A Bad Deal on Extenders

As soon as the election is over, the lame duck Congress will be pressed to deal with several pieces of must-pass legislation before the end of the year, including their last chance to retroactively extend a set of tax breaks that have been expired since last year. These tax extenders are routinely extended for a year or two at a time without offsets so they add to the national debt, causing it to grow even more than already projected under current law.

An article from Bloomberg suggests that some lawmakers may be considering breaking tradition -- but not in a good way. Instead of extending the provisions for just one or two years (adding a smaller amount to the debt), they will select a few of the bigger provisions to extend permanently.

For example, one potential deal between the two parties could permanently extend and expand the research & experimentation tax credit (as provided for in H.R. 4438); permanently increase the amounts that small businesses can write off immediately; and continue the expansions to refundable tax credits like the Child Tax Credit and American Opportunity Tax Credit that were originally passed in the 2009 stimulus (ARRA) and that currently expire in 2017. Along with these new provisions this potential deal would also provide for a two-year (2014 and 2015) extension of all the other provisions. This is bipartisanship in the worst sense: both parties adding provisions they want to the national credit card.

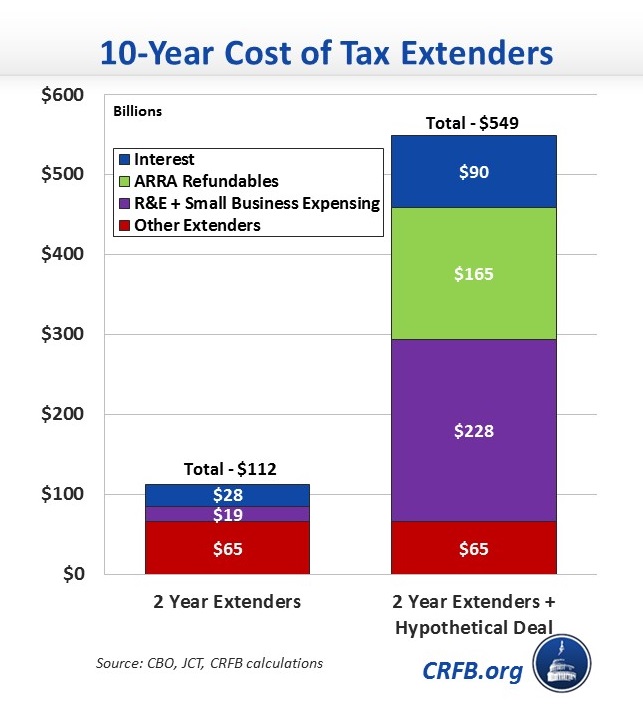

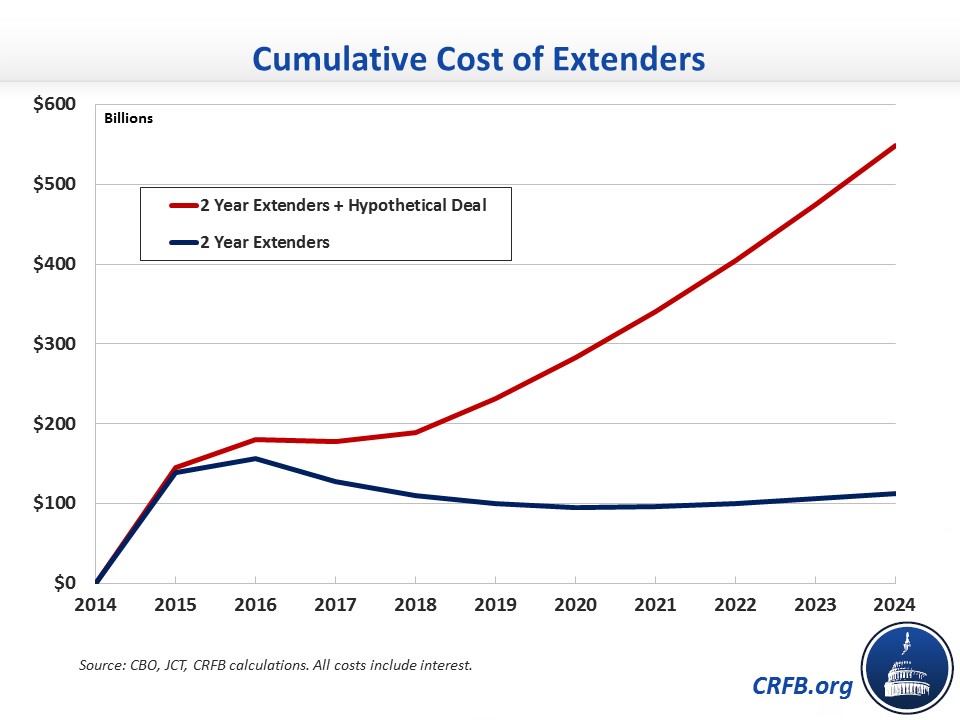

This potential deal would cost about $460 billion ($550 with interest), over five times more expensive than simply extending all the provisions for two years as the Senate Finance Committee has done, which costs about $85 billion without interest.

Continuing the extenders for just two years will add almost $140 billion to the 2015 deficit, but it will save money after 2016. Because some of the largest tax extenders are timing shifts that move tax deductions forward, companies must pay more in taxes after they expire when they don't have those deductions available. However, when the permanent extensions of small business expensing and the ARRA credits and extension and expansion of R&E are added, the costs continue to grow over time.

Permanently extending or expanding any of these provisions without paying for it would lock-in higher debt levels and lower revenue baseline. This lowers the bar for tax reform – a future "revenue-neutral tax reform" would work off a lower baseline and thus, result in lower revenues and higher deficits than they would already be in current projections.

One of the results is that it will be more difficult for House Republicans to balance the budget in ten years with only spending cuts as they have done in the past two budgets. If this package passes, a future House budget would need to include an additional $460 billion of cuts over ten years (or about $50 billion of additional cuts in the last year) to hit the same balanced budget target. In the past, the budget have used the current law revenue baseline which assumes that tax extenders are either not renewed or fully paid for with other revenue.

Each of these permanent extensions and expansions is called for in the President's Budget, though the budget also included more than enough savings to pay for them. The President's advisors recommended vetoing each of this deal's respective pieces that have been voted on in the House, because they were unpaid for. But it is uncertain how the President would view a trade that would include extension of refundable credit expansions that he supports.

Instead of a fiscally irresponsible trade where both parties add to the debt and burden the next generation, it would be great if policymakers could break with convention to abide by PAYGO for any temporary extenders. Ideally, lawmakers would accompany an extenders bill with a process to achieve comprehensive tax reform.

Note: This blog has been updated to clarify that the score used with respect to the R&E tax credit is a permanent extension and expansion as provided for in H.R. 4438, which passed the House 274-131 in May.