Congress Should Strengthen Administrative PAYGO

The Fiscal Responsibility Act (FRA) of 2023 re-established Administrative PAYGO (Pay-As-You-Go) – a rule requiring the executive branch to offset administrative actions that increase deficits, with certain exceptions. In this piece, we explain:

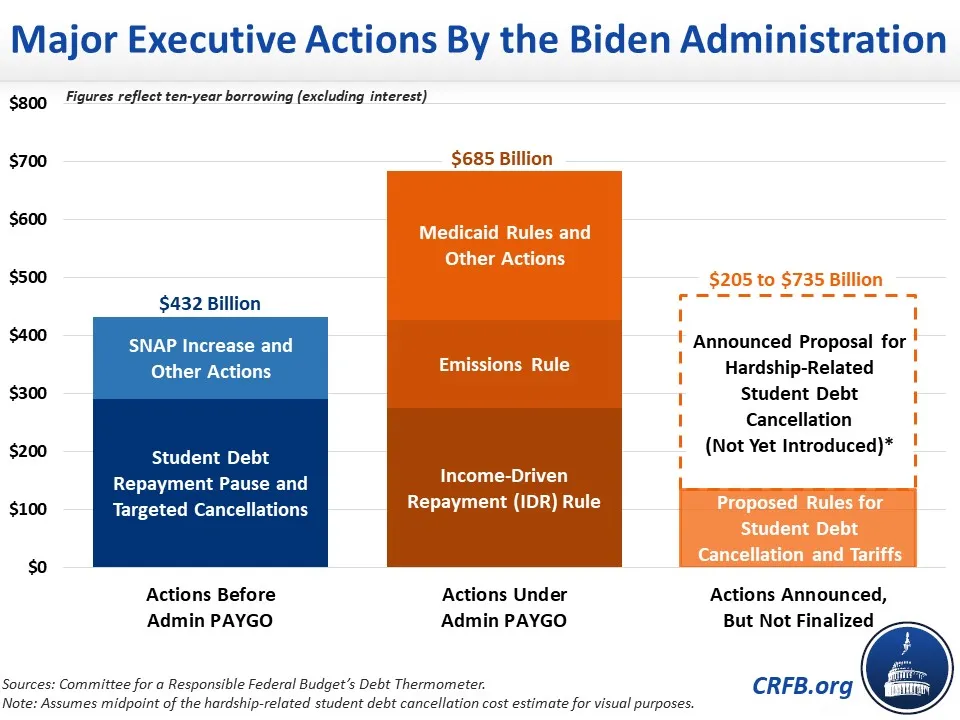

- $685 billion of new ten-year borrowing (excluding interest) has been authorized since the re-establishment of Administrative PAYGO.

- This borrowing has been allowed to occur largely because of the broad waiver authority under current Administrative PAYGO rules.

- The Administration is currently pursuing additional executive actions that could require $205 to $735 billion in additional borrowing if implemented.

- Congress should make permanent and strengthen Administrative PAYGO in order to prevent this and future Presidents from borrowing without Congressional approval.

Although Congress is generally charged with tax and spending decisions, executive orders, regulations, and other administrative actions can sometimes have significant budgetary implications – this has been especially true in the current administration. Administrative PAYGO is designed to prevent such changes from worsening the overall fiscal picture.

Unfortunately, the Administration’s broad use of the waiver authority written into the law – meant to allow for “delivery of essential services” or “effective program delivery” – has made Administrative PAYGO essentially moot thus far. When Administrative PAYGO applies to a rule, agencies can either request and obtain a waiver from the Office of Management and Budget (OMB) or identify actions that would offset the direct spending increase associated with the rule. OMB’s director determines whether a rule meets the criteria for the waiver or not. So far, no agency has identified offsets for new rules and no waiver request has been rejected. Administrative PAYGO is also set to expire at the end of this calendar year. Congress should extend and strengthen this rule.

Prior to the implementation of Administrative PAYGO, the current administration issued major executive actions adding over $430 billion to the deficit (before interest). This included over $290 billion for various types of student debt cancellation and relief, over $180 billion from unilaterally increasing Supplemental Nutrition Assistance Program benefits, and over $70 billion from various health care expansions – partially offset by roughly $115 billion in savings from a Medicare Advantage rule and delaying a prescription drug rule.

Since Administrative PAYGO was put in effect, the Biden Administration has finalized another $685 billion of estimated ten-year borrowing from additional executive actions. This includes roughly $275 billion from a student debt Income-Driven Repayment reform that was first developed before Administrative PAYGO was in effect and is currently on hold by the courts. It also includes nearly $260 billion from Medicaid actions and other smaller rules as well as about $150 billion from a vehicle emissions rule that will drive up the cost of electric vehicle tax credits.

The President has also introduced but not finalized two rules that would add roughly $135 billion to the ten-year deficit, on net. This includes a proposed rule to cancel student debt for certain borrowers – especially those who have seen their balances grow due to interest accumulation – and a plan to increase tariffs on China. Additionally, President Biden has announced but not formally introduced another plan to cancel student debt for those facing hardship – which we estimate could cost anywhere from $70 to $600 billion over a decade.

This borrowing has been allowed to continue in part because of the waiver authority within Administrative PAYGO, and because the rule requires little transparency and no enforcement mechanism.

In addition to being extended, policymakers could strengthen Administrative PAYGO by tightening waiver authority, requiring more reporting and oversight, and perhaps establishing a scorecard and sequester as under statutory PAYGO.

The Strengthening Administrative PAYGO Act of 2024, reported out of the House Budget Committee in May, would represent a solid move in the right direction. The bill would permanently extend Administrative PAYGO and create requirements for the Office of Management and Budget to submit estimates of the budgetary impact of rules they are waiving as well as require them to be documented more transparently.

With the national debt on course to set a new record as a share of the economy in just three years and interest payments surging past Medicare and defense spending, policymakers should do everything they can to foster an environment of responsible fiscal stewardship. Administrative PAYGO – while ineffective thus far – could be made into a tool that promotes good governance and prevents the executive branch from unilaterally making our nation’s finances worse.