Would Joe Biden Significantly Raise Taxes on Middle Class Americans?

During the 2020 Republican National Convention, several speakers claimed that Democratic nominee and former Vice President Joe Biden would substantially raise middle-class taxes if elected President.

On the first night of the convention, former South Carolina Governor and United Nations Ambassador, Nikki Haley, claimed that “A Biden/Harris administration would…want massive tax hikes on working families."

Then, on the second night, Eric Trump, son of President Donald Trump, said, “Joe Biden has pledged to raise your taxes by $4 trillion. Eighty-two percent of Americans would see their taxes go up significantly.”

We find that these statements range from somewhat misleading to largely false. While middle class Americans could see an increase in their net tax burden under a Biden administration, this would be an indirect result of higher corporate taxes (which are borne, in part, by workers), not from direct tax increases. Furthermore, any potential indirect increases in middle-class tax burdens would be modest and could hardly be described as significant or massive.

It is important to note that our analysis focuses only on the taxes proposed by the Biden campaign thus far. While we have not yet published our comprehensive analysis of Biden's spending proposals, adding up the stated costs of some of his plans makes it clear that his proposed tax increases to date are insufficient to fully offset his spending agenda. To avoid adding trillions to budget deficits over the coming decade and put debt on a stable path, additional taxes or spending cuts would be needed, which could potentially fall on the middle class.

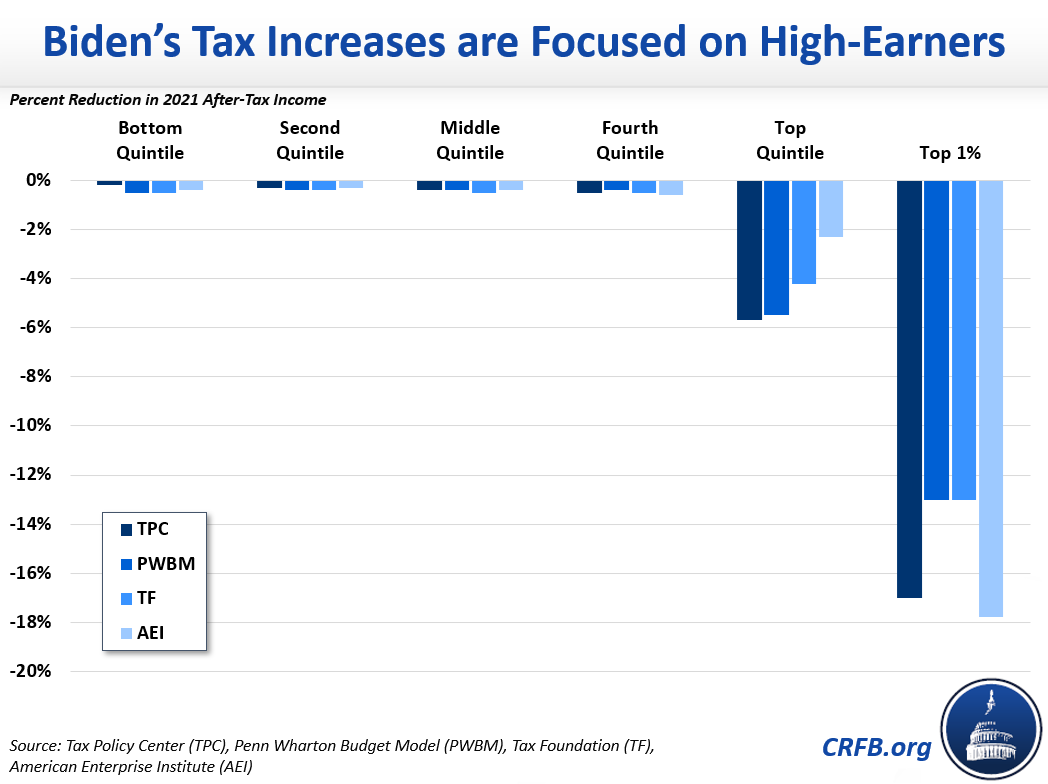

Biden's Tax Increases are Focused on High-Earners

Vice President Biden has proposed significant overall tax increases. In our recent paper, Understanding Joe Biden’s 2020 Tax plan, we estimate Biden's tax proposals would raise between $3.35 and $3.67 trillion on net over a ten-year period. His proposed gross tax increases would likely total more than $4 trillion, which would be partially offset by some targeted tax reductions.

However, the vast majority of those taxes would be borne by very high income households. In fact, the Biden plan appears to be designed in a way that would honor his pledge to not raise direct taxes on individuals and households earning less than $400,000 per year.

Biden’s proposed direct tax increases — including raising the top individual income tax rate from 37 percent to 39.6 percent, taxing capital gains as ordinary income and at death for taxpayers with over $1 million in annual income, limiting various individual and business tax breaks for high-earners, and applying the Social Security payroll tax to high wages — appear to be designed to only affect individuals or households with annual income above $400,000. For example, Biden would create a "donut hole" within the Social Security tax base so that no income was taxed between the current taxable maximum of $137,700 and $400,000 of wages.

The rest of Biden's proposed tax increases would fall largely on corporations. As our paper explains, Biden would raise the corporate income tax rate from 21 percent to 28 percent, set minimum corporate taxes on domestic and foreign income, and impose a financial risk fee on large banks.

Of course, in many ways, a corporation is nothing more than an organized group of individuals, and those individuals cannot be easily isolated from the effects of policies that change the tax burden of their respective corporation. Most economists and estimators believe corporate tax burdens are borne by some combination of shareholders, owners of capital, and workers. Since many middle-class households include both workers and shareholders (through pensions and retirement accounts, for example), any increase in corporate taxes would indirectly increase their tax burden, albeit modestly.

Based on analyses and estimates of Biden's tax plan published by the Tax Policy Center, Penn Wharton Budget Model, Tax Foundation, and American Enterprise Institute, tax burdens among the bottom 80 percent of households in the income distribution would see a 0.2 to 0.6 percent reduction in after-tax income. For a typical family in the middle of the income distribution, this amounts to $180 to $260 per year. Importantly, these outside analyses do not cover all the elements of the Biden tax plan; we filled in the holes in our paper and believe the missing policies would partially offset the net reduction in after tax income for lower- and middle-income households.

Notably, 80 to 90 percent of the total proposed tax increases in Biden’s plan would fall on the top five percent of earners. While tax burdens would rise by 0.2 to 0.6 percent for most households, they would rise by 2.3 to 5.7 percent for the top 20 percent of earners and by 13.0 to 17.8 percent for those in the top 1 percent in 2021. The Tax Policy Center finds that households in the top one percent (those earning $837,000 or more) would face an average tax increase of $300,000 per year.

As we mentioned before, this analysis only takes into account tax provisions that have been proposed by the Biden campaign thus far. As proposed, additional revenue that would be raised through Biden's tax plan would only pay for a portion of his overall spending agenda.

For example, Biden recently announced his "Build Back Better" initiative, which includes a plan to spend $2 trillion over four years on clean energy and sustainable infrastructure, $700 billion over four years to boost American manufacturing and technological innovation, and $775 billion over ten years on programs for child and elderly care. Adding this to Biden's $850 billion preschool and K-12 education plan, his $1.5 trillion health care plan, and just part of Biden's agenda would cost nearly $6 trillion over a decade. Nearly $6 trillion more would be needed to stabilize debt-to-GDP at today's near-record levels.

Since Biden's proposed tax increases would raise less than $4 trillion, on net, substantial new revenue and spending cuts would likely be needed. This new revenue could potentially come from taxes on the middle class.

Still, Vice President Biden's current proposals feature no direct tax increases on the middle class or any household earning less than $400,000 per year. Moreover, any indirect tax increases on these households — which would stem from higher corporate taxes — would be relatively modest.

Our Ruling: Somewhat Misleading to Largely False

This Fiscal FactCheck is a part of our US Budget Watch 2020 project, which will explain, score, and fact check claims and policy proposals made during the 2020 campaign. If you think we missed an important claim and would like us to look into it, contact us at info@crfb.org and we'll do our best to look into it. Learn more about US Budget Watch 2020 here.