Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Policymakers Shouldn't Weaken Build Back Better Surtax

To help finance new spending and tax breaks, the House-passed Build Back Better Act (and the Senate Finance Committee’s version) includes a high...

Build Back Better Drug Reforms Would Lower Costs

The House-passed Build Back Better Act includes several reforms to reduce prescription drug costs for the federal government, seniors, and the public...

What Does Student Debt Cancellation Mean for Federal Finances?

We've previously estimated that cancelling all federal student debt would cost the same as the outstanding value of the loans, which is currently $1.6...

2021 Inflation Totaled 6.7 Percent

The Bureau of Labor Statistics (BLS) today released Consumer Price Index (CPI) inflation data for December 2021. Based on BLS’s data, we estimate CPI...

Addressing Tax Expenditures Could Raise Substantial Revenue

While the House and Senate each has put forth its own version of the Build Back Better Act reconciliation legislation, the offsets that will be...

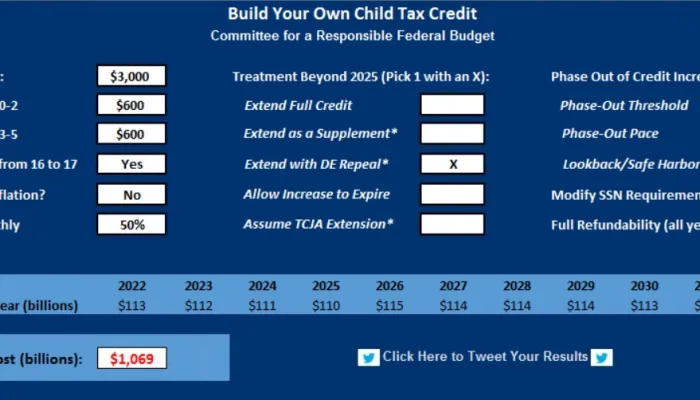

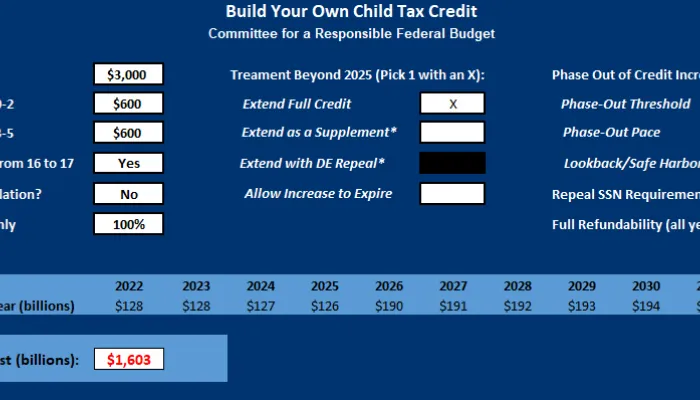

Build Your Own Child Tax Credit 2.0

UPDATE (August 2023): We have released an updated web-based version of the CTC model. You can find the model here. As lawmakers continue to debate if...

Our Top 21 Fiscal Charts of 2021

2021 was a busy year for fiscal policy, which gave us ample opportunities to conduct substantive policy analyses using charts and tables. This year...

Build Your Own Child Tax Credit

UPDATE (August 2023): We have released an updated web-based version of the CTC model. You can find the model here. As the year comes to a close...

CBO Scores the Build Back Better Act

The Congressional Budget Office (CBO) has released cost estimates for every title of the House-passed Build Back Better Act (H.R. 5376). Without...

New SALT Proposals Would Improve House Bill

So far, nearly every proposal introduced or suggested to change the state and local tax (SALT) deduction cap would be unnecessarily costly and...

SALT Repeal Just Below $1 Million is Still Costly and Regressive

To avoid cutting taxes for households making over $1 million, some politicians have suggested eliminating the State and Local Tax (SALT) deduction cap...

Two-Thirds of the “One Percent” Get a Tax Cut Under Build Back Better, Due to SALT Relief

Last month, we showed that the House-passed Build Back Better Act would cut taxes for roughly two-thirds of those earning more than $1 million per...