Options for Reforming the Charitable Deduction

The Urban Institute has a new report on the charitable deduction (co-authored by CRFB board member Eugene Steuerle) that details some options for reforming it. The charitable deduction, which has existed since 1917, is one of the largest tax expenditures in the code. The Joint Committee on Taxation estimates that from 2011 to 2015, it will result in about $245 billion of foregone revenue.

The Urban report looks at a variety of reforms to the deduction. They group the reform options into four categories: caps, floors, credits, and grants. They summarize seven different options:

- Limiting the value of itemized deductions to 28 percent (including the charitable deduction) for people making over $250,000

- Capping the total benefit taxpayers receive from all tax expenditures, including itemized deductions, at 2 percent of adjusted gross income (this proposal is one that CRFB president Maya MacGuineas has proposed alongside Martin Feldstein and Daniel Feenberg).

- Create a 2 percent of AGI floor for the charitable deduction and a cap of 15 percent.

- Create a 1 percent of AGI floor or a $210/420 floor.

- In lieu of a deduction, allow all taxpayers a tax credit equal to 12 percent of their donations, subject to a 2 percent adjusted gross income floor. (this option is from the Simpson-Bowles commission).

- In lieu of a deduction, allow a 25 percent tax credit.

- In lieu of a deduction, provide charities an amount equal to 15 percent of a donor's contribution.

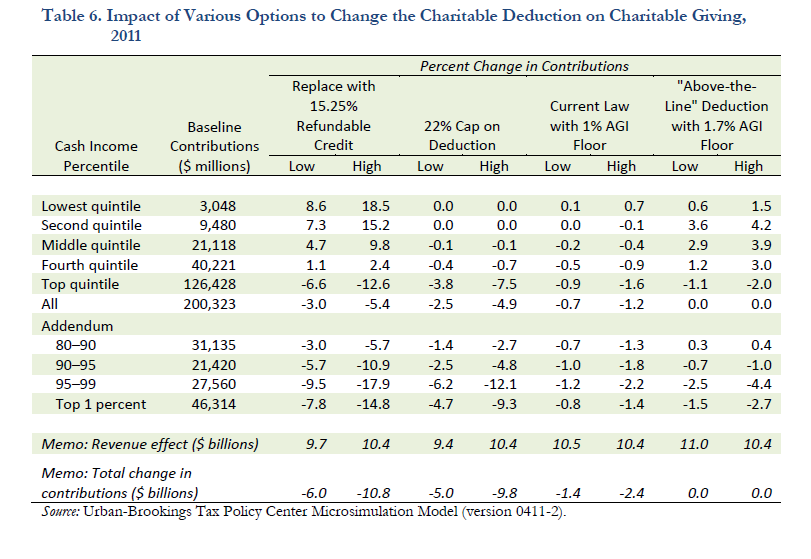

The Urban analysis notes that looking solely at the amount of revenue raised does not represent the full impact of each policy. They provide the following table of options that raise roughly the same amount of revenue, but have different effects on the total amount of charitable giving.

As the table shows, the floors have the least effect on total contributions, while converting the deduction into a refundable credit could lower total contributions by as much as $11 billion. However, since the refundable credit--as opposed to the deduction--is far more likely to be available to lower- and middle-income people, the lower four quintiles show significant increases in contributions.

The report is very informative in terms of the trade-offs that policymakers face if they seek to limit the deduction. The goals of progressivity, raising revenue, and maintaining charitable giving tend to bump into each other, so lawmakers will have to choose wisely.