Ways & Means Committee Adds $270 Billion to Deficits by Repealing Estate Tax

The House Ways & Means Committee on Wednesday approved the “Death Tax Repeal Act of 2015,” which would permanently repeal the estate tax that applies to inheritances over $5.43 million. Repealing this tax would cost almost $270 billion over the next ten years, according to the Joint Committee on Taxation, or about $320 billion with interest. Since the bill does not include any offsetting revenue increases or spending cuts, the cost would be added to the national debt.

The bill repeals the estate tax on inheritances and its close cousin – the generation-skipping transfer tax. The top rate on the gift tax, imposed on gifts of over $14,000 per person, is reduced from 40 percent to 35 percent. Since 99.8 percent of estates are worth less than the exemption amount, the $270 billion tax break would go to the wealthiest 0.2 percent of estates.

Proponents of the bill argue that the tax hurts small businesses and family farms by creating unnecessary tax burdens, harms minority- and women-owned businesses, and only raises 1 percent of the government's revenue. Opponents point out that the tax affects a very small number of the very wealthiest estates, taxes at a much lower rate than the headline 40 percent, and is the only way that unrealized capital gains are ever taxed.

Even though the estate tax raises less than 1 percent of federal revenues, $270 billion is not insignificant. If lawmakers choose to repeal the estate tax, they should include revenue or spending offsets to avoid adding to the debt.

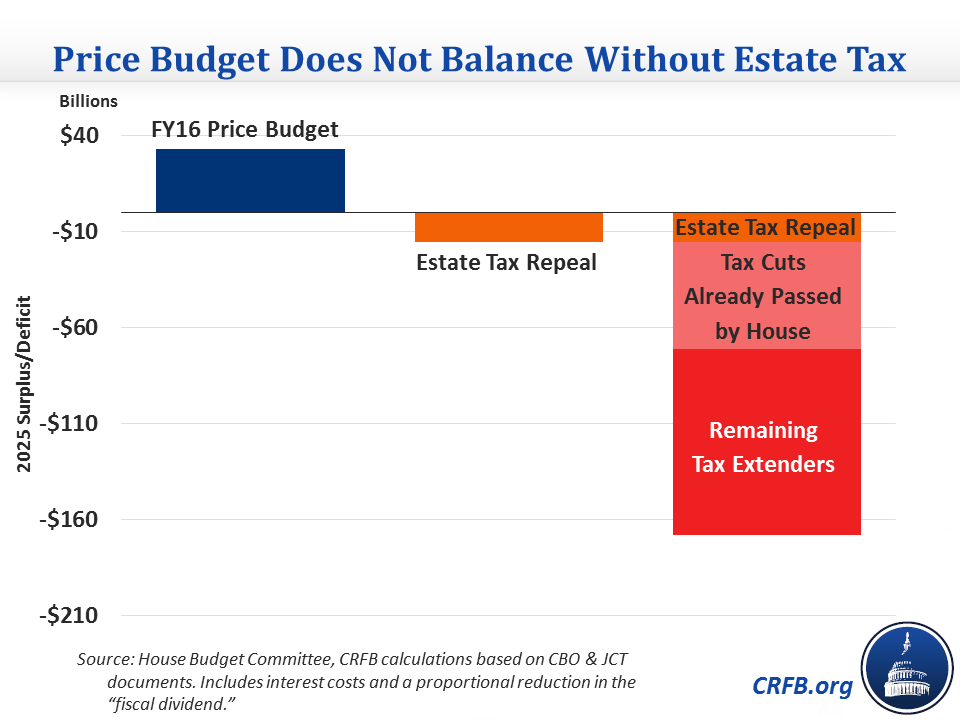

On the same day, the House passed a budget resolution which balances within 10 years and even provides a surplus, using $5.5 trillion in spending cuts. That budget assumes the amount of revenues that would be raised under current law, which is inconsistent with bills that cut taxes. If the estate tax were to be repealed, the budget would no longer balance – the $33 billion surplus in 2025 turns into a deficit of more than $10 billion.

Further, the Ways & Means Committee already passed $320 billion in tax cuts this year without offsets, also inconsistent with the budget resolution. Those tax cuts and the estate tax bill mean that the Republican budget would still have about a $70 billion deficit in 2025, rather than balancing. If Congress additionally deficit-financed all the expired and expiring tax provisions, the deficit would be approximately $170 billion.

It is inconsistent for lawmakers to support a balanced budget on one hand while passing measures to increase budget deficits on the other. Whereas their budgets rely on current law levels of revenue to reach balance, the Ways & Means Committee has now passed $590 billion of tax cuts, or about $700 billion with interest. In order to reach balance, they would now need to find a similar amount of revenue increases or spending cuts on top of the aggressive changes already included in their budget. If lawmakers are serious about lowering deficits and putting debt on a downward path, they should not pass hundreds of billions of dollars of deficit-financed tax cuts.