Rep. Ribble Releases Legislation to Make Social Security Solvent

Representative Reid Ribble (R-WI) along with a bipartisan group of cosponsors released the Save Our Social Security Act today, a bill which would make the program solvent for the next 75 years. His plan, which was developed in part by using our Social Security Reformer, includes a combination of benefit changes and tax increases that would close the program's currently projected 75-year shortfall and close almost the entire 75th year deficit. It is an admirable proposal that would greatly improve retirement security for future generations, both by ensuring the system's solvency and by enhancing benefits for more vulnerable beneficiaries, and it could provide the framework for a bipartisan Social Security solvency plan.

Ribble's plan includes several policies to slow benefit growth and raise revenue in order to close Social Security's financing gap. The savings to achieve solvency would come from about one-third revenue increases, one-third progressive benefit changes, and one-third from a retirement age increase. He would:

- Increase the maximum earnings the payroll tax applies to from the current 83 percent of earnings to 90 percent by 2022, making the "taxable maximum" in that year nearly $350,000 rather than about $150,000. Additional benefits credited would be 2.5 percent of these newly-taxed earnings, compared to 15 percent for earnings just below the cap.

- Reduce the top benefit formula factor from 15 percent to 5 percent, phased in over five years.

- Increase the normal retirement age from 67 to 69 between 2022 and 2034 and index it to life expectancy after that.

- Switch to the chained CPI for cost-of-living adjustments.

- Increase the number of earning years from which benefits are calculated from 35 to 38.

In addition, Ribble's plan would enact two policies to increase benefits for low-income and older beneficiaries. He would enact a new minimum benefit of 100 percent of the poverty line for workers with a 20-year work history that increases up to 125 percent of the poverty line for those with 40 years of work, and he would bump up benefits by 5 percent of the average benefit once a person has been on the program for 20 years.

Plugging these policies into our Social Security Reformer (with a few adjustments for slight differences in parameters) shows that Ribble's plan would ensure solvency over 75 years and likely several years beyond that. The 75-year shortfall would be closed entirely, and the 75th year deficit would be reduced by 90 percent.

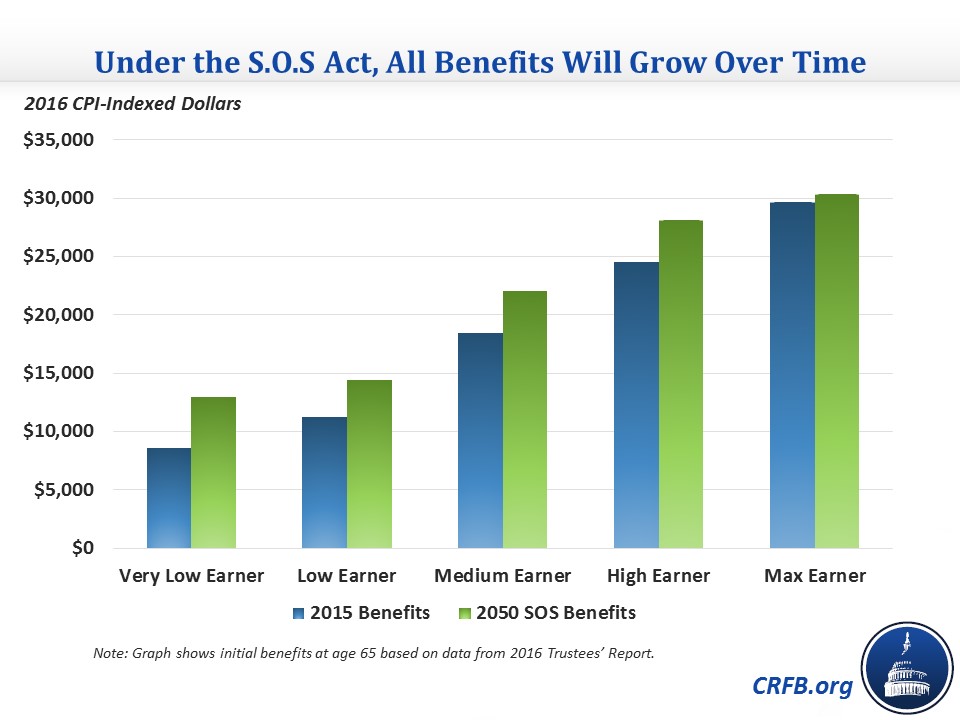

The Chief Actuary of the Social Security Administration confirms this conclusion, showing that the plan would close the 75-year shortfall and 90 percent of the 75th year shortfall (though the Chief Actuary's calculations are based off the 2015 Trustees Report, which has a higher 75th year shortfall). The Chief Actuary also calculates how benefits would be affected for people at different earnings levels. The changes are progressive, so lower earners are less affected (or get higher benefits) than higher earners. It clearly shows the effect of the minimum benefit, as "very low" earners retiring at age 65 would have benefits above the scheduled amount (the amount that would be paid regardless of trust fund status). All other earners except those earning at least the taxable maximum ($118,500 this year) get benefits below the scheduled amount but near or above the amount they would get if no changes are made. In light of recent talk about expanding Social Security benefits, it's worth noting that the actuary's analysis shows that under the legislation, all future beneficiaries still have higher benefits in inflation-adjusted dollars than current beneficiaries due to the natural benefit growth built into the program.

Ribble and the other members cosponsoring the legislation deserve a lot of praise for coming up with a plan to ensure Social Security's solvency over 75 years and beyond. That he does it with a combination of benefit changes and revenue increases rather than relying on just one side is also important and provides a framework, along with other plans like the Bipartisan Policy Center's, for a bipartisan Social Security solution. The plan is a productive contribution to the Social Security debate and hopefully will encourage others to offer their own plans. As CRFB President Maya MacGuineas said about the plan:

Fixing Social Security requires making real choices, and Rep. Ribble and his colleagues should be commended for having the political will to make those choices. The alternative of doing nothing is a deep benefit cut for all beneficiaries. That’s a retirement crisis we can’t afford.

Create your own plan with our Social Security Reformer.