Retargeting Tax Expenditures

As Senator Finance Chairman Max Baucus (D-MT) and Ranking Member Orrin Hatch (R-MI) continue to work through tax reform using their "blank slate" approach, their Senate colleagues have 11 days left to submit “add-backs.” As we’ve written before, many tax preferences are expensive, regressive, economically distorting, and do not pass the cost-benefit analysis.

Surely, though, policymakers will want to add back some of the more popular tax preferences and when they do they should find ways to redesign them to be better targeted. Fortunately, lawmakers do not need to start from scratch in designing these add-backs. We’ve written in the past about more efficient ways to design mortgage interest deduction, the charitable deduction, and employer health exclusion.

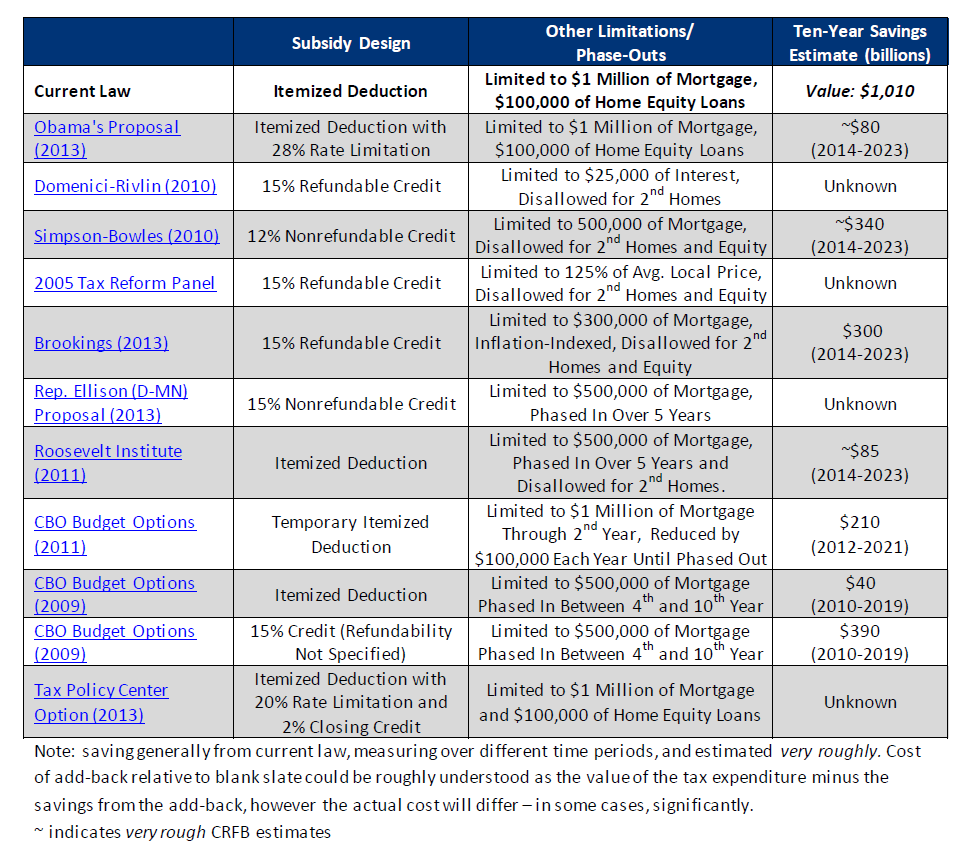

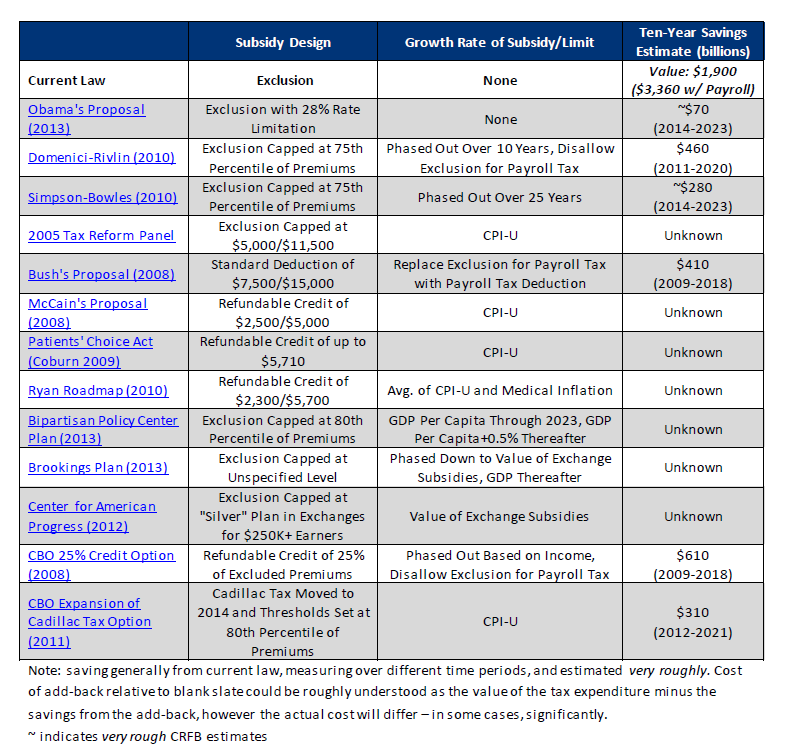

In the tables below we’ve compiled many of these options along with ten-year budget estimates (or our own rough guestimates) offered at the time. Note that these estimates are compared to current law, not a blank slate, and they are very rough since they use different ten-year windows and estimated against different baselines, with different pieces of legislation enacted since the estimate was calculated.

First, we take a look at the mortgage interest deduction, which in theory promotes homeownership, but in reality largely subsidizes the construction of more expensive homes and benefits higher-income earners. Some proposals would add limitations to the current deduction including not allowing it to be used for second homes and home equity loans, while others would redesign the provision such as turning it into a refundable or nonrefundable credit. A unique option from Tax Policy Center could reduce the tax expenditure's value while increasing house prices as well.

Options to Reform the Mortgage Interest Deduction

[Click to expand and for links]

Like the mortgage interest deduction, the charitable deduction also intends to promote a desirable goal, in this case increasing contributions to charities. However, it may be subsidizing donations that would have been made anyways and only benefits those who itemize, mostly higher-income earners. Popular reform approaches include turning the deduction into a credit or creating a floor to limit the "windfall" provided to taxpayers.

Options to Reform the Charitable Deduction

[Click to expand and for links]

There are a number of options for addressing the health exclusion, both within the income tax and the payroll tax. Options include turning the exclusion into a credit, capping the exclusion as a percentage of premiums, linking the exclusion to the Affordable Care Act exchanges, and other reforms.

Options to Reform the Health Exclusion

[Click to expand and for links]

By no means is this a complete list of proposals to replace the three tax expenditures, but it shows that many plans have come up with viable ways to make these provisions more efficient. Provisions to promote homeownership, charitable contributions, and employer contributions to health insurance may be kept in a reformed tax code, but hopefully lawmakers will look at the alternatives to current provisions and maximize fairness and efficiency while reducing their costs.