W&M Tax Bill Would Cost Over $1 Trillion if Made Permanent

The House Ways and Means Committee will soon consider the American Families and Jobs Act, legislation to temporarily extend various business tax provisions and expand the standard deduction while repealing certain energy tax credits from the Inflation Reduction Act and enacting other reforms.

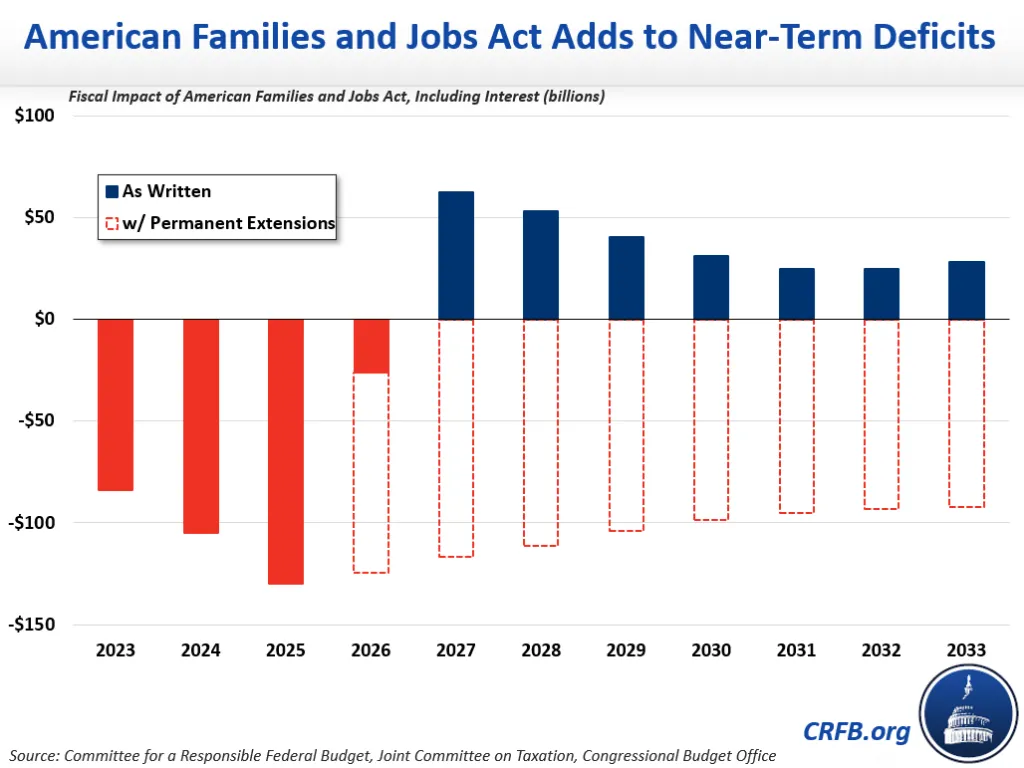

As written, we estimate the bill would cost $80 billion over a decade with interest ($19 billion before interest), including $320 billion through the end of fiscal year (FY) 2025. The smaller ten-year cost is driven by several factors but mainly by the fact that most of the bill's tax cuts expire at the end of 2025. We estimate that the plan would cost over $1.1 trillion ($950 billion without interest) through 2033 if these temporary tax cuts and extensions were made permanent.

Budgetary Cost of the American Families and Jobs Act (2023-2033)

| Policy | Official Cost | Permanent Cost |

|---|---|---|

| Expand the Standard Deduction by $2,000/$4,000 through 2025 | $95 billion | ~$500 billion' |

| Reinstate R&E expensing through 2025 | $25 billion | ~$200 billion |

| Delay tighter limit on interest deductibility through 2025 | $19 billion | ~$50 billion |

| Extend 100% bonus depreciation (full expensing) through 2025 | $3 billion | $325 billion |

| Increase pass-through 179 cap from $1 million to $2.5 million, index to inflation | $44 billion | $44 billion |

| Loosen certain tax reporting rules | $24 billion | $24 billion |

| Expand tax breaks for Opportunity Zones small business stock sales | $13 billion | $13 billion |

| End Superfund tax & enact other supply chain security measures | $12 billion | $12 billion |

| Repeal clean electricity tax credits scheduled to take effect in 2025 | -$116 billion | -$116 billion |

| Repeal expansion of clean vehicle tax credits | -$100 billion | -$100 billion |

| Subtotal, Cost of American Families and Jobs Act, Excluding Interest | $19 billion | ~$950 billion |

| Interest Costs | $61 billion | ~$180 billion |

| Total, Cost of American Families and Jobs Act, Including Interest | $80 billion | >$1.1 trillion |

Sources: Joint Committee on Taxation, Congressional Budget Office, and Committee for a Responsible Federal Budget estimates. Numbers may not sum due to rounding. 'Represents extension of proposed increase in the standard deduction assuming other parts of the TCJA were already extended.

Whether temporary or permanent, the costs of the bill will be somewhat front-loaded due to the time-specific nature of some of the tax breaks (such as full expensing) and because the offsets come in part from repealing tax credits that take effect in the latter half of the decade. As written, we estimate the plan would cost over $80 billion in 2023 and $130 billion in 2025 but reduce annual deficits by about $30 billion per year by 2033. If temporary provisions were made permanent, the bill would cost about $90 billion in 2033, including interest.

Given high inflation and debt approaching record levels, policymakers should not be pursuing tax cuts that worsen the deficit in the near term or over time. While the Ways and Means Committee should be commended for identifying offsets, their reliance on arbitrary expirations to hold down the bill's costs today suggests further costs in the future. As we explained before with regards to the Build Back Better legislation, "arbitrary expirations don’t make policies cheaper, they just make them shorter."