Postal Service Emerges as Offset for Highway Trust Fund

Bloomberg Businessweek reported last week that House Republicans are considering a plan that would utilize savings from U.S. Postal Service (USPS) reforms to pay for general fund transfer to the Highway Trust Fund (HTF). Bloomberg’s Angela Keane and Derek Wallbank wrote:

"Raising the U.S. gasoline tax is out as a way to shore up the Highway Trust Fund. So is taxing drivers based on the number of miles they clock. A plan to use taxes on companies’ overseas profits hasn’t gone anywhere.

So House Republicans are now turning to the money-losing U.S. Postal Service.

Unusual as it may sound; possible savings from revamping the agency’s operations are on the table as one way to patch highway funding, said two Republican legislative aides with knowledge of the talks."

As we have written previously, USPS is in dire financial condition. USPS is losing about $6 billion a year and has already defaulted on payments to the U.S. Treasury for employee benefits. USPS has relied solely on revenue generated by its services for funding since 1971, aside from a very small appropriation to subsidize mail for overseas voters and the blind. USPS spending is considered “off-budget,” so recently proposed reforms would create savings measured using a “unified budget” but would actually worsen the “on-budget” deficit.

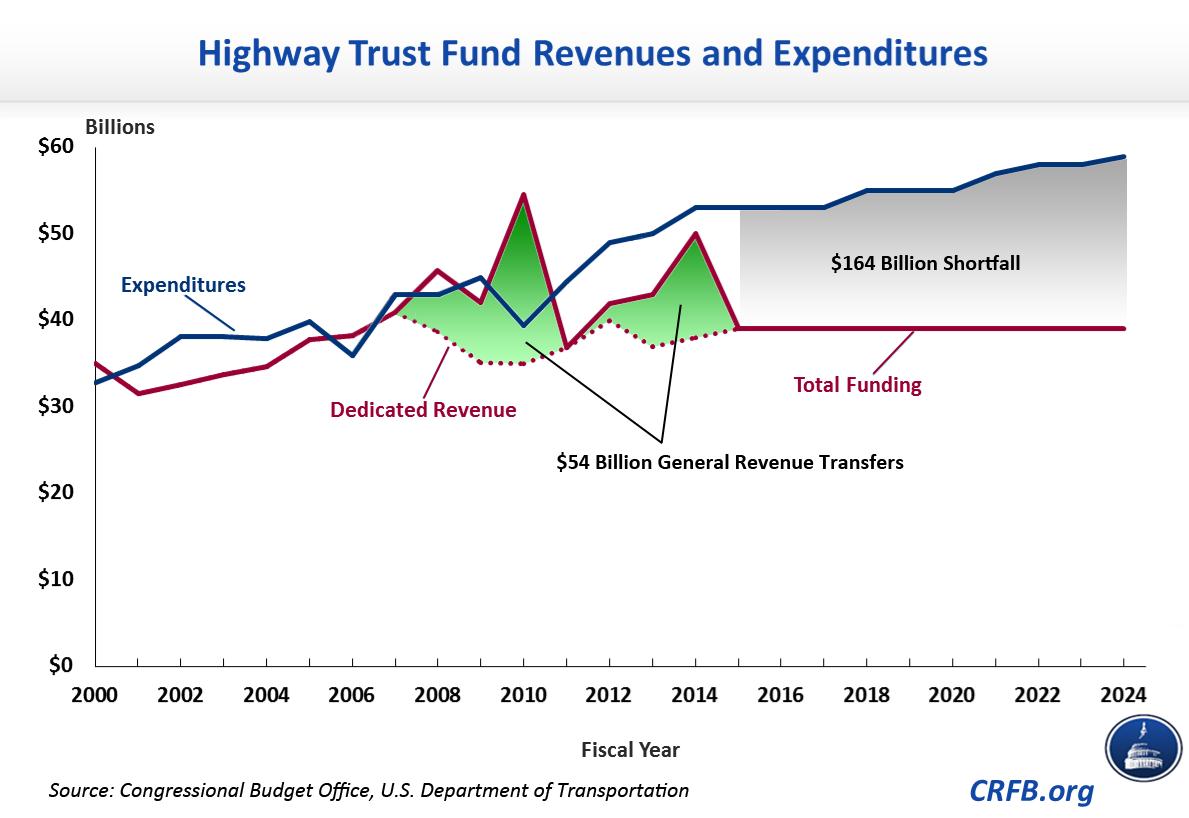

The HTF is also in financial trouble, with dwindling funds that could cause a disruption in highway construction as soon as August. As we recently explained, Congress has provided $54 billion to the HTF since 2008 to fill the funding gap created by declining gas tax revenue and is considering funding options to continue highway construction.

According to a memo from House Leadership to Republican Members, the forthcoming proposal would eliminate certain types of mail delivery on Saturdays but would still allow for delivery of packages, priority mail, and express mail, while keeping post offices open. According to the memo, this option would save $10.7 billion over the next 10 years, offsetting an immediate transfer of that amount to the Highway Trust Fund. The proposal would also transfer $1.3 billion from the Leaking Underground Storage Tank (LUST) Trust Fund to HTF. According to the memo the total transfer would extend HTF solvency through May 2015.

Congress should act to fix the financing of both USPS and HTF, ideally by enacting long-term solutions for each that bring dedicated revenues in line with desired spending levels. It is encouraging that policymakers are looking for offsets for any general fund transfer to the HTF as required by language in the House-passed Fiscal Year 2014 budget resolution that was incorporated by the Ryan-Murray budget agreement, although the immediate costs of the transfer would be offset over ten years, contrary to the requirement established in the budget resolution requiring the transfers to be offset in the same year they occur. This is a significant improvement over past practices of making general revenue transfers, which allowed spending from the HTF to continue in excess of dedicated revenues without acknowledging the cost.

The savings scored from reforms of USPS exploit the same budget scoring convention that the budget resolution sought to end -- the baseline assumption that spending for a program would continue even after it was statutorily required to curtail spending because of insufficient funding. Further, this proposal would be a one-time funding infusion that would do nothing to address the long-term funding issues of the HTF and would force Congress to revisit this issue in just a year.

Enacting reforms to USPS and counting those savings as both improving the financial condition of USPS and using those funds for transportation projects is double counting. Like the HTF, the USPS is required to limit spending and does not have an automatic claim on general revenue. Any general revenue transfer to USPS would require an act of Congress. Therefore, reducing mail delivery will not actually save money but rather avoid a cut in postal operations required by law in the future.

Improving the financial outlook of USPS does reduce the probability of a taxpayer funded bailout in the future. However, there is currently no legal obligation for Treasury to fund ongoing postal operations beyond what USPS could finance itself. Therefore, savings produced by USPS reforms do not reduce obligations of the general fund and does not free up resources to offset spending in other areas of government.

We hope Congress will enact meaningful reforms to both USPS and HTF to stabilize their finances over the long term for their own sake and avoid continuing to rely on for short-term extensions that lurch from crisis to crisis. To the extent a general revenue transfer is necessary to avoid an immediate crisis in the HTF while a long-term fix is developed and implemented those transfers should be offset with savings that are not used for any other purpose. Further, such distractions make it more difficult for Congress to focus on the long-term drivers of our debt, unsustainable growth in entitlement spending and the mismatch between spending and revenue.