Senate Finance Committee Hearing on Transportation Funding

The Senate Finance Committee held a hearing May 6th titled, “New Routes for Funding and Financing Highways and Transit.” During the hearing Senators and witnesses covered a range of topics including the consequences of the impending insolvency of the Highway Trust Fund (HTF), the Administration’s four-year transportation proposal, and other budgetary, economic, and administrative issues with transportation funding.

The hearing included testimony from Senator Barbara Boxer (D-CA), Joseph Kile from CBO, the Virginia Secretary of Transportation Aubrey Lane Jr., Jayan Dhru from S&P, Samara Barend from AECOM Capital, and Chris Edwards from the Cato Institute.

CBO Assistant Director Kile addressed the upcoming shortfall, explaining that Congress can either cut spending, increase dedicated revenues, or transfer revenues from the General Fund (GF) to make up the difference.

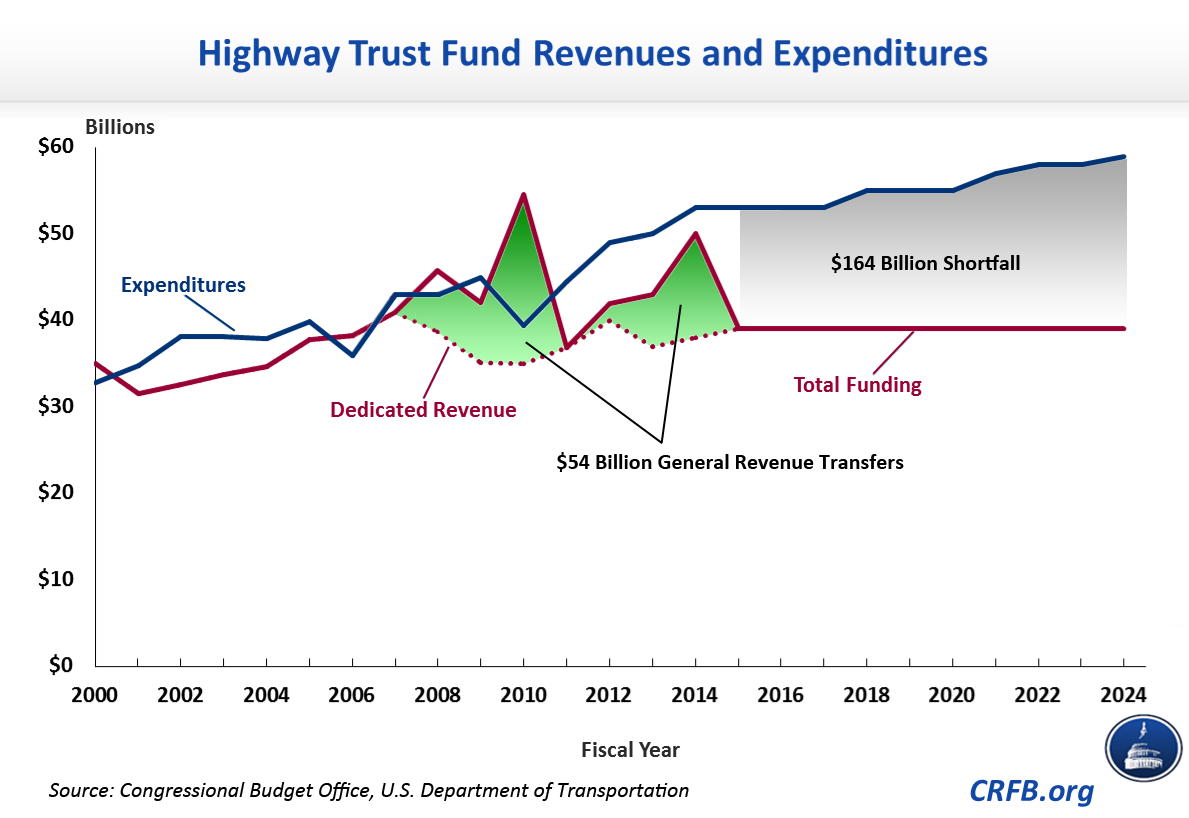

The graph below shows that revenues dedicated to the trust fund, comprised primarily of the gas tax, have been insufficient to cover expenditures in recent years, but Congress has made transfers from the GF to make up some of the difference. If Congress does not act, the HTF could reach levels low enough to disrupt ongoing work as soon as August. Witnesses and senators characterized this possibility as a major problem that could cause project delays, layoffs, and larger economic harm.

In general, senators and witnesses agreed that a long-term extension of highway programs is preferable because uncertainty generated by short-term extensions of funding causes inefficiencies for state and local governments, private investors, and infrastructure users, all of which harm the economy. In the past, Congress has sometimes passed short-term extensions of the transportation authorization as the deadline approaches before settling on a deal for a longer-term extension. It is possible that the impending deadline imposed by the dwindling trust fund balance – which could cause disruption as much as month or two before the authorization expires – may prompt Congress to focus on a longer-term extension earlier in the process than in the past.

As illustrated above, Congress has transferred $54 billion to the HTF to cover shortfalls since 2008. However, there is growing opposition to continuing such transfers without finding offsets. Under current scorekeeping conventions, CBO does not score GF transfers to the HTF as a cost even though they allow HTF spending to be higher than would otherwise be allowed. Law prohibits the HTF from borrowing or spending beyond its current balance, so any transfers allow more spending than otherwise would occur. That is why we and others have argued that the responsible way to treat any GF transfers to the HTF would be to score them as costs as House Budget Committee Chairman Paul Ryan (R-WI) did in his FY 2015 budget. If Congress decides to continue current funding levels or increase them, they should identify offsets to avoid increasing the deficit. So far, both President Obama and House Ways and Means Committee Chairman Dave Camp (R-MI) have proposed dedicating temporary revenue from corporate tax reform to the HTF, although Camp’s draft also relies on that revenue to make his tax reform proposal revenue-neutral, a form of double-counting.

While many in Congress may see transportation spending as a priority, they have been unable to identify changes to HTF funding to bring gas tax revenue in line with spending. Ideally, Congress will find a permanent solution which brings dedicated revenues for the HTF in line with spending. However, if Congress chooses to implement a short-term fix, then any transfers from the general fund should be offset by real revenue increases or spending cuts.