Thinking Broadly: TPC's Analysis of Limits on Tax Expenditures

There is a clear consensus across the political spectrum that reforming the tax system will require going after the many tax expenditures that litter the code. However, many observers have commented that political difficulties could derail the process or signficantly scale back reform efforts. But some have also observed that a uniform limit applied to certain tax expenditures may be a more politically expedient option than going after specific ones. This approach garnered particular attention during the 2012 Presidential campaign when Republican candidate Mitt Romney floated the idea of a cap on deductions. It also became part of the discussion during the fiscal cliff negotiations as a way to raise revenue.

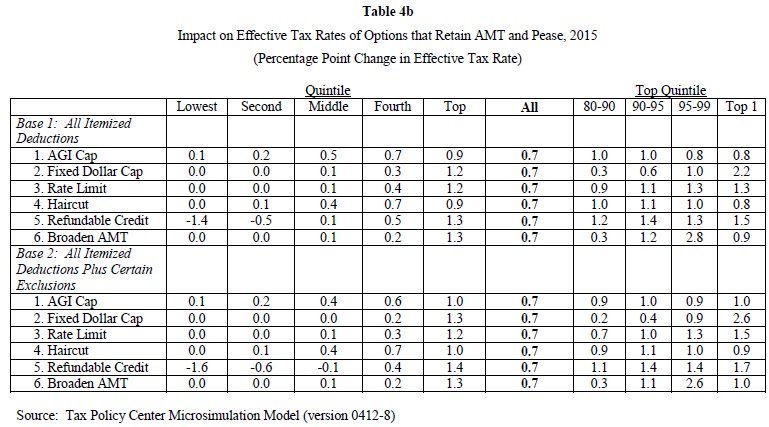

Tax Policy Center has now added to the discussion with its latest paper "Evaluating Broad-Based Approaches for Limiting Tax Expenditures" by authors Eric Toder, Joseph Rosenberg, and Amanda Eng. The paper looks at a number of different tax expenditure limitations, many of which were included in our revenue options report, and evaluates them on the revenue raised and the distribution of the tax change. The six limitations they examine are:

- A percent of income cap (like the Feldstein-Feenberg-MacGuineas cap)

- A fixed dollar cap (like Gov. Romney mentioned)

- A "rate limit" on the value of preferences (similar to the President's budget)

- A percent "haircut" in preferences

- Replacing each preference with a refundable credit

- Including preferences in the Alternative Minimum Tax (AMT)

The authors model a number of scenarios with these six limitations. They show what the effect would be of applying these to just itemized deductions, and also to the health insurance exclusion and the exclusion for interest earned on municipal bonds. They also evaluate the provisions if they are enacted in conjunction with a repeal of the AMT and the "Pease" limit which indirectly phases out itemized deductions for high earners (the limits are made less generous when these repeals are included to replace the lost revenue.

Given the specific parameters the authors choose, each proposal raises between $1 and $1.2 trillion of revenue over ten years. In terms of progressivity, the refundable credit is the most progressive, since it actually cut taxes for the bottom two quintiles while raising them the most on the highest quintile. Most options effectively hold the bottom two quintiles harmless since they would either not hit the specified limit or they do not benefit much from itemized deductions or the exclusions in the first place.

From a policy standpoint, it would be better to evaluate each tax expenditure and decide whether to reform, retain, or eliminate it. But the political appeal of using a broad-based limit is clear as well. At the least, the TPC paper shows that these kind of limits can both raise a significant amount of revenue and be prgoressive. As House Ways and Means Chairman David Camp (R-MI) and Senate Finance Chairman Max Baucus (D-MT) move forward with their efforts to reform the tax code, they may serve a useful purpose either as a primary reform or as a backstop to a more sweeping tax reform plan.