Spending and Revenue in the FY 2016 House Budget

House Budget Committee Chairman Tom Price (R-GA) released his FY 2016 budget yesterday, outlining a framework that would significantly reduce the debt as a share of the economy and balance the budget by 2024. Our initial analysis of the budget showed it decreased deficits and placed debt on a clear downward path. This post examines the House budget's spending and revenue levels.

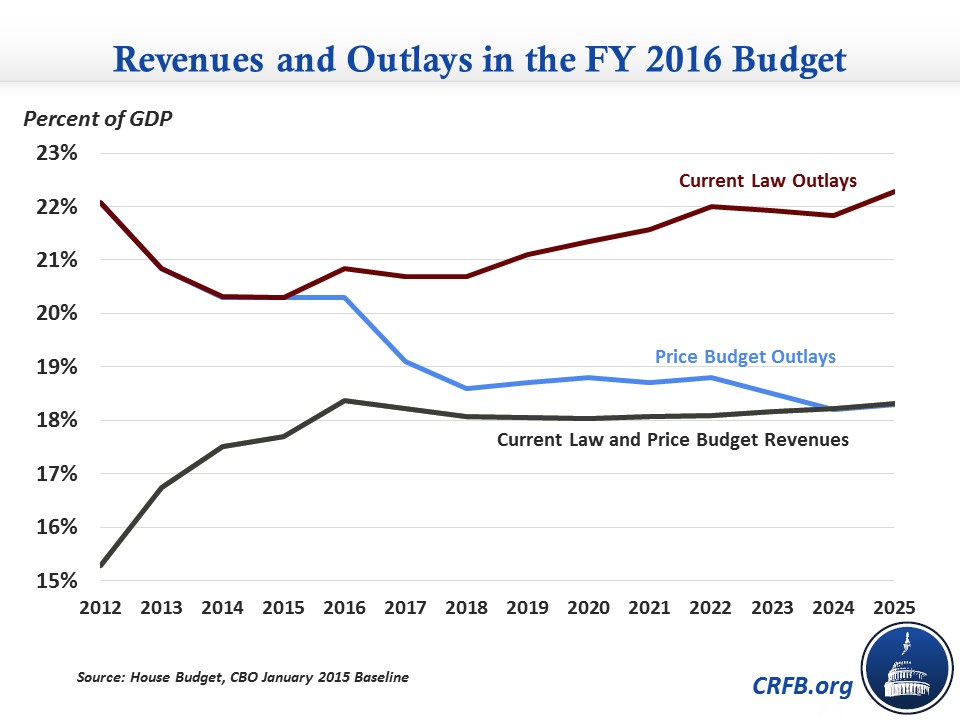

The Price budget achieves balance entirely on the spending side, using a cumulative $5.5 trillion of spending cuts over 10 years to gradually reduce spending from 20.4 percent of GDP today to 18.3 percent by the end of the decade. This brings spending and revenue closely in line, with the small difference made up for by an assumed "fiscal dividend" of about 0.3 percent of GDP in 2025.

We described some of the details of Chairman Price's $5.5 trillion in spending cuts here. They included significant reductions to both domestic discretionary and mandatory spending. Some of the largest cuts include a repeal of the coverage provisions in the Affordable Care Act and block granting Medicaid and food stamps. Beginning in 2017, the budget proposal would also cut future non-defense discretionary spending to well below sequester levels – by over $700 billion through 2025, on top of the $360 billion from sequester. At the same time, it would restore over $350 billion of the $550 billion of defense sequester cuts.

It remains to be seen whether these spending cuts are realistic, including whether Congress will follow through with steep cuts to nondefense spending, whether they can repeal the ACA without losing the savings and revenue in the legislation, and whether they will be able to identify the $1 trillion in "other mandatory" savings from income security programs and elsewhere.

But if these cuts are successful, spending would fall considerably and deficits would follow.

| House Budget Committee FY 2016 Proposal (Percent of GDP) | |||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Price Budget | |||||||||||

| Outlays | 20.4% | 20.3% | 19.1% | 18.6% | 18.7% | 18.8% | 18.7% | 18.8% | 18.5% | 18.2% | 18.3% |

| Revenues | 17.7% | 18.5% | 18.4% | 18.1% | 18.1% | 18.0% | 18.0% | 18.0% | 18.0% | 18.1% | 18.2% |

| Fiscal Dividend | - | 0.1% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | -0.1% | -0.1% | -0.2% | -0.3% |

| Deficit | 2.7% | 1.8% | 0.8% | 0.5% | 0.7% | 0.8% | 0.7% | 0.8% | 0.4% | 0.0% | -0.1% |

| Debt | 74.2% | 74.0% | 72.0% | 69.0% | 67.0% | 65.0% | 63.0% | 62.0% | 50.0% | 57.0% | 55.0% |

| Price Budget Without Fiscal Dividend* | |||||||||||

| Outlays | 20.4% | 20.1% | 18.9% | 18.5% | 18.7% | 18.9% | 18.8% | 19.0% | 18.7% | 18.4% | 18.5% |

| Revenues | 17.7% | 18.4% | 18.2% | 18.1% | 18.1% | 18.0% | 18.1% | 18.1% | 18.2% | 18.2% | 18.3% |

| Deficit | 2.7% | 1.7% | 0.7% | 0.5% | 0.6% | 0.8% | 0.7% | 0.9% | 0.5% | 0.2% | 0.2% |

| Debt | 74.2% | 73.4% | 71.1% | 68.6% | 66.8% | 65.1% | 63.2% | 62.3% | 60.5% | 57.8% | 56.0% |

| January CBO Current Law | |||||||||||

| Outlays | 20.3% | 20.8% | 20.7% | 20.7% | 21.1% | 21.4% | 21.6% | 22.0% | 21.9% | 21.8% | 22.3% |

| Revenues | 17.7% | 18.4% | 18.2% | 18.1% | 18.1% | 18.0% | 18.1% | 18.1% | 18.2% | 18.2% | 18.3% |

| Deficit | 2.6% | 2.5% | 2.5% | 2.6% | 3.0% | 3.3% | 3.5% | 3.9% | 3.8% | 3.6% | 4.0% |

| Debt | 74.2% | 73.8% | 73.4% | 73.3% | 73.7% | 74.3% | 75.0% | 76.1% | 76.9% | 77.7% | 78.7% |

Source: House Budget Committee, January CBO Baseline

*This section represents CRFB calculations if Price's budget were measured using GDP projections from CBO, without the bonus from economic growth that Price includes in his projections.

On the revenue side, the House budget assumes levels equal to current law, neither raising more nor less money than the current tax code is projected to over the next decade. It also calls for comprehensive tax reform.

However, the budget also calls for the repeal of the Affordable Care Act, including the portion which raised revenue through new taxes, penalties, and changes to insurance coverage. To repeal those taxes and still be true to the proposed budget, the House would need to raise over $1 trillion in additional revenue to offset the revenue lost from repealing the Affordable Care Act.

Similarly, the House Ways & Means Committee has already passed $320 billion of tax cuts this year, in the form of permanently extending certain expired tax provisions called the tax extenders. Those bills were deficit-financed. However, the budget's revenue levels are based on current law, which assumes those provisions expire. To be true to the budget, the House would need to either allow those provisions to expire or offset the cost of the tax bills with other revenue. We would encourage the House, in the spirit of this budget, to offset any proposed tax cuts.

Sadly and somewhat contradictorily, the budget included a non-binding policy statement that in the future, the budget process should be reformed so those extensions should not need to be offset. If this were the case for all expired and expiring tax provisions, the budget would be running a $120 billion deficit instead of a $33 billion surplus in 2025.

Importantly, the House budget is just the first step in a long process. Hopefully the best parts of it – including its emphasis on the importance of putting debt on a downward path – will end up not only in the concurrent budget resolution but in legislative negotiations as well. Ultimately, achieving serious fiscal reform will likely require bipartisan support, and will need to look at both sides of the budget – not only spending cuts as in the House budget, or only revenue (on net) as in the President's budget.

Over the course of the week, we will continue to analyze the House Republican budget, as well as the Senate Budget Committee’s Chairman’s Mark and any alternative budget resolutions on our blog. You can also read more about developments with the FY 2016 budget here.