Murphy-Corker: A Responsible Solution for Highways and an Irresponsible One for Tax Extenders

Senators Chris Murphy (D-CT) and Bob Corker (R-TN) announced a proposal this week to close the Highway Trust Fund (HTF) shortfall by increasing the gas tax by 12 cents a gallon over the next two years and indexing it to inflation. As we highlighted in our transportation paper this week, Congress should come up with a long-term solution to permanently solve the structural imbalance between current spending from the HTF and dedicated revenues into the HTF. The Murphy-Corker proposal is the only bipartisan proposal thus far that would do so, and it represents a significant step forward in the discussion about addressing the HTF shortfall.

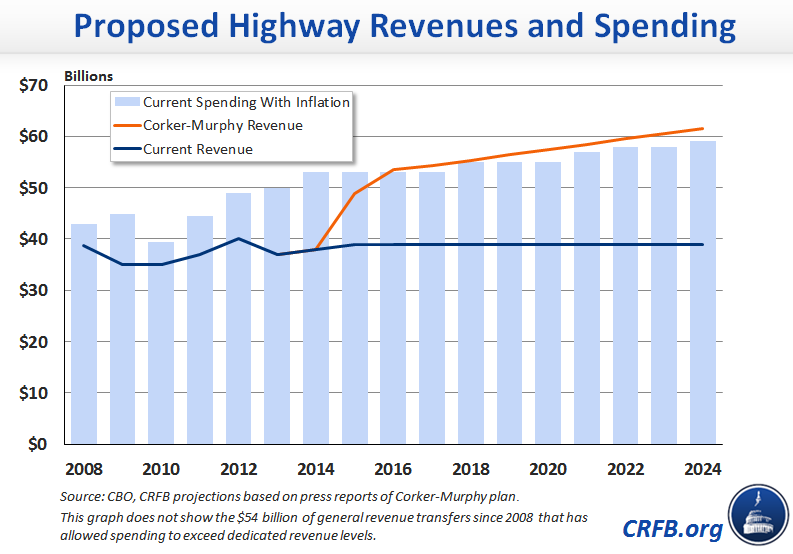

The proposal would increase the gas tax by six cents in each of the next two years, boosting the current rate from 18.4 cents per gallon to 30.4 cents per gallon by 2016, which is equivalent to 1993 inflation-adjusted levels. It would also index the gas tax to the Consumer Price Index (CPI) thereafter so it would reach approximately 37 cents by 2024. This tax increase would generate about $180 billion in net new revenue.[i]

The new revenue would be more than enough to cover the $170 billion projected highway shortfall. Unlike other proposals that rely on general revenue transfers or depositing revenues from temporary revenue increases, the Murphy-Corker proposal would provide real additional resources to the HTF to fully fund it and restore its integrity as a user-pays, self-financed program. This proposal essentially follows the recommendation of the Simpson-Bowles fiscal commission to increase gas tax revenues to match projected spending. If Congress disagrees with this approach, our transportation paper lists a number of other options to reduce the shortfall, including options to reduce spending and increase current sources of revenue, as well as new revenue sources for the HTF.

Unfortunately, the Senators' proposal also calls for $190 billion in deficit-financed tax relief. Although Murphy and Corker do not specify what tax relief they would provide, they suggest the permanent extension of some of the recently expired tax provisions or other bipartisan proposals to reduce taxes by at least the amount of revenues raised from the gas tax over the next decade. As we've talked about before, extending tax cuts without offsets will increase the debt and worsen the country's already tenuous fiscal situation, resulting in costs that have not previously been accounted for. While it is likely that Congress may extend some of these tax provisions, a permanent extension is much worse because it locks in the costs of these tax breaks instead of waiting for tax reform to fund their extension or letting them expire.

Unfortunately, a loophole in budget scoring conventions will allow this bill to appear as a small tax cut, even though it would increase the deficit by $190 billion. The bill raises more than $180 billion in gas tax revenue, allows for that much additional highway spending, and also cuts taxes by slightly more: $190 billion. This is possible because the CBO budget baseline already assumes highway spending will continue at current levels with inflation, so allowing additional spending does not count as a cost.

Murphy and Corker present the gas tax increase and tax relief as distinct proposals, and to their credit they don't claim the gas tax revenues offset the costs of tax cuts. However, the budgetary treatment of the HTF creates the risk of double counting gas tax revenues as both shoring up HTF and offsetting other tax cuts and spending, as done by several recent proposals. The President's transportation proposal took a commendable approach to stop double counting by providing that new gas tax revenue does not count on the PAYGO scorecard, preventing it from being used as an offset for any other purpose.

The Murphy-Corker bill takes a strong step forward by being the only proposals to permanently address the chronic shortfall in highway funding. However, as currently written, the proposal would also increase the deficit by proposing $190 billion of unspecified tax cuts.