Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

FY 2022 Reconciliation Tracker

Last Updated: 12/20/2021 Budget reconciliation is underway ( read more about the full process here), with House and Senate lawmakers crafting a...

Limiting the Cost of Medicare Expansion

As Congress negotiates proposals for Medicare benefit expansions, it should consider ways to limit their costs by either dropping the expansions...

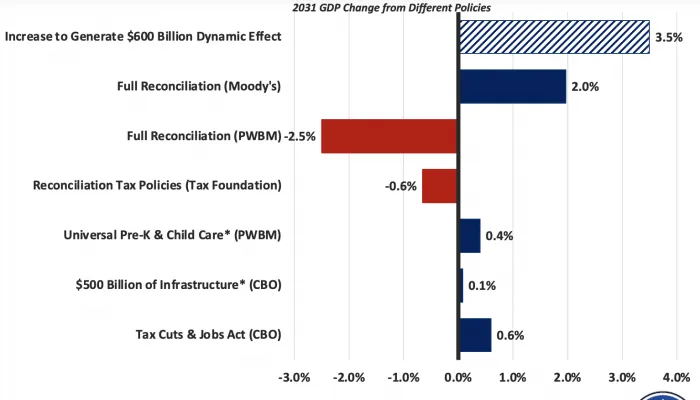

Reconciliation Unlikely to Produce $600 Billion in Dynamic Revenue

Policymakers are claiming their $3.5 trillion reconciliation package will be fully paid for by counting on $600 billion of dynamic feedback on top of...

Maya MacGuineas: Mind the (tax) gap: To fund new spending, people should pay the taxes they owe

Maya MacGuineas is president of the Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt. She recently wrote an opinion...

Five Ways to Improve the FY 2022 Reconciliation Package

Congress is attempting to enact a large and ambitious agenda of new programs through the reconciliation process. While President Biden has made the...

Prevent Government Shutdowns Act of 2021 Introduced in the Senate

Recently, Senators James Lankford (R-OK) and Maggie Hassan (D-NH) introduced the Prevent Government Shutdowns Act of 2021 (PGSA). The bill would...

Better Targeting in Reconciliation

As lawmakers negotiate the details of their reconciliation package, they will need to scale back some of their ambitions to prevent arbitrary policy...

Ways and Means Proposes $1.3 Trillion of Tax Breaks, $2.3 Trillion of Tax Hikes

UPDATE (9/13/2021): The Joint Committee on Taxation has released a full score of the revenue proposals, including the revenue-raising items. The table...

SALT Cap Repeal Would Be a Costly Mistake

Recent reports indicate Congress may repeal the $10,000 cap on the State and Local Tax (SALT) deduction in its $3.5 trillion reconciliation bill, with...

Closing the Stepped-Up Basis Loophole

Reconciliation should not add a penny to the national debt. As lawmakers work to craft a package with $3.5 trillion of new spending and tax breaks...

Representatives Murphy and Cuellar Push for Fiscally Responsible Reconciliation

Representatives Stephanie Murphy (D-FL) and Henry Cuellar (D-TX) recently sent a letter to House majority leadership outlining principles for the...

Biden Administration’s SNAP Increase Could Add $180 Billion to Deficits

The U.S. Department of Agriculture (USDA) recently announced it will be revising the Thrifty Food Plan (TFP), used for the calculation of Supplemental...