Pension Insurer Expects to Be Out of Funds By 2022

The Pension Benefit Guaranty Corporation (PBGC) put out an annual report this week of its financial status insuring private pensions around the country. Although most pension plans look to be in better shape than last year, some plans covering multiple companies are likely to fail. At that point, between 1 and 1.5 million people would receive a guaranteed amount from the PBGC that is lower than their promised benefit. However, the PBGC itself is underfunded, and does not have sufficient reserves to sustain these payments for the long term. According to the report, the pension fund will "more likely than not" run out of funds by 2022 and is 90 percent likely to run out by 2025.

The PBGC provides insurance to defined-benefit private pension plans covering approximately 44 million people. Companies covered by PBGC pay premiums for this insurance. In exchange, PBGC will pay benefits to plan employees if the pension plan goes bankrupt. There are two separate insurance programs with different premiums, rates, and payout rules: one covering approximately 34 million workers in plans maintained by a single employer, and another covering 10 million workers in multiemployer plans.

First, the report's good news: single-employer plans are in a stronger financial position than last year, though they are not out of the hole yet. The PBGC's ten-year deficit improved from $32 billion last year to a deficit of $7.6 billion this year, mostly because of the improved economy and the increased premiums in the Murray-Ryan budget agreement. That agreement increased single-employer premiums for 2015 and 2016 and indexed them to wage growth. Although the program is still projecting a deficit, it is expected to be solvent throughout the next decade thanks to balances in its revolving fund.

Now, the report's bad news: many multiemployer plans are severely underfunded, particularly those involving unions with declining membership. Because of lower than expected market returns, declining numbers of employees, and other factors, the number of underfunded plans has increased dramatically this decade.

Multiemployer plans covering almost 1.5 Million people are severely underfunded (i.e., <40% funded)

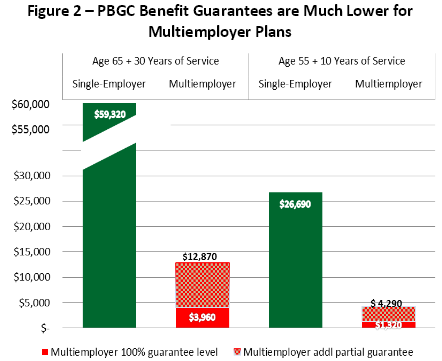

If these severely underfunded plans fail, PBGC will begin paying their employees' benefits, albeit at a much lower level. The exact level is determined by formula, but no worker will receive more than 82 percent of their scheduled benefits and many will receive less. For instance, a worker who was disabled after three years of work and was receiving a monthly payment of $250 would only receive $107 under the guarantee, or 43 percent of their promised benefits. The graph below shows that the multiemployer system currently has much lower guarantees for the same type of worker than the single-employer system.

The report projects that the multiemployer fund will not have enough funds to sustain even the lower level of guaranteed benefits and is more than 50 percent likely to run out of funds in 2022, a number consistent with CBO's projection of 2021. According to CBO's projections, the fund would need almost $9 billion of additional funds to pay continue paying guarantees to multiemployer plans through 2024.

Lawmakers have already raised PBGC premiums – requiring companies to pay more – twice in recent years. The 2012 highway bill raised premiums on both single and multi-employer plans, while the 2013 Murray-Ryan budget agreement raised premiums again on single employer plans. Several options are available to address the shortfall, including raising premiums again, extending rules for improving underfunded plans which expire at the end of 2014 as Senate Finance Chairman Ron Wyden (D-OR) would do, or allowing the PBGC to set its own premiums to ensure solvency as the President's budget would do. Thus far, the PBGC has not depended on general tax revenue, but lawmakers could transfer money into the pension fund with offsets from other parts of the budget.

Lawmakers may be cautious about raising premiums three times in three years, but the PBGC report highlights that some reforms are still needed, particularly for multiemployer plans. As with changes to Social Security, making changes sooner rather than later can allow changes to be phased in gradually, protect more beneficiaries, and reduce the fear and uncertainty around a sudden benefit cliff in 2022.