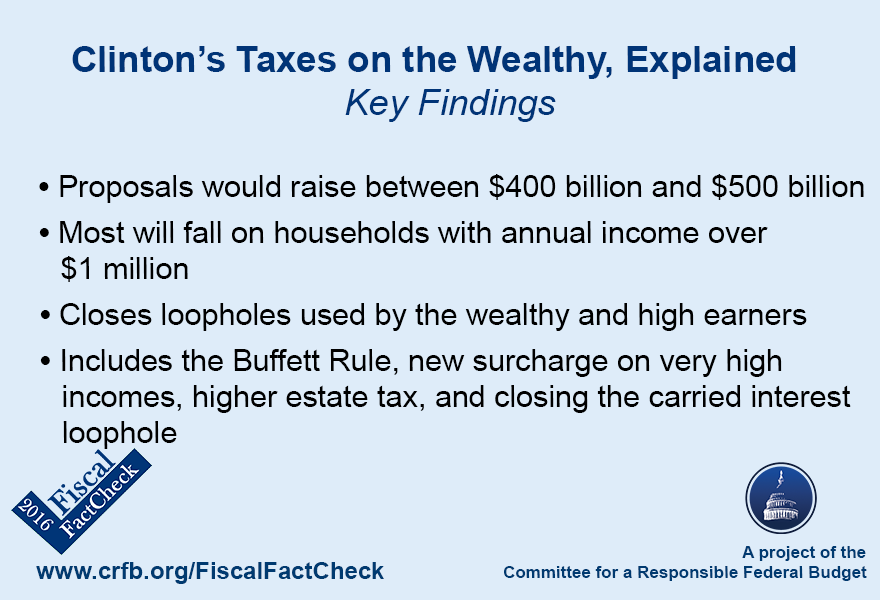

Clinton's Taxes on the Wealthy, Explained

Democratic presidential candidate and former Secretary of State Hillary Clinton has proposed several new taxes that would raise taxes on the wealthy by between $400 billion and $500 billion to pay for new investments helping the middle-class. The majority of the new taxes will fall on households with annual income over $1 million, while the remainder comes from closing loopholes used by the wealthy and high-income earners. Below, we explain Sec. Clinton's proposals, many of which can be found in President Obama's budget.

Buffett Rule

Sec. Clinton reiterated support for the Buffett rule, a proposal from President Obama which would impose a minimum tax rate of 30 percent on incomes over $1 million (phasing in so it does not fully take effect until incomes reach $2 million). According to the Tax Policy Center, the average household making over $1 million already pays an average effective rate of 34 percent, but the rule would raise more money from those who pay less than 30 percent because of other tax preferences, such as deductions, tax-free income, or the lower rate on capital gains and dividends. The Joint Committee on Taxation has estimated this proposal would raise $66 billion.

A New Surcharge on Very High Incomes

The largest proposed revenue-raiser is a 4 percent surcharge on incomes over $5 million, which currently face income tax rates of 39.6 percent on wage income and 23.8 percent on long-term investment income. We assume this rate increase would be on top of the rate individuals might face under the Buffett Rule. The campaign estimates that this proposal will raise $150 billion over the next ten years. According to data from the IRS, about 35,000 taxpayers would pay this tax, or about 1 in 5,000.

A Higher Estate Tax

The plan's next largest revenue-raiser is to increase the estate taxes imposed on very large inheritances. Currently, there is a 40 percent tax on inheritances over $5.45 million (adjusted for inflation each year), a tax which hits about 0.2 percent of all estates. The plan would return the estate tax to its 2009 parameters, which would increase the rate to 45 percent and tax estates worth over $3.5 million (not indexed for inflation). The amounts are doubled for married couples, so the plan would reduce the threshold for taxing a couple's estate to $7 million from about $10.9 million.

A similar policy in the President's Budget raised $138 billion over ten years. According to an old estimate from the Tax Policy Center, this proposal would roughly double the number of estates that owe tax.

The plan also would close other estate tax loopholes, pointing to an article describing how affluent individuals circumvent the tax by setting up trusts to pass wealth along to their heirs. Policies in the President's Budget to address this and other estate tax loopholes would raise about $12 billion.

Other Loophole Closers

Sec. Clinton's plan also would close an assortment of loopholes almost exclusively used by high-income earners using policies in the President's Budget and also the Tax Reform Act of 2014, a tax reform draft from former Ways and Means Chairman Dave Camp (R-MI).

Her plan points to four different proposals from the President's budget.

The plan would close the carried interest loophole, which lets investment managers get some of their income taxed at preferential capital gains rates. It would also tax derivatives annually to prevent investors from using derivatives to manipulate their tax bills from year to year. Additionally the proposal would deny some deductions when companies use reinsurance as a way to send income overseas, often to countries with no corporate income tax like Bermuda. Finally, it would limit the tax benefits of retirement accounts bigger than $3.4 million.

In addition to the loopholes explicitly mentioned, her plan includes a reference to close additional loopholes not yet identified.

| Policy | Ten-Year Revenue (billions) | |

| "Buffett Rule": minimum tax of 30% on incomes over $1 million | $65 billion | |

| Impose 4% surcharge on incomes over $5 million | $150 billion | |

| Restore the estate tax to 2009 parameters | $140 billion | |

| Prevent derivatives from being used to escape tax by taxing all types of derivatives annually on their value | $15 billion | |

| Close carried interest loophole | $15 billion | |

| Close various estate tax loopholes identified in the President's Budget | $10 billion | |

| Close "Bermuda reinsurance loophole" | $10 billion | |

| Limit tax benefits of retirement accounts at $3.4 million | $5 billion | |

| Additional measures to prevent high-income taxpayers from misclassifying income as capital gains or avoiding paying tax | $0 to $90 billion | |

| Total | $410 to $500 billion | |

Source: Based on descriptions from Clinton campaign fact sheet. Estimates largely from Joint Committee on Taxation estimates of the President's Budget; Congressional Budget Office option for the Buffett Rule; 4% surcharge estimate from Clinton campaign via media reports. Numbers are rounded, but are attempts to score provisions as the Congressional Budget Office would.

Other Tax Proposals

While they aren't mentioned in this plan, Sec. Clinton has other proposals to raise revenue, such as capping the benefit of tax expenditures for high earners, which is used to pay for her plan to provide debt-free college, and lengthen the holding period to obtain the lowest capital gains rates.

The plan doesn't specify what the additional revenue would pay for, beyond "investments that will drive strong growth and raise the pay of middle-class families." We hope that one of those investments is investing in the next generation and putting debt on a downward path a share of the economy.