SGR Bill Would Add $500 Billion to Long-Term Debt

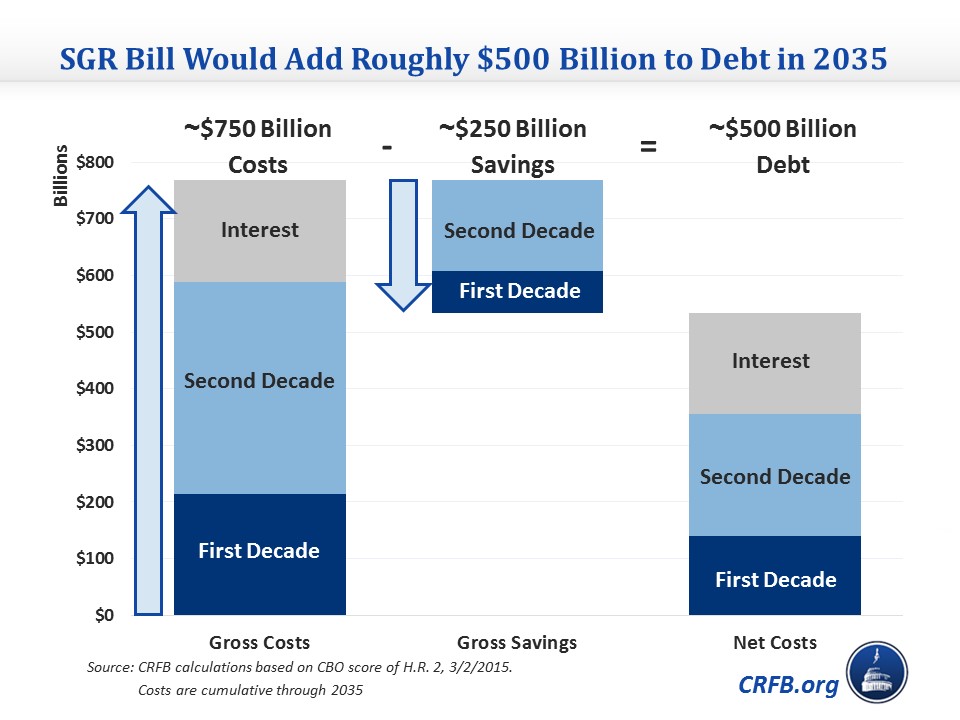

Earlier today, the Congressional Budget Office (CBO) released its score of the Medicare Sustaintable Growth Rate (SGR) reform bill under consideration in the House. According to CBO, the legislation would increase federal deficits by $141 billion through 2025 and much further in the second decade. By our rough calculations, including interest, that means the SGR reform bill would add over $500 billion to the debt by 2035.

More specifically, CBO estimates the spending increases in the legislation will total $210 billion over the next decade. Only about one-third ($70 billion) of this spending would be offset, with a combination of provider reductions, increased means-testing of Medicare premiums, and other minor reforms. (Details are available in the table at the bottom of this blog.)

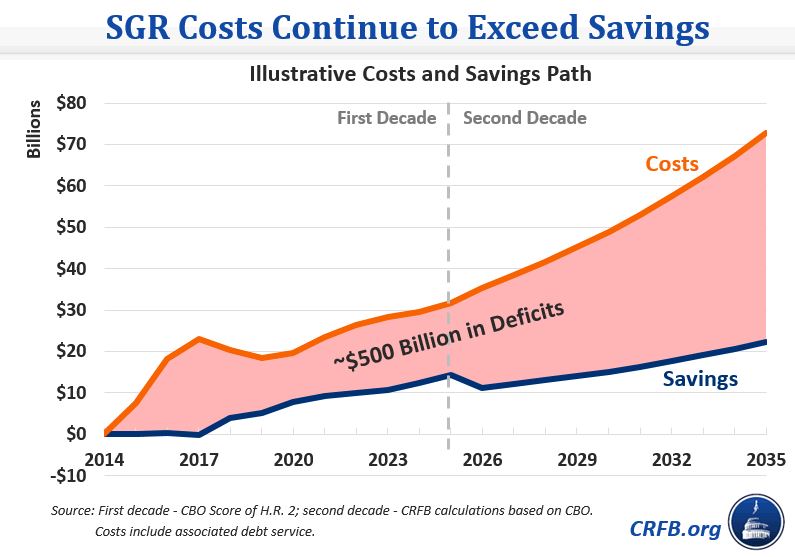

As we had predicted, savings would then grow in the second decade but not by enough to pay for costs. In fact, according to CBO it would most likely barely be enough offset the additional costs beyond a payment freeze.

Although CBO does not offer full details, we roughly estimate over twenty years the bill will call for roughly $600 billion of primary spending increases, $250 billion of offsets, and $150 billion of net interest costs over the next two decades.* The result: more than half a trillion dollars of additional debt by 2035.

Some have defended the lack of full offsets in the bill by measuring it against an "Alternative Fiscal Scenario" (AFS). Against a scenario like the AFS, CBO finds that the bill "could represent net savings or net costs...but the center of the distribution of possible outcomes is small net savings." Yet the AFS shows what would happen if future Congresses were fiscally irresponsible (in the case of SGR, far more irresponsible than they've been in the past) and added doc fixes to the debt. If the best argument for this bill is that "it could have been worse," that argument should be of little comfort to those concerned about the long-term growth of Medicare and the national debt.

As we explained recently, lowering the bar to measure this bill against a scenario that assumes unpaid-for doc fixes is inconsistent with standard budget rules, historical precedent, and even other descriptions of the bill. It is also a circular argument that suggests we shouldn't count the costs of adding to the debt because some future Congress is likely to do so anyway.

In reality, doc fixes have been offset 98 percent of the time and failure to do so does add to the debt. Judging from CBO's estimates, doing so would add more than $500 billion to the debt in the next two decades alone.

With Medicare's costs already growing unsustainably, supporters should think twice about growing them further.

*****

Details of SGR Reform Bill

| Provision | 2015-2025 Cost/Savings (-) |

| Physician Payment System | $175 billion |

| Temporary Health Extenders | $16 billion |

| Permanent QI and TMA | $11 billion |

| CHIP Reauthorization | $6 billion |

| Other Spending | $2 billion |

| Gross Costs | $210 billion |

| Means-Tested Premiums | -$34 billion |

| First-Dollar Medigap Coverage Limit | <-$1 billion |

| Post-Acute Care Payment Increase Limit | -$15 billion |

| Inpatient Hospital Payment Adjustment | -$15 billion |

| Medicaid DSH Extension | -$4 billion |

| Other Provisions | -$1 billion |

| Gross Savings | -$70 billion |

| Net Cost | $141 billion |

Source: CBO

*Note that we are more confident in our estimate of net costs than the magnitude of either costs or savings in isolation