Treasury Confirms Calendar Year 2024 Deficit Tops $2.0 Trillion

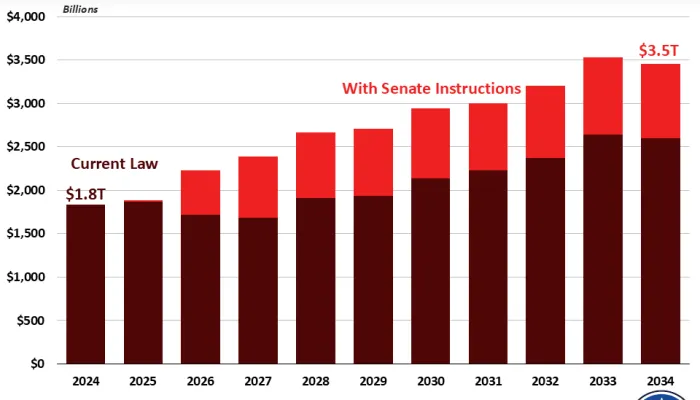

The Treasury Department released the Monthly Treasury Statement for December, showing the United States borrowed $2.0 trillion in calendar year 2024, $711 billion in the first three months of fiscal year 2025, and $87 billion in December.

Read our full analysis of the 12-month rolling deficit here.

The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

There is absolutely no just justification for running a $2 trillion deficit in a year when the economy was strong and we were still fighting inflation. And what an expensive about face to have gone from 2023 – a year in which Congress passed legislation that reduced the debt by $1.3 trillion over ten years – to 2024, where they increased it by $1 trillion over the decade. Today’s report of the Treasury makes it clear we’re still headed in the wrong direction, with $711 billion in borrowing in just the first three months of the new fiscal year. Our fiscal health is cruising downhill, and fast.

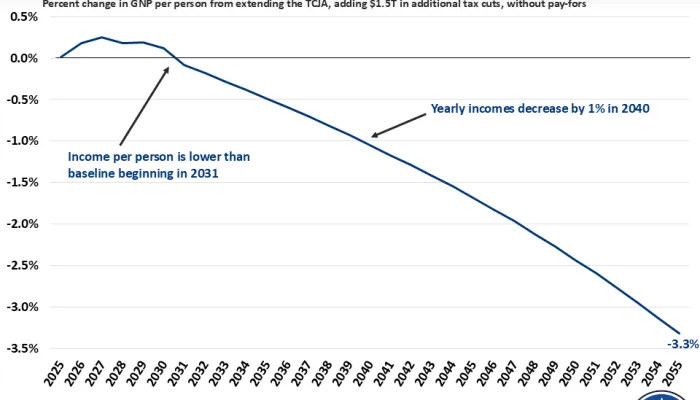

Next week, the next administration will be sworn in, and with it will come a flurry of decisions on how to address spending and revenues and what to prioritize in terms of legislation and executive actions. Many of these decisions will focus on the known unknowns in the year ahead – budget reconciliation, government funding, the debt ceiling, discretionary spending caps, and extensions of the expiring 2017 tax law. Critically, these moments have the potential to add trillions more to the deficit when we’re already going to spend more on debt interest than national defense and Medicare this year.

The bottom line is that 2025 is going to be full of consequential decisions for the federal budget. Competing interests and political expediency will tempt lawmakers to trade new spending for new or extended tax cuts, but with the debt headed for an all-time record in just two years and our major trust funds facing insolvency in less than eleven, they should work to avoid backsliding this year as they did last year.

###

For more information, please contact Matt Klucher, Assistant Director for Media Relations, at klucher@crfb.org.