House GOP Sketches Out Details on Tax Reform

The House Republicans continue to rollout several policy proposals/frameworks, recently releasing a tax reform plan that aims to reduce tax rates and simplify the tax code. Though the plan is not quite as detailed as (for example) former Ways and Means Committee Chairman Dave Camp's (R-MI) tax reform draft, it gives a good idea of where House Republicans are looking to go on taxes. But while the plan is a welcome addition to the tax reform debate, it would fall short on revenue because it explicitly aims for a lower revenue target than the current tax system would meet.

Individual Tax Policies

The plan would consolidate the current seven individual income tax rates ranging from 10 to 39.6 percent down to three rates of 12, 25, and 33 percent and nearly double the standard deduction, resulting in equal or lower marginal tax rates for all taxpayers. The plan would provide a 50 percent exclusion for capital gains, dividends, and interest, lowering the effective top capital gains and dividends rate from 20 percent to 16.5 percent, excluding the current 3.8 percent surtax – which is eliminated as part of the House’s health plan (interest income is currently taxed at ordinary income rates). The Alternative Minimum Tax (AMT) and estate tax would be eliminated (though it isn't clear if step-up basis would be as well), and the child tax credit and dependent exemption would be consolidated into a $1,500 credit ($1,000 of which would be refundable).

To partially offset the cost of these changes, the plan would eliminate all itemized deductions except the mortgage interest deduction and charitable deduction. For those two deductions, any reforms would be left up to the Ways and Means Committee other than the explicit instruction that mortgage interest deduction changes would not affect already-existing mortgages. The plan would also eliminate exclusions for non-wage compensation other than health care and retirement savings, limiting the health exclusion as part of their health care plan and leaving retirement savings incentives to the Ways and Means Committee to determine how to reform. Education tax preferences would be consolidated in some form, leaving at least a savings account provision (like section 529 plans) and a tax relief provision (like the American Opportunity Tax Credit). Other remaining tax preferences would be eliminated other than the Earned Income Tax Credit, which would remain as is.

Business Tax Policies

For the corporate income tax, the plan would reduce the tax rate from 35 to 20 percent while making investments immediately deductible but limiting interest expense deductions to interest income. Most business tax preferences would be eliminated (the domestic production activities deduction is specifically named) with the exception of last-in, first-out (LIFO) inventory accounting and the R&E tax credit. For international income, the plan would move to a territorial system where income earned abroad by U.S. companies is exempt from U.S. taxation, and a 8.75 percent one-time tax would be assessed on unrepatriated income. The reformed corporate tax would function more like a consumption tax, since it would allow investments to be deducted immediately and would eliminate both taxes on interest income and interest expense deductions. Also as a result, the tax would be border-adjusted so it would apply to imports but not exports.

Pass-through business income, which is currently taxed at individual income tax rates, would continue to be taxed at ordinary income rates but with a top rate of only 25 percent rather than 33 percent.

Parameters of House GOP Tax Reform Plan

| Parameter | Current Law | House GOP Plan |

|---|---|---|

| Structure of the Code | ||

| Tax Rates | Seven rates of 10-39.6% | Three rates of 12-33% |

| Standard Deduction | $6,300/$12,600 in 2016 | $12,000/$24,000 |

| Dependent Exemption | $4,050 per dependent | $1,500 per child credit ($1,000 refundable); $500 non-refundable credit for non-child dependents |

| Child Tax Credit | $1,000 per child credit; partially refundable | |

| Savings and Investment | ||

| Capital Gains and Dividends | Four rates of 0-20% with a 3.8% tax for income above $250K | Three rates of 6%, 12.5%, 16.5% |

| Interest | Taxed as ordinary income | Three rates of 6%, 12.5%, 16.5% |

| Other Individual Taxes | ||

| AMT | Applied to higher-income taxpayers with relatively low tax rates | Eliminated |

| Estate Tax | Applied to estates greater than $5.45M at rates up to 40% | Eliminated |

| Individual Tax Preferences | ||

| Mortgage Interest Deduction | Available for interest on the first $1.1M of a mortgage | Retained in some form; no changes for current mortgages |

| Charitable Deduction | Available for charitable giving up to 50% of income | Retained |

| State and Local Tax Deduction | Available for income and sales taxes | Eliminated |

| Other Deductions | Available (generally only if they exceed 2% of income) | Eliminated |

| Health Exclusion | Available for employer-provided insurance; 40% tax on high-cost plans | Capped at an unspecified level |

| Retirement Savings | Various provisions for tax-free contributions or withdrawals | Retained |

| Other Exclusions | Various exclusions for non-wage compensation and other items | Eliminated |

| Earned Income Tax Credit | Refundable credit with $5,572 max benefit for worker with two children in 2016 | Retained |

| Education | Various provisions available to reduce the cost of college or saving for college | Consolidated to at least include a savings account and a tax relief provision |

| Business Provisions | ||

| Corporate Tax Rate | Top rate of 35% | Top rate of 20% |

| Pass-Through Businesses | Taxed at individual level at ordinary income rates | Taxed at individual level at ordinary income rates up to 25% |

| Depreciation Schedules | Investments generally deducted over time based on asset life | Investments deducted immediately |

| Interest Deductions | Deductible up to 50% of taxable income and 1.5/1 debt-to-equity ratio | Deductible only up to amount of interest income |

| International Income | Taxed by U.S. when repatriated back to U.S. parent company; "passive" financial income taxed immediately | Not taxed by U.S.; certain passive income rules are retained |

| R&E Credit | Available for incremental increases in R&E expenditures | Retained |

| LIFO Accounting | Allowed for inventory accounting | Retained |

| Other Tax Preferences | Various investment incentives and other provisions | Eliminated |

Source: House Tax Reform Task Force, Internal Revenue Service

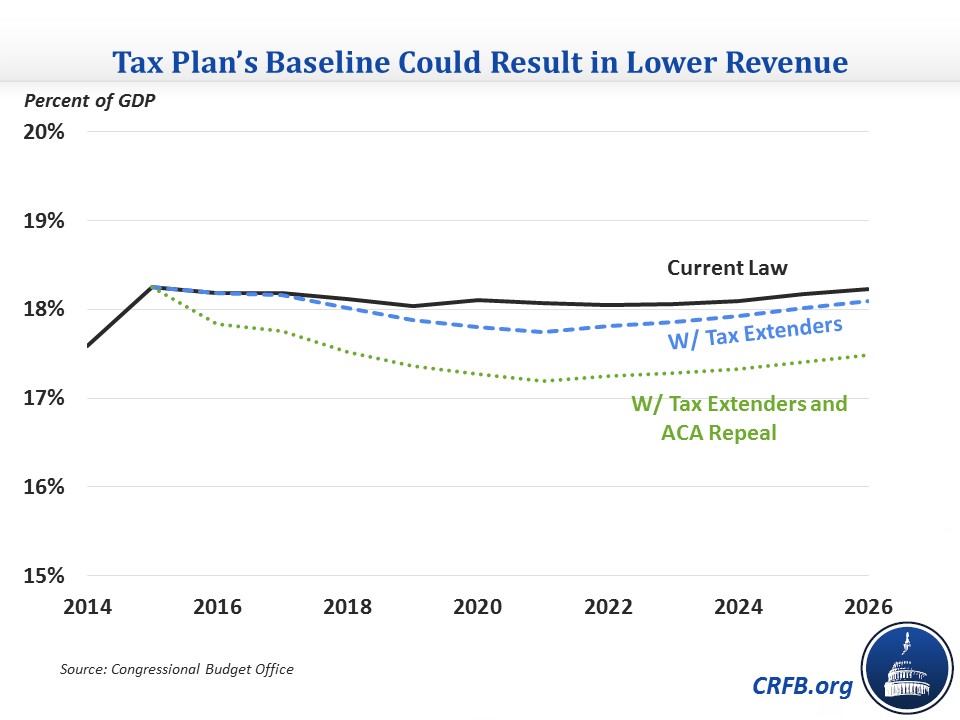

Revenue Effect

The plan claims that it would be revenue-neutral but defines it in a way that would ultimately aim lower than current law amounts. First, they say that the baseline should take into account around $400 billion of tax cuts that were only temporarily extended in last year's tax extenders bill, thus lowering their target by that much and making the costs of extending those tax cuts disappear from the budget process. Notably, the majority of the $400 billion cost comes from bonus depreciation, a policy that was enacted in 2008 as temporary stimulus. In addition, when Congress agreed to legislation making most tax extenders permanent, lawmakers explicitly stated that the provisions extended temporarily would be allowed to expire, so they shouldn’t even be considered as part of a “current policy” baseline because the policy decision in the extenders deal was that those tax breaks would expire. Including the costs of extending those tax breaks in the baseline would effectively undo one of the few fiscally responsible elements of the tax extenders deal. Any tax reform that aims for revenue-neutrality shouldn't include temporary tax extenders beyond their expiration date unless they are offset within the context of the plan.

Second, the plan would aim for revenue-neutrality under dynamic scoring, which takes into account macroeconomic effects in assessing the revenue effect. These effects are notably uncertain – the Joint Committee on Taxation (JCT) estimated that Chairman Camp's plan would produce additional dynamic revenue in a range of between $50 and $700 billion – but would be presented as a concrete point estimate and used to obviate the need for further base-broadening or less rate reduction to achieve revenue-neutrality. Lawmakers should instead ensure that their plan is revenue-neutral without relying on dynamic revenue from growth, which – if it materializes – would be better dedicated toward deficit reduction.

Both putting temporary tax extenders in the baseline and counting dynamic revenue have the potential to lower the revenue target by hundreds of billions of dollars compared to a current law baseline.

Another issue is that the tax plan assumes that the $1.3 trillion of tax increases used to finance the coverage expansions in the Affordable Care Act are repealed in the House GOP's health care plan. That is a reasonable assumption, but tax-writers should be careful not to lock in low revenue levels if that plan doesn't get enacted or doesn't adequately offset the revenue loss.

Beyond the lower revenue target of revenue-neutrality relative to a current policy baseline with dynamic effects, there is also the question of whether the actual policies would reach the target, which is not entirely clear without further details or an official score. Citizens for Tax Justice estimates that the plan would cost $4 trillion over ten years, with more than three-fifths of the revenue loss coming from corporate taxes. The Tax Foundation estimates it would cost $2.4 trillion over ten years on a static basis and $191 billion on a dynamic basis, with about half of the static cost coming from corporate revenue. It also expects the tax cuts to cost half as much as a percent of GDP in the second decade than in the first since a large portion of the first decade's revenue loss comes from one-time revenue (particularly the move to full expensing). Ultimately, JCT would have the final word on the plan's overall effect, but these two organizations have found it would lose revenue.

*****

The Task Force's tax reform plan is an admirable effort to clean up the tax preferences that litter the code and greatly simplify the system. As lawmakers build from that framework and hopefully add more detail, they should ensure that they pay for tax extenders, don't rely on uncertain economic growth to achieve revenue-neutrality, and ideally raise additional revenue for deficit reduction.