House and Senate Budgets Don't Balance in 2025 With Enacted Legislation

The House and Senate are going to a conference committee to reconcile the differences between their budget resolutions, but legislative developments may make reaching their goal of a balanced budget more difficult. Building off of the numbers laid out in their original budgets, neither the House nor Senate budget would get to balance by 2025 after accounting for legislation that has already passed each chamber. Budget conferees have the choice of either requiring that savings be identified to offset these new costs, or making their budgets only add up on paper, ignoring real costs that they intend to pass.

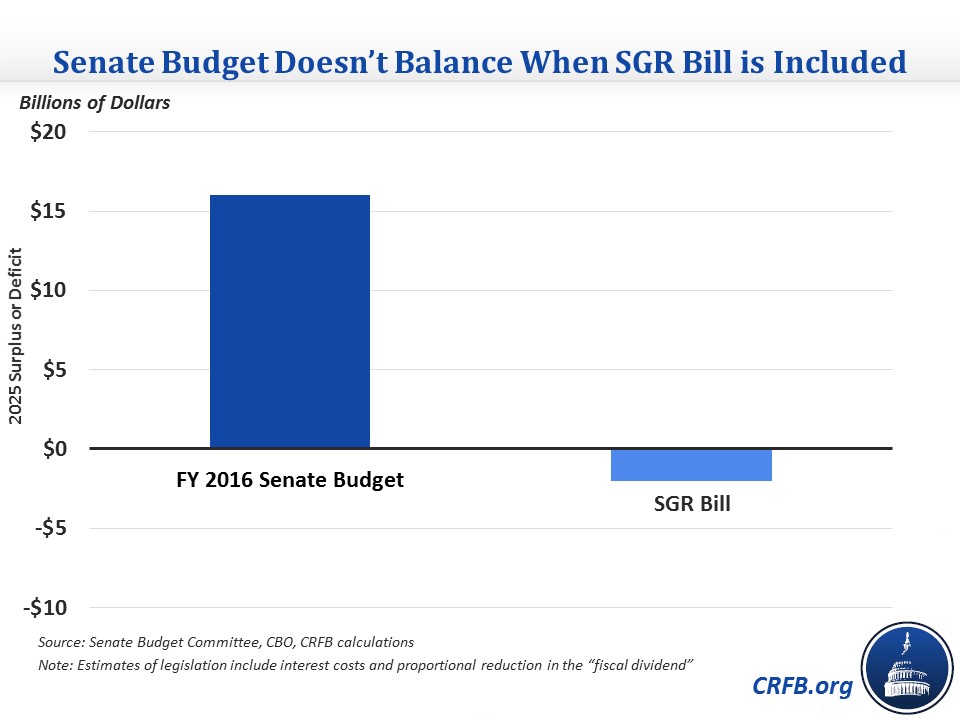

The one major bill with budgetary effects that passed both chambers is the Sustainable Growth Rate (SGR) replacement bill, now on its way to the President. Including interest, the bill increases 2015-2025 deficits by nearly $175 billion and increases 2024 and 2025 deficits by $17 billion per year. This deficit increase is enough to flip the Senate budget's $16 billion 2025 surplus to a $2 billion deficit.

The House budget did assume the cost of the SGR bill in their budget but assumed it would be paid for, so the budget would need to now find $290 billion of Medicare savings instead of the original $148 billion to stick to its numbers. Nonetheless, the SGR bill itself does not flip the budget to deficit in 2025.

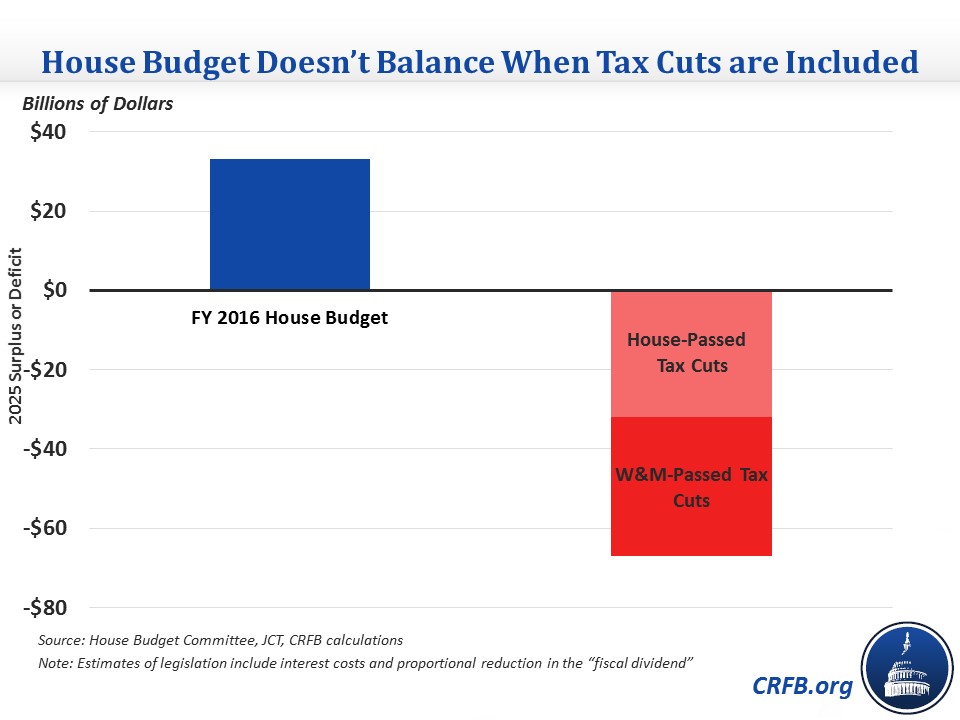

However, the House has also passed $400 billion worth of tax cuts by reviving and continuing select tax extenders permanently and repealing the estate tax.

The Ways and Means Committee has also passed a $180 billion extension of the R&E tax credit, although the House has not yet taken it up. Adding the House-passed tax cuts flips the budget's 2025 surplus of $33 billion to a more than $30 billion deficit, and adding the W&M tax cut further increases the 2025 deficit to more than $65 billion. These tax cuts are inconsistent both with the promise of balance and the fact that the budget resolutions stick to current law revenue levels.

Congress's legislative actions have not been consistent with their deficit reduction promises. Lawmakers can tighten up budget enforcement procedures in the conference committee to make fiscal irresponsibility more difficult, but ultimately it will be up to their political will to find offsets for policies.