s, a second round of fiscal consolidation in both countries focused more on structural budget reforms, such as with pensions, and included fiscal rules to keep future budgets in line.

Italy is a more mixed example. They were able to successfully implement debt reduction measures in the 1990s; however, many of the measures were temporary and the appetite for deficit reduction waned, leading to debt leveling off in the 2000s. The high debt that remained left Italy somewhat poorly equipped to deal with the Great Recession.

Exports Matter

One factor that's often out of the control of policymakers is the level of exports and the competitiveness of a country's products abroad. Currencies can be depreciated so as to make exports more attractive in foreign markets. But often times, the favorability of exports to deficit reduction efforts is determined elsewhere. Belgium, Canada, and Italy all benefited by varying degrees from higher levels of exports, which was due to both currency depreciations or devaluations and favorable economic environments abroad in the 1990s.

Persistence, Persistence, Persistence

The IMF notes that having a major fiscal turnaround doesn't happen overnight (that goes for you, fiscal cliff). In the international context, reducing the primary deficit by one percentage point of GDP per year is considered rare (and may be undesirable, depending on the circumstances). Even the successful cases highlighted here were at or below that mark over their best ten years. Thus, being persistent and patient with deficit reduction is important.

The graph below shows how different factors contributed to or undermined a country's debt reduction efforts.

The conclusions to be taken from the IMF case study are simple ones: deficit reduction should be structural and made to stick over a long period of time. Meanwhile, policymakers should do their best to create an environment conducive to economic growth in both fiscal and other economic policies.