Clinton's College Affordability Proposal, Explained

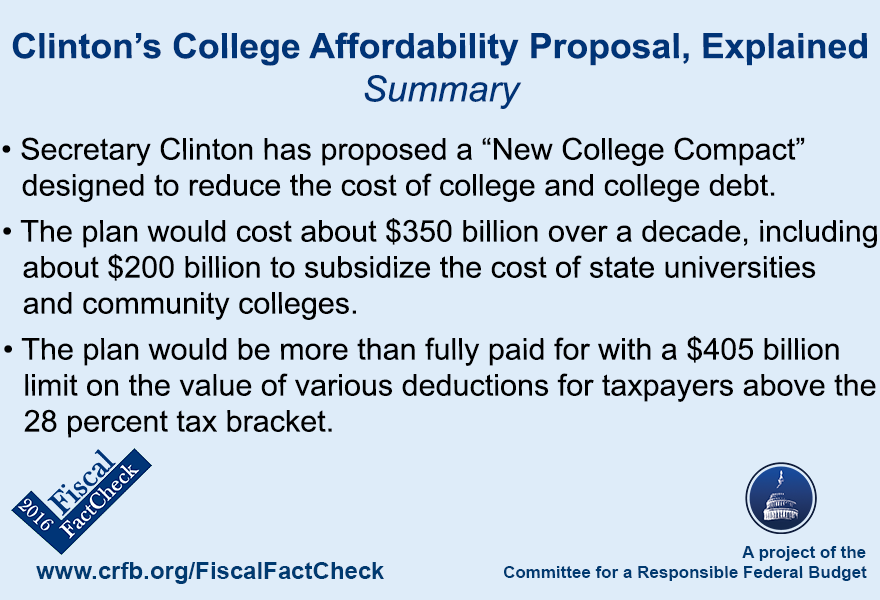

One of Democratic presidential candidate Hillary Clinton's first major policy proposals focused on college affordability. Called the "New College Compact," Clinton offered a two-pronged plan that aims to reduce costs for new students and reduce debt for past students. The plan is fully paid for and includes several ideas that have already been suggested by policymakers.

The Basics

The two major goals of Clinton's plan aim to make college more affordable for both new and current college students and lessen the burden of student loan debt by: (1) controlling the rising costs of higher education and (2) reducing educational debt for those already with student loans.

Controlling Costs

Included in this first prong are several initiatives that aim to "bend the cost curve" for higher education and encourage states to both increase their share of education spending while controlling costs. The plan provides states with grants for their public universities to ensure residents can access in-state tuition "debt-free," assuming that parents make a "reasonable contribution" and students work 10 hours a week. In order to qualify, states would need to increase investment in higher education over time, and universities would have to prove that the funds were going towards instruction rather than secondary aims like athletics. Lower-income students would get enough financial assistance to graduate debt-free, while those with higher incomes could complete two years of AmeriCorps and one year in a public service job after graduation to have their debt forgiven. Clinton also proposes increasing the size of the AmeriCorps program.

The plan also offers $25 billion in assistance to private institutions with low endowments that largely serve minority and underserved students. Finally, the plan also embraces President Obama's proposal to offer two years of tuition-free community college.

Tackling Debt

The second prong of Clinton's approach confronts existing student loan debt. The proposal would cut federal student loan interest rates to the budget-neutral level for the federal government before accounting for risk (student loans are projected to earn the government $50 billion over the next ten years) and allow Americans with student loan debt to refinance at today's lower interest rates. Interest rates were last changed in 2013 to link them more closely to the ten-year Treasury rate.

Simultaneously, the plan would tighten eligibility for federal funds to penalize schools with higher-than-average post-graduation default rates, simplify the income-based repayment plans that are currently offered, and strengthen consumer protections to ensure student loan borrowers understand the risk of taking on debt.

The Budget Impact

| Costs of Clinton's College Affordability Proposal | |

|---|---|

| Policy | 10-Year Cost/Savings (-) |

| Provide two years of tuition-free community college | $60 billion |

| Provide grants to states and public universities | $140 billion |

| Support for private institutions that help underserved students | $25 billion |

| Allow existing student loans to be refinanced at lower rates | $60 billion |

| Grow the AmeriCorps program and expand the education benefits for participating | $20 billion |

| Other initiatives | $45 billion |

| Primary Cost | $350 billion |

| Limiting deductions at 28 percent for the wealthy | $405 billion |

| Funding Left Over | $55 billion |

Source: CRFB calculations using Clinton campaign factsheets, media reports, combined with Tax Policy Center, CBO, and JCT estimates where available.

Clinton estimates that these initiatives will total $350 billion over 10 years. She plans to fully pay for this cost by limiting tax deductions for the wealthy at 28 percent, which is similar to the plan proposed in President Obama's FY16 budget. Charitable giving would not be subject to this 28 percent limit. The Tax Policy Center estimates this reform would raise $405 billion, which is more than enough to pay for the education package. It remains to be seen what Clinton will do with this extra revenue, whether she will scale back the tax limitation to raise less money, use the additional revenue to pay for other initiatives, or use some revenue for deficit reduction.

Similar Existing Proposals

While Clinton's proposal includes several new ideas, it also borrows from several existing proposals. In addition to the proposals borrowed from the President's budget, it includes ideas from Sen. Elizabeth Warren's (D-MA) student loan refinancing plan and the bipartisan proposal from Sens. Jeanne Shaheen (D-NH) and Orrin Hatch (R-UT) for restructuring the formula for federal funds eligibility. Her proposed Borrower Bill of Rights was also introduced in the Senate by Sen. Dick Durbin (D-IL). Streamlining the many loan forgiveness programs into one is a bipartisan proposal from Sens. Angus King (I-ME), Richard Burr (R-NC), and others. Her policy to ensure that GI Bill money is counted as federal funds when making sure that a school does not get over 90 percent of its revenue from the federal government was suggested by Sen. Tom Carper (D-DE) and others. Finally, her proposal to refund GI Bill benefits for students at the now-defunct Corinthean Colleges was previously proposed by Sen. Blumenthal (D-CT).

Two of Clinton's Democratic opponents have also released education plans. Her opponent, Sen. Bernie Sanders (I-VT), goes farther in promising free tuition at public universities, whereas Clinton's proposal includes some contributions from parents and requires students to work 10 hours per week. Sanders estimates that his universal public college plan would cost $750 billion over ten years, which is paid for by a tax on stock trades and other financial transactions. And Gov. Martin O'Malley's proposals have included some of the same elements as Clinton's, including more investment in public colleges, loan refinancing, and making income-based repayment the norm.

Update: This explainer has been updated to reflect the permanent extension of the American Opportunity Tax Credit (AOTC) in the tax extenders package that passed at the end of 2015. Secretary Clinton proposed to make the AOTC permanent, so the original version of this explainer charged $80 billion for the AOTC, and her total college plan cost $430 billion. Now that the AOTC has been permanently extended, she will no longer be charged for its $80 billion, and her college plan now costs $350 billion. This update also includes Tax Policy Center's recent estimate of the tax offset on the wealthy that Sec. Clinton uses to pay for her education plan.