Inversions Reduce Revenue, But Extenders Cost More

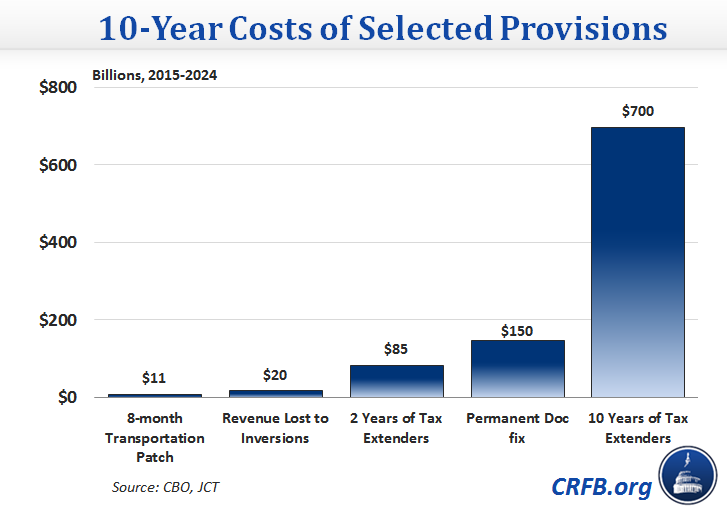

Many policymakers have expressed concern about "tax inversions," transactions where American companies move their headquarters overseas in order to pay a lower tax rate. The inversions are estimated to cost about $20 billion in lost corporate tax revenue over the next ten years. Yet even as Congress and the Administration debate whether to stop inversions, there is bipartisan agreement on a series of tax breaks that could cost 35 times more. Reviving the tax extenders continually over the next 10 years will cost about $700 billion (about $400 billion in corporate tax breaks, and about $300 billion for other businesses and individuals).

Since the beginning of the year, at least 14 companies have announced mergers or purchases of overseas companies that would result in an American headquarters moving overseas. Commonly called "tax inversions," these transactions often take place only on paper – no offices or employees move, but the company is considered foreign for tax reasons. By inverting, companies avoid the U.S. corporate tax rate of 35 percent on their overseas earnings, instead paying a much lower (or sometimes zero percent) rate that other countries charge on income outside their borders. This erosion of the corporate tax base is problematic, and there's several ways to address it. One suggestion, by CRFB President Maya MacGuineas, calls for a strategic pause where companies agree not to invert for nine months, paired with a fast-track procedure to encourage comprehensive tax reform.

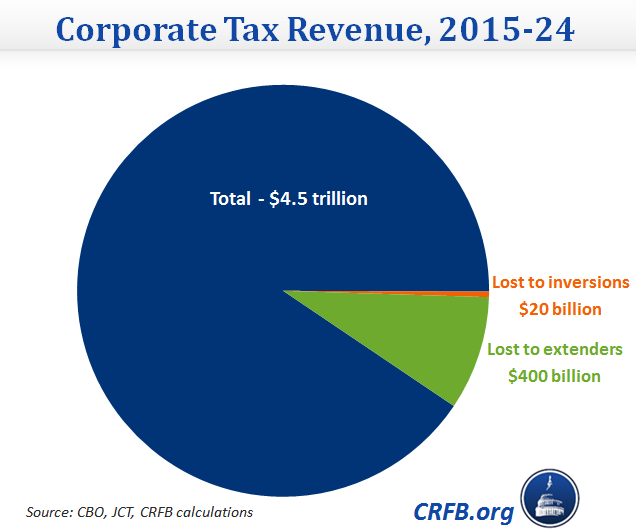

Inversions are estimated to cost about $20 billion in lost tax revenue over the next 10 years, or about 0.5% of the $4.5 trillion that will be paid in corporate taxes during the same period. Legislation stopping them would raise enough to pay for about one-quarter of the $85 billion cost of continuing the extenders for two years, as the Senate Finance Committee would do. But the extenders have often been extended year-after-year. For example, the current Finance Committee bill continues 52 out of 54 provisions, and expands some tax breaks that were not in the original bill. If the package were continually extended, the provisions would cost $700 billion. (The House, on the other hand, has taken a much more expensive approach, expanding the package to cost over $1 trillion.)

Although the majority of the tax extenders are for corporations, some are for individuals (like deductions for paying sales tax or for commuting to work), and others are specifically for non-corporate businesses. Using available estimates and assuming the other business extenders were split 50-50 between corporate and non-corporate businesses, we estimate that the extenders would cost about $400 billion in lost corporate tax revenue, still 20 times the amount that will be lost to inversions over the next decade.

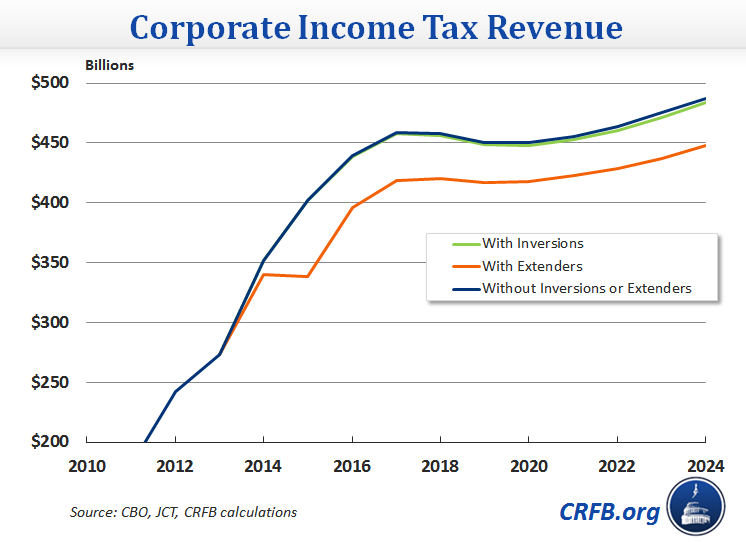

The extenders' costs are front-loaded, because of provisions like bonus depreciation which encourage shifting deductions to earlier years. If the extenders were passed permanently, they would reduce corporate tax revenue by about 15 percent in 2015 and about 8 percent in later years.

Given the magnitude of our debt problems will eventually require additional revenue, we should not be reducing revenue levels. For this reason, we've called for Congress to abide by PAYGO for the tax extenders, finding other savings to pay for the cost of any tax breaks they choose to continue. If Congress wants to lower corporate taxes by passing the extenders, they should find savings to pay for it.

Related Posts: