2017 Tax Cuts Continue to Lose Revenue

UPDATE (June 2024): This analysis has been updated for CBO's June 2024 baseline update.

The Congressional Budget Office (CBO) estimated the Tax Cuts and Jobs Act (TCJA) of 2017 would add $1.8 trillion to deficits (excluding interest) through Fiscal Year (FY) 2028 on a conventional basis or $1.3 trillion after accounting for the dynamic effects of faster economic growth. Despite some claims that the tax cuts have paid for themselves, actual revenue collections have been relatively consistent with CBO’s estimates. Adjusted for inflation, corporate and individual income tax revenue closely matched CBO’s post-TCJA projections last year, and total revenue since 2017 has been within 2 percent of CBO’s projections.

Importantly, even a significant divergence from 2018 projections would not prove the original estimates of TCJA wrong. Estimates are by their nature uncertain, and the economy has gone through a tremendous amount of change – including a pandemic, deep recession, and inflation surge – since those projections were made. Still, CBO’s 2018 projections match actual outcomes pretty closely when one adjusts for inflation.

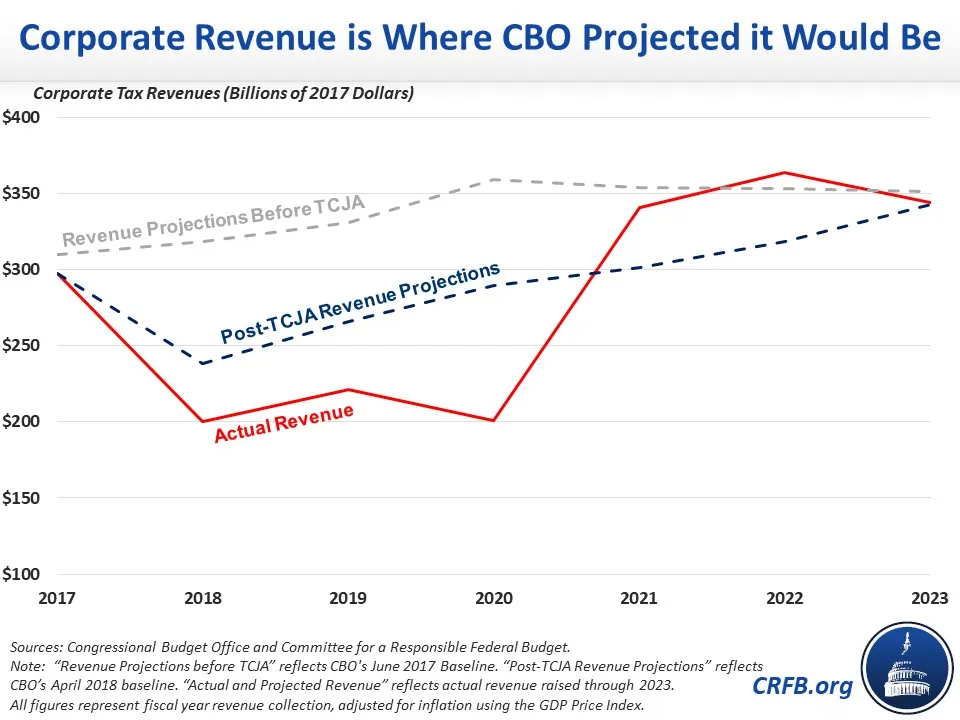

On the corporate side, as others have pointed out, nominal revenue collection was $353 billion below the pre-TCJA baseline since 2018 but was $24 billion above that baseline in 2023. However, once adjusting for the recent surge in inflation, real (inflation-adjusted) revenue collection is currently below pre-TCJA projections and almost identical to where CBO projected it would be after the TCJA was enacted. Importantly, the TCJA was not projected to significantly reduce corporate tax revenue in 2023 as some of its tax cuts were phased out and new offsets phased in (though Congress has proposed to largely reverse these choices).

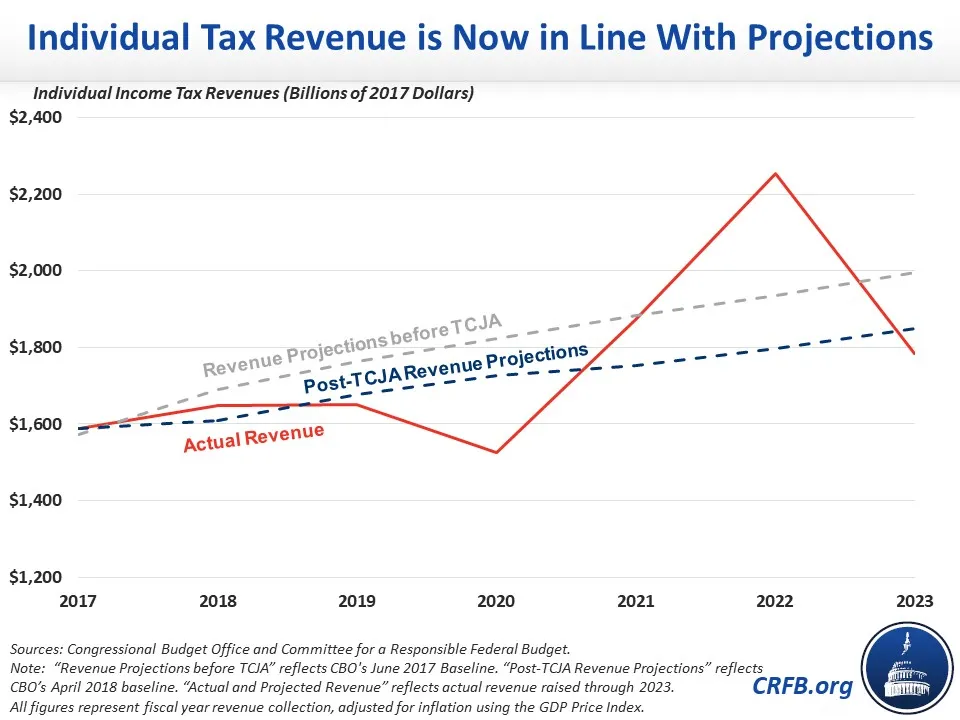

A similar story is true on the individual income tax side. Revenue closely matched CBO’s post-TCJA projections through 2019, fell below them in 2020 as a result of the pandemic, surged above them in 2022 due largely to a one-time inflation- and capital gains-driven windfall, and then fell to within close range of CBO’s projections in 2023. In all years besides 2022, individual income tax collections came in below the pre-TCJA baseline.

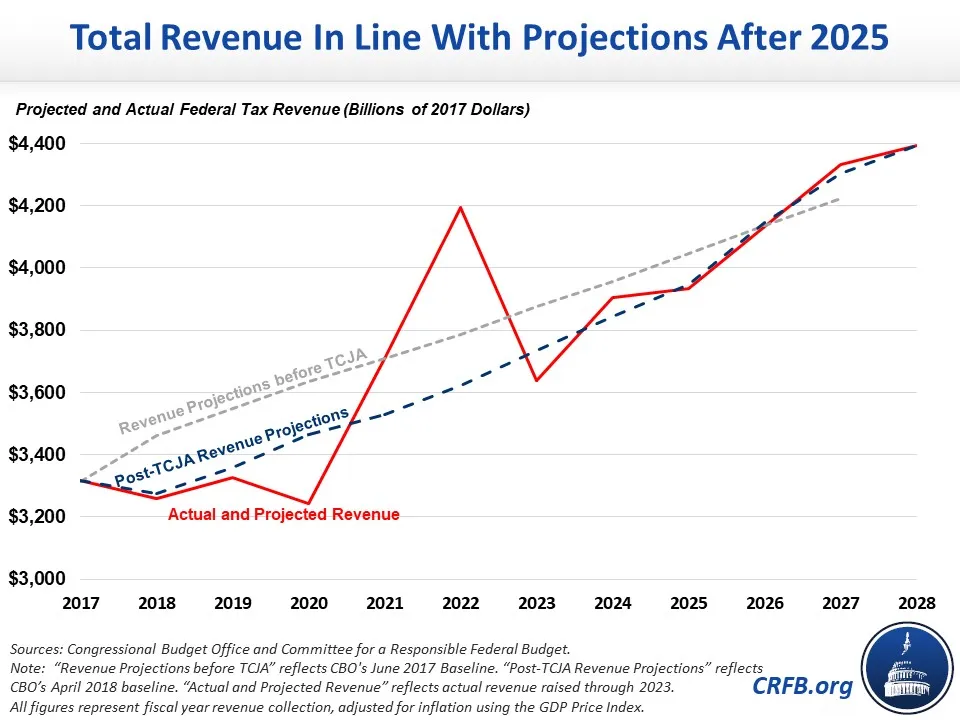

Total real revenue in 2023 was $3.6 trillion, well below CBO’s pre-TCJA projection of $3.9 trillion and even somewhat below its post-TCJA projection of $3.7 trillion.

Going forward, real revenue is projected to closely match CBO’s post-TCJA projections, which actually exceed its pre-TCJA projections starting in 2027. This is not because the tax cuts will start “paying for themselves,” however, but rather because a large number of the tax cuts will expire at the end of 2025 (in addition to the measures that have expired or emerged already).1

Extending these expiring tax cuts could lose $3.4 trillion over the subsequent decade, or more than $4 trillion if corporate provisions are revived as well. Lawmakers should not extend or revive these tax cuts without offsets and should instead pursue revenue-raising tax reform. Tax cuts do not pay for themselves, but fiscally responsible and pro-growth tax reform can boost incomes and improve our nation’s fiscal outlook. That should be a key goal of tax reform.

____________________________________________________________

1 A small amount of the difference is due to economic and technical changes – however, most of these changes were incorporated before the TCJA was implemented and are not a result of the tax cuts themselves.