The Zero Plan Re-Emerges in the Tax Reform Debate

According to press reports today, Senate Finance Committee Chairman Max Baucus (D-MT) and Ranking Member Orrin Hatch (R-UT) are about to take a very encouraging step on tax reform this morning, releasing a letter to their colleagues to inform them that the Committee will follow the Fiscal Commission's "Zero Plan" approach to tax reform this year. We’ve talked about this approach in the past, but we will review it to show where the idea came from, its potential benefits, and where the conversation might lead to next.

What’s the “Zero Plan”?

Under the "Zero Plan," lawmakers first begin by eliminating all individual and corporate tax expenditures and reducing rates accordingly to meet a revenue target. Then, lawmakers must justify which tax preferences, if any, to add back in, keeping in mind that tax rates would have to rise in order to offset any costs. Thus, the Zero Plan is the "clean slate" from which the construction of the new tax code then proceeds.

The Zero Plan was proposed by Erskine Bowles and Al Simpson and ultimately adopted by a majority of the 2010 Fiscal Commission as an approach to both reduce tax rates and raise revenue. Prior to that, other tax reform efforts engaged in similar exercises, including as part of the 1986 tax reform effort and 2005 Tax Panel. The 2005 Tax Panel found that the top rate under this approach could be reduced from (at the time) 35 percent to 23 percent while still leaving room to pay for a permanent Alternative Minimum Tax repeal.

What Are the Potential Benefits?

The corporate and individual tax codes are riddled with close to 200 tax expenditures. These preferences cost the federal government roughly $1.3 trillion in lost revenue each year while making the tax code more complex, hurting the economy by distorting people’s behavior, and increasing yearly deficits and debt. Most advocates of tax reform agree that we should reduce these tax preferences either to lower marginal tax rates, cut deficits, or both. The Zero Plan approach makes this outcome much more likely to occur by putting the onus on advocates of tax preferences to justify them and forcing lawmakers to come to terms with the trade-off between adding back these preferences and keeping rates low.

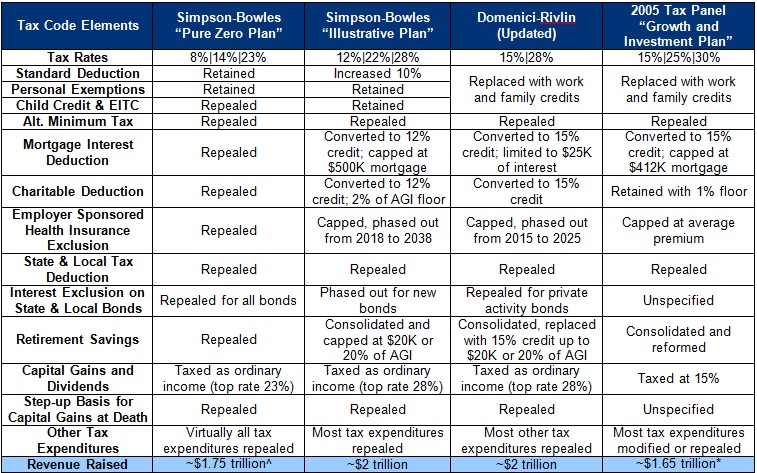

By eliminating, reducing, or replacing many of the costliest tax expenditures, the Simpson-Bowles plan, the Domenici-Rivlin Debt Reduction Task Force, and the 2005 President's Advisory Panel all were able to reduce the top rate to below 30 percent while providing $1 to 2 trillion for deficit reduction.

Note: Revenue estimates are pre-fiscal cliff deal and would be different now due to the different baseline

Why This Effort is Encouraging

The process that Senators Baucus and Hatch are about to outline today paves the way for a comprehensive overhaul of the tax code with a bipartisan framework for the reform process. Senators would have until the end of July to submit detailed requests for tax preferences to be considered in the reform process. The Finance Committee will then develop a bill to be marked up in the fall, with the goal of lowering marginal tax rates and simplifying the code.

To be sure, the process will still be fraught with political and economic complications, but we seem to be heading toward in the right direction. You can try your hand at solving the riddle on the corporate side with our corporate tax tool.

Surely, a “zero plan” approach would eventually lead to some tax preferences being added back in. Lawmakers should be mindful that any provisions added back in would have to be paid for with higher tax rates and would lead to less base-broadening. Importantly, popular tax breaks like the mortgage interest deduction and charitable deduction need not be completely eliminated, as there are many options that can better encourage vital goals while also raising revenue.

The bipartisan nature of the proposal that reportedly will be put forward in today’s dear colleague letter will hopefully open the door for a real conversation about the hard choices we need to make to ensure our fiscal future.

Further Reading

Release: CRFB Praises Senators Baucus and Hatch for Tax Reform Approach

Overview

- Tax Reform: Reducing Tax Rates and the Deficit

- Joint Committee on Taxation Releases Latest Estimates of Tax Expenditures

- The Distribution of Major Tax Expenditures in the Individual Income Tax System (CBO)

- Reforming the Corporate Tax Code

- Corporate Tax Reform Calculator

Replacements and Redesigns for Major Tax Expenditures

- Retargeting Tax Expenditures (Includes Summary Table of Replacement Options)

- Don't Take the Health Exclusion Off the Table

- TPC Finds Little Price Shock for Reforming the Mortgage Interest Deduction

- Options for Reforming the Charitable Deduction

- Thinking Broadly: TPC's Analysis of Limits on Tax Expenditures

Tax Reform Plans