Short-Term Extenders Package Is Still Irresponsible

Faced with the possible opposition over a $700 billion deal to extend permanently some of the expiring "tax extenders", Congress may consider a bill that would only extend them for two years. Yet the legislation introduced in the House, despite its lower price tag, would still be fiscally irresponsible – not only because it would add to the debt without offsets, but because it would actually expand a number of tax breaks beyond their traditional cost.

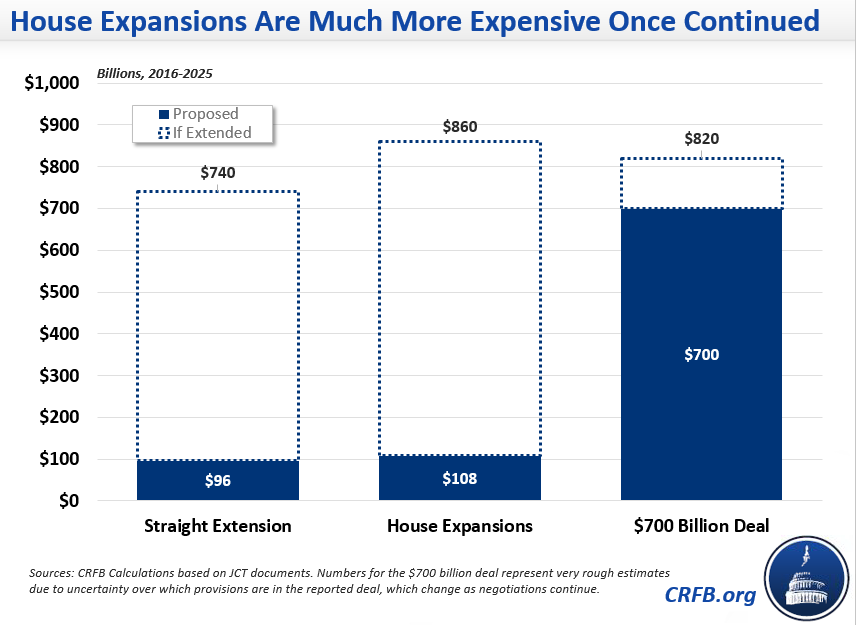

According to the Joint Committee on Taxation, simply reinstating all recently expired tax breaks for two years (2015 and 2016) would cost about $96 billion. The House bill by itself would cost $12 billion more, or $108 billion. Even more troubling, the House bill sets the stage for continued expansions; and if made permanent those would cost $860 billion – that is $120 billion more than a permanent extension of all provisions, and nearly $160 billion more than the permanent deal we discussed last week.

The expansions include making the research credit more generous – increasing its costs by 40 percent – increasing and expanding bonus depreciation, and indexing thresholds for Section 179 expensing, among others. The expansion of bonus depreciation moves in the opposite direction of the big deal being discussed which would phase out bonus depreciation over five years. The bill also includes a few new policies, such as legislation expanding 529 accounts considered earlier this year. Unlike the temporary tax extenders legislation reported by the Senate Finance Committee in July, the House bill does not offset the additional costs from expanding provisions beyond current policy.

It would be bad enough to continue the recently expired tax extenders without offsets – as we have written before, these provisions were put in place on a temporary basis in part to minimize their price tag when initially enacted, but there are plenty of ways to pay for them going forward. Yet this bill is far worse since it actually expands many provisions in a way that will encourage lawmakers to increase the debt more in the future.

If this were not troubling enough, House Ways & Means Chairman Brady (R-TX) has indicated (behind paywall) Congress is considering adding to the legislation a two-year delay of the Affordable Care Act's medical device tax and “Cadillac tax” on high-cost health insurance plans. This by itself could add $20 billion to the price tag after interest, and would set the stage for future delays that could total over $100 billion over the next decade and over $700 billion over the next two decades. Continuing to delay the Cadillac tax would also drive up health spending by removing one of the most important cost control measures from the Affordable Care Act.

The House bill sets a dangerous precedent for costly new policies. Although the expansions and additions only cost an extra $12 billion now, it sets up a process where these new tax breaks will be continually extended in their more expensive form, eventually costing an extra $120 billion with interest. Ideally, Congress should address tax extenders and any potential expansions of them in the context of comprehensive tax reform. Until then, Congress should pass a temporary extension of extenders that is offset by other revenues as we proposed in our PREP plan. Short of that, the approach taken by the Senate Finance Committee offsetting the costs of new or expanded tax breaks would limit the damage to our fiscal condition.

Further Reading:

- Emerging Tax Deal Could Add $2.3 Trillion in Debt by 2035

- Tax Deal Goes Beyond Simple Extensions

- Seven Reasons to Pay for Tax Extenders

- Who Gets What In the Tax Extenders Deal?