Gap Widens Between Trustees and CBO on Social Security

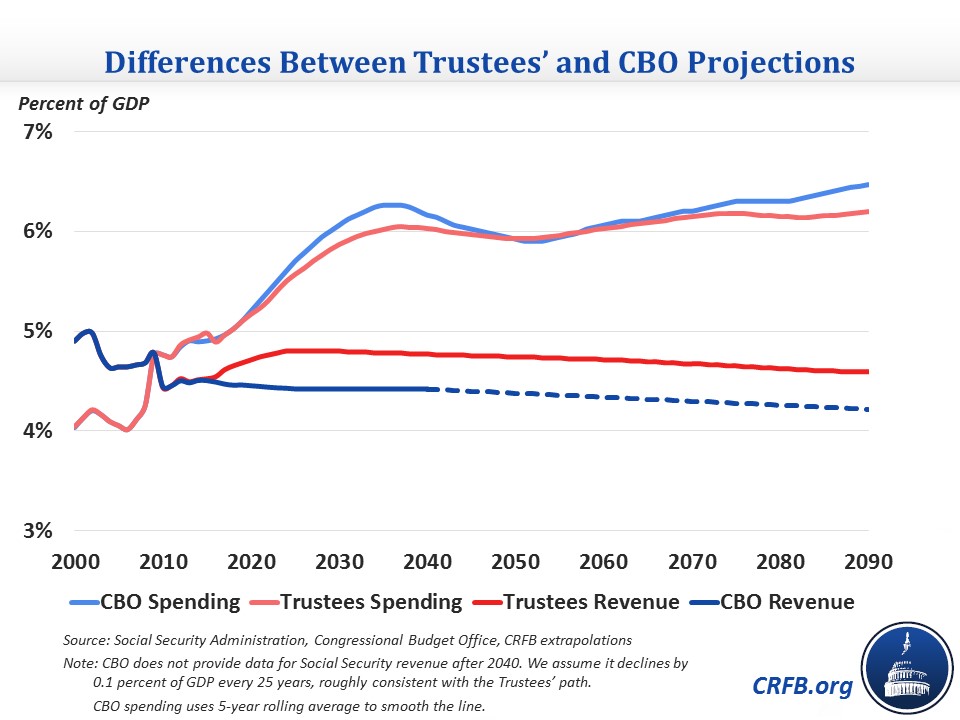

Although the Social Security Trustees estimate the program's financial outlook has slightly improved relative to last year, the Congressional Budget Office (CBO) takes a different view. As with Medicare, CBO is far more pessimistic about Social Security's future. This is true relative to last year, but especially relative to the Social Security Trustees. Indeed, while the Trustees project a 2034 insolvency date (on a combined basis) and 2.7 percent of payroll 75-year shortfall, CBO estimates insolvency will come five years earlier, and that the program will have a 75-year shortfall of 4.4 percent of payroll.

The difference between CBO and the Trustees represents a widening gap between the two scoring agencies that first appeared in 2013. In that year, CBO estimated the shortfall to be 25 percent larger than the Trustees' estimate. In 2014, they estimated it to be nearly 40 percent larger than their counterparts. And this year, they estimate it to be nearly two-thirds larger. The bulk of this difference can be explained by four differences in assumptions:

Life Expectancy: Starting in 2013, CBO increased its projection of the average decline in mortality rates (increases in life expectancy) from 0.78 percent to 1.17 percent per year, matching the decline seen between 1950 and 2010, while the Trustees had an average decline of 0.8 percent per year, a rate that they continue to use. This difference means that a person born in 2040 is expected to live about one-half of a year longer in CBO's assumption. While this difference takes many decades to show up -- even someone born this year wouldn't reach the retirement age until the 2070s -- it does result in higher outlays in CBO's projection late in the 75-year period.

Taxable Wage Growth: Starting this year, CBO incorporated growing inequality into its projection of Social Security revenue. Since Social Security taxes are only assessed on a certain amount ($118,500 in 2015) adjusted for average wage growth, the distribution of income is important in determining what share of total earning is subject to tax. CBO assumed that the share of earnings subject to the payroll tax would decline from 83 percent now to 79 percent by 2025 and an average of 78 percent in the 2025-2039 period (they had assumed an 82 percent share last year). By contrast, the Trustees assume that share will decline only slightly to 82.5 percent in ten years and remain at that level.

Disability Incidence: Disability incidence is defined as the number of people awarded disability benefits per thousand workers eligible. CBO assumes a long-term disability incidence of 5.6 awards per 1,000 workers while the Trustees have an average incidence of 5.4 awards (both adjusted for the age and gender composition of the population). This means that CBO projects a greater share of the workforce receiving disability benefits, thus raising costs relative to revenue.

Interest Rates: The Social Security trust fund gets special bonds that pay an interest rate that is generally above the average rate paid on debt held by the public. The Trustees assume an average long-term interest rate of 5.6 percent, while CBO assumes an interest rate of 5 percent. This difference would not show up in the usual spending and revenue lines of the program, but it would result in a higher trust fund balance and help stave off insolvency for a bit of time if interest rates were higher.

These differences should underscore that no projections for Social Security will be exact; rather, they give a general idea of where a reasonable set of economic and demographic data would take Social Security. The Trustees display the uncertainty of their projections as well, providing a low-cost and high-cost scenario and probability bands for when the trust fund could be exhausted.

Regardless, both CBO and the Trustees see it likely that the Social Security trust fund will be exhausted within the next 20 years and that lawmakers will have to make significant changes to ensure 75-year solvency.