Trust Fund Insolvency Dates Are Approaching Fast

Although most of our analysis of CBO's Long-Term Budget Outlook has focused on debt projections, CBO also makes projections about the solvency of trust funds over the long term. And, unfortunately, it finds that most major trust funds will become insolvent in the not-too-distant future.

CBO has already projected the impending disruption of construction projects due to the Highway Trust Fund depletion later this year, the 20 percent across-the-board benefit cut facing Social Security Disability beneficiaries sometime in FY 2017, and the need to address the Pension Benefit Guaranty Corporation's Multiemployer Pension fund by 2021. In this report, it finds that the the combined Social Security trust funds (assuming the SSDI program borrows from the Old-Age trust fund) and the Medicare Hospital Insurance (HI) trust fund will both run out of money around 2030. In other words, CBO projects that all the major trust funds will be depleted just over fifteen years from now. And, at that point, significant automatic benefit/payment cuts would take place.

As we touched on before, Social Security's projected finances are worse than last year, a product of lower payroll tax revenue and lower interest rates. On the other hand, the HI insolvency date has been moved back about five years due to CBO's continued downward revisions to Medicare spending. Still, these changes give a 15-year clock for both the Social Security trust fund and the HI trust fund. These trust funds would experience a sizeable cut in spending (benefits) to bring outlays in line with revenue when the trust funds are exhausted.

| Exhaustion Dates for Major Trust Funds | ||

| Trust Fund | Exhaustion Date | Percent Cut Required |

| Highway Trust Fund | FY 2015 | 28% |

| Social Security Disability Insurance | FY 2017 | 20% |

| PBGC Multiemployer Fund | FY 2021 | 87% |

| Medicare Hospital Insurance | ~2030 | ~15% |

| Social Security Old-Age and Survivors Insurance | 2032 | ~30% |

| Social Security Combined | 2030 | ~27% |

Source: CBO, CRFB calculations

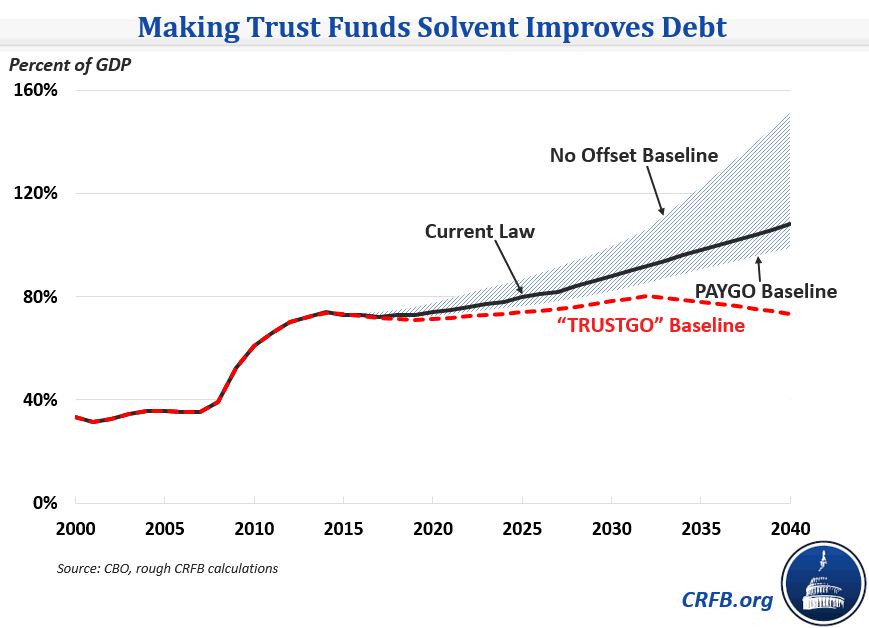

Although CBO projects insolvency dates for the major trust funds, it does not incorporate the consequences of insolvency into its budget projections; rather, it assumes that programs continue to spend as scheduled (implicitly funded through general revenue transfers). If policymakers chose the responsible course and ensured that the trust funds were made solvent with changes to their dedicated spending or revenue, the budget outlook would be much improved.

While CBO does not provide sufficient data on dedicated revenue for exact projections, our rough estimates suggest that if Congress fully abided by PAYGO, wound down war spending, and brought all major trust fund spending and revenue in line upon insolvency, then the rise in debt would be halted by the early 2030s. Specifically, debt would rise from 74 percent of GDP today to 80 percent by 2032, then fall to 73 percent by 2040. By contrast, CBO projects debt will increase to 108 percent of GDP in 2040 under its baseline, and it would further increase to 150 percent if Congress continued to extend various policies without paying for them (the "No Offset Baseline").

There are many options available to policymakers to shore up the trust funds. Social Security reform options are well understood, and users can design their own reform plan here. Numerous health care options that would reduce Medicare Part A spending exist; additionally, policymakers could choose to raise the payroll tax rate as they did for high earners in the Affordable Care Act. Finally, we have outlined a long list of options to close the Highway Trust Fund's structural shortfall. If lawmakers use these options rather than transferring general revenue or relying on gimmicks, they can make the long-term budget outlook significantly brighter.