CBO: Social Security Looks Much Worse Than We Thought

Although some argue that policymakers can wait to solve our long-term entitlement problems, CBO's recent Long-Term Budget Outlook suggests otherwise. According to their projections, the Social Security program is in particular trouble -- and much worse than we thought. According to CBO's latest projections, the trust fund will become insolvent three years earlier than what we previously thought, and its long-term funding gap is 50 percent larger.

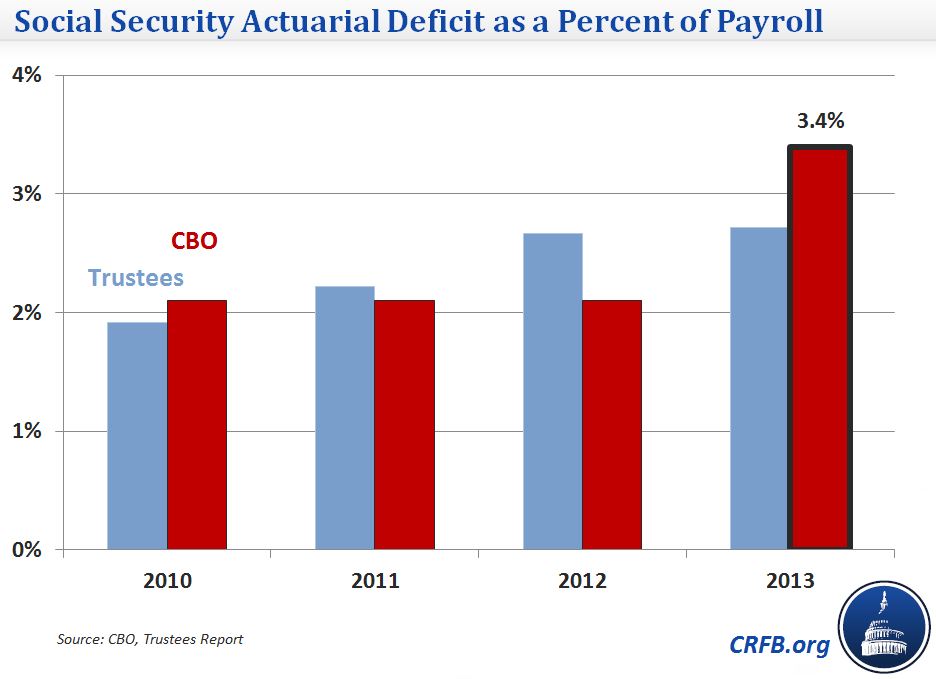

CBO now projects the Social Security Trust Fund to become insolvent by 2031 (previously 2034 in the 2012 outlook), at which point benefits will be automatically cut by nearly 25 percent. It's a concerning development; over the past few years, CBO has consistently moved up the date of insolvency. The actuarial balance has also deteriorated from 2.1 percent of payroll deficit in CBO's 2012 outlook to a 3.4 percent of payroll deficit this year. By comparison, the Social Security Trustees recently projected insolvency in 2033 and an actuarial deficit of 2.7 percent of payroll.

If one uses the unified view of the budget, Social Security still appears unsustainable given our fiscal position. Spending on Social Security is due to rise in the new few decades, from 4 percent of GDP in 2000 to 4.9 percent of GDP today to 6.2 percent by 2033. After the retirement of the baby boom generation, the increase in spending begins to slow, but Social Security will still grow to 6.6 percent by 2080.

Source: Social Security Trustees, CBO

Note: CBO projections use 5-year moving averages to avoid rounding error

Trustee's projections have been adjusted to account for changes in GDP accounting

The deterioration of the Social Security outlook from last year and compared to the Trustees is in part based on the assumptions. CBO assumes in this year's outlook that people will live longer and therefore spend more years collecting benefits. CBO projects average life expectancy will be 84.9 in 2060, compared to 83.6 in the Trustee's Report. Other smaller factors such as an increased rate of disability and tax changes in ATRA also contributed to the increase of the actuarial deficit.

Note: Past CBO projections use the Alternative Fiscal Scenario

2031 might still seem far off, but in the context of the Social Security program it is far from it. A new retiree this year will be only 80 in 2031, and a 49 year today would be reaching the normal age. Both retirees, under current law, would be subject to an immediate 25 percent benefit cut. As we showed in our recent report, "Social Security and the Cost of Delay," no matter how one decides to solve Social Security, it is costly to wait. Using the Trustees numbers for instance, 75-year solvency could be achieved with 16.5 percent across-the-board benefit cut today, but a 23 percent cut would be required in 2033. Likewise, a 2.7 percentage point payroll hike today could achieve 75-year solvency, but in 20 years, a 4.2 percentage point increase would be needed. No matter what combination of reforms are used, the larger the needed changes will need to be the longer lawmakers wait.

Those numbers are based on the Trustees more optimistic projections. If CBO is right, the cost of waiting might be far higher.