How to Offset the Tax Extenders

Update (12/3): This blog has been updated to reflect a correction the Joint Committee on Taxation made to its estimate of the wind production credit.

After proposing a nearly $450 billion budget-busting deal on the tax extenders that received a veto threat from the White House, Congress is scaling back its plans to a one-year retroactive extension of the extenders. This $42 billion plan would end the uncertainty on tax extenders for the upcoming filing season by extending the provisions for 2014, but it would leave the issue to be dealt with again next year (with extensions again needing to be retroactive). Furthermore, many of these policies were meant to encourage economic activity or provide economic stimulus, but by being done retroactively, this extension is simply providing a windfall for activities that have already taken place. Retroactive tax cuts are poor policy and a sign of a broken legislative process.

Still, this approach is a clear improvement over the previous deal because it has a much lower cost, and it doesn't permanently lower baseline revenue for tax reform, which will be needed to pay for an aging population. Encouragingly, it also limits extensions to current policies and no longer includes expansions as the previous package did.

| Cost of One-Year Retroactive Extensions of Tax Extenders | |

| Extension | 2015-2024 Cost |

| R&E Credit | $7.6 billion |

| Wind Production Tax Credit | $6.4 billion |

| Subpart F Exception for Active Financing Income | $5.1 billion |

| Mortgage Debt Forgiveness Exclusion | $3.1 billion |

| State and Local Sales Tax Deduction | $3.1 billion |

| 15-Year Recovery Period for Leasehold, Restaurant, and Retail Property | $2.4 billion |

| Bonus Depreciation | $1.5 billion |

| Section 179 Expensing | $1.4 billion |

| Work Opportunity Tax Credit | $1.4 billion |

| Biodiesel Production Credit | $1.3 billion |

| Look-Thru Rule for Payments Between Related Subsidiaries | $1.2 billion |

| New Markets Tax Credit | $1 billion |

| Exclusion of Gains on Small Business Stock | $0.9 billion |

| Mortgage Insurance Premium Deduction | $0.9 billion |

| Other Provisions | $4.3 billion |

| Total | $41.6 billion |

Source: House Rules Committee

Numbers may not add up due to rounding.

Even with the more responsible nature of the package, lawmakers should still offset the lower cost so they don't reverse the progress that has been made on deficits in recent years. That's where CRFB's PREP Plan can help.

PREP gives three principles for offsetting tax extenders in a way that maintains fiscal responsibility and sets up broader reform of the tax code. They are:

-

- Address most tax extenders permanently in the context of tax reform

- Fully offset the cost of any continued extenders in the interim without undermining tax reform

- Include a fast-track process to achieve comprehensive tax reform

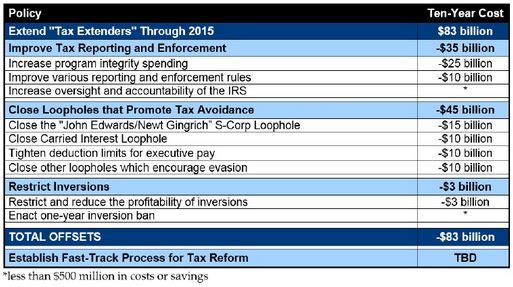

Obviously, a one-year extension would satisfy the first criterion, but 2 and 3 have yet to be fulfilled. On 2, the PREP plan includes enough savings to offset a two-year, $83 billion extension of all of the provisions that expired at the end of 2013, except for bonus depreciation. Doing a one-year extension means that lawmakers could pick and choose among these provisions rather than having to do the whole package (or something equivalent).

In order to avoid stepping on the toes of tax reform, the offsets come from provisions that improve tax enforcement, close loopholes, and restrict inversions and their tax benefits. These offsets do not raise tax rates or reduce explicitly legislated tax breaks.

The first category, raising $35 billion, mainly consists of increased program integrity funding for the IRS to close the tax gap, estimated at nearly $400 billion in 2006. In addition, the plan adopts a number of small proposals from the President's budget and Chairman Camp's discussion draft to increase reporting requirements, increase tax penalties, and make various other changes.

The second category, raising $45 billion, closes tax loopholes that have been on lawmakers' radars for years. The largest policy would close the "reasonable compensation" loophole, more commonly known as the John Edwards/Newt Gingrich loophole, which allows corporation owners to reduce their payroll tax liability. Another frequently-proposed item would tax carried interest as ordinary income. The plan would also tighten limits on deductions for executive pay by counting performance incentives toward the limits.

The final category includes a $3 billion provision from Senate Democrats to restrict interest deductions for inverted companies and establishes a one-year ban on inversions.

From a debt perspective, the plan's trade of temporary costs for permanent savings means that while it is deficit-neutral in the first ten years, it would produce deficit reduction after that; just looking at the 2020-2024 window, the tax package saves $40 billion. Offsetting a one-year extension would have a similar effect.

From a tax policy perspective, the plan will pave the way for tax reform to be enacted next year -- especially crucial if they do only a one-year extension -- that would deal with these provisions once and for all and improving the tax code in a comprehensive manner. Referring to the Senate's two-year extension bill, Senate Finance Committee Chairman Ron Wyden (D-OR) stated earlier this year that "I am determined this will be the last extenders bill on my watch." This plan is a way of making that a reality, whether they do a one- or two-year extension.

Click here to read the full PREP plan.