Accounting For Growth With Trump's Fiscal Plans

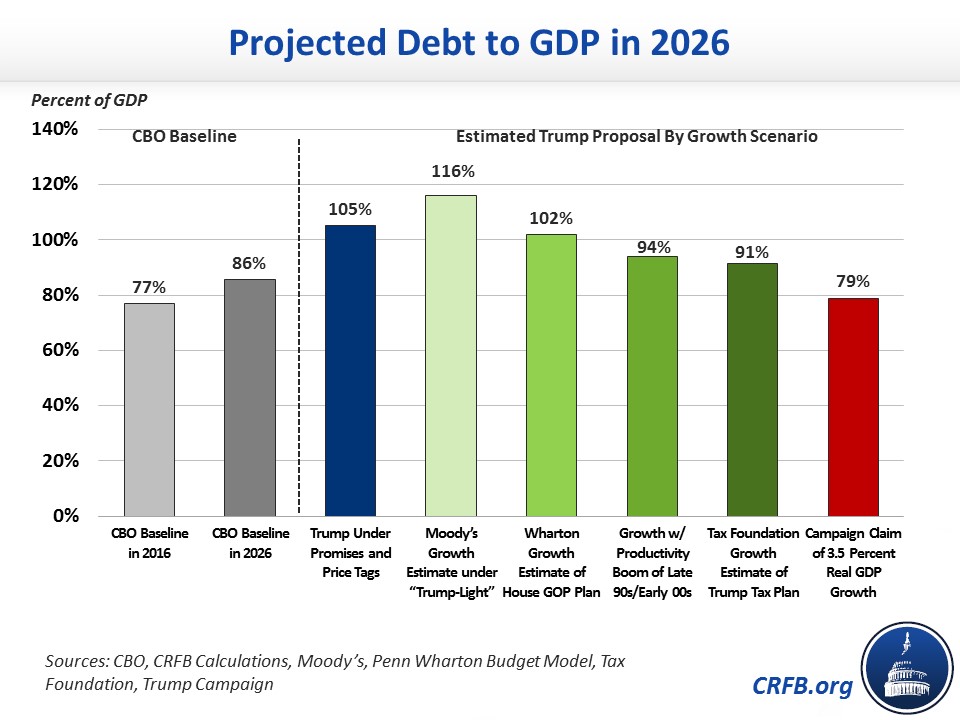

Last week, we estimated that Donald Trump's policies would increase ten-year deficits by $5.3 trillion, resulting in debt held by the public reaching 105 percent of Gross Domestic Product (GDP) by 2026. These estimates were based on "conventional scoring" that does not account for any possible economic growth effects of the policies he proposes. But what if Trump's policies do change the rate of economic growth?

A faster rate of economic growth would reduce the cost of Trump's plan by increasing the tax revenue generated by the federal government; it would also increase the size of the economy and therefore the nation's capacity to carry debt.

Before estimating just how growth might change our estimates, it is important to recognize that the actual effects of Trump's plans are unlikely to differ significantly from our conventional estimates — which account for behavioral changes but not changes to the size of the economy. In our assessment, Trump's policy proposals could impact the growth rate, but the magnitude of these changes is likely to be small in relative terms and could be negative overall.

While tax reform and regulatory reform are likely to accelerate growth, for example, the effects are likely to be relatively small and could be offset or more than offset by Trump's proposals to reduce the number of immigrants, reduce international trade, and increase the national debt. Certainly, there is little reason to think Trump's policies could lead to the 75 percent increase in the average real GDP growth rate suggested by his advisors. As we've explained before, achieving this level of growth would require faster sustained productivity gains than any time in modern history.

With that said, if faster growth does materialize it would certainly reduce the cost of Trump's plan. Under our conventional projections, which assume 2 percent real annual GDP growth, Trump's plan would cost $5.3 trillion over a decade. Assuming the 3.5 percent growth claimed by the Trump campaign — a level far higher than most dynamic estimates suggest is achievable — that cost would fall to $1.5 trillion.

Of course, other growth scenarios would lead to different outcomes. For example, using the dynamic growth effects estimated by the Tax Foundation,* resulting in an average growth rate of 2.8 percent, Trump's plan would cost $3.4 trillion. And assuming we were able to return productivity levels to where they were in the late 1990s and early 2000s in the dot-com boom, Trump's plan would cost $3.8 trillion.

Debt Under Donald Trump's Plan With Different Growth Assumptions

| Average Annual Growth Rate | 10-Year Deficit Increase | |

|---|---|---|

| Promises & Price Tags (Conventional Score) | 2.0% | $5.3 trillion |

| With Alternate Growth Assumptions | ||

| Moody’s Growth Estimate under “Trump Lite” | 1.4% | $6.6 trillion |

| Wharton Growth Estimate of House GOP Plan | 2.1% | $4.7 trillion |

| Growth w/ Productivity Boom of Late 90s/Early 00s | 2.6% | $3.8 trillion |

| Tax Foundation Growth Estimate of Trump Tax Plan | 2.8% | $3.4 trillion |

| Campaign Claim of 3.5 Percent Real GDP Growth | 3.5% | $1.5 trillion |

Sources: CBO, CRFB Calculations, Moody’s, Penn Wharton Budget Model, Tax Foundation, Trump Campaign

These projections, however, are still likely more generous that what is achievable under Trump's plan. When the Penn Wharton Budget Model modeled the House Republican tax plan — which is in many ways similar to Trump's tax plan — they estimated growth would average just 2.1 percent per year; under that assumption, Trump's plan would cost about $4.7 trillion.

Indeed, the one analysis that has attempted to look at the growth effect of Trump's plan in its entirety, conducted by Moody's Analytics, found growth would be slower under Trump's plan than current law. In their estimate of "Trump Lite," which is most similar to Trump's current plan in light of recent additions and adjustments, they found Trump would lower growth by just over 0.5 percentage points a year — suggesting 1.4 percent real growth against the latest baseline. Assuming this slower growth, we estimate that Trump's plans would cost $1.3 trillion more than our conventional score, or $6.6 trillion total.

Under each of these scenarios, the debt-to-GDP ratio will rise from today's levels. And in all but the 3.5 percent growth scenario, debt will grow faster than under current law. Assuming the Moody's estimates are correct, debt would grow from 77 percent of GDP today to about 116 percent of GDP by 2026. Assuming the Wharton growth estimates, debt would grow to 102 percent. And even with the massive productivity growth rates of the 1990s, debt-to-GDP would still grow to 94 percent of GDP.

If 3.5 percent real GDP growth were achieved, debt would grow only modestly as a share of GDP — to 79 percent by 2026 — and would actually be nearly 7 percentage points below current law. However, the likelihood of such growth rates is extremely low, and it certainly should not be counted on to ensure the plan does not add to the debt.

The bottom line is that while faster economic growth can help the fiscal picture — and more importantly increase income growth for Americans — no achievable level of growth would be sufficient to prevent Trump's current proposals from adding to the already-growing debt. We would therefore encourage Trump to further reform and add to his proposals, especially by reforming the nation's entitlement programs. Entitlement reform and debt reduction are both important keys to long-term economic growth and could thus create a virtuous cycle of growth and fiscal sustainability.

*Note: in this analysis, we use the midpoint between the Tax Foundation's two estimates of Trump's tax plan that account for different interpretations of Trump's tax proposal on businesses.

Updated: A previous version of this blog had a typo in the chart and the corresponding number in the text for the Wharton Growth Estimate of the House GOP Plan. It has been corrected to indicate debt in 2026 would be 102% of GDP