Is President Trump's Tax Cut the Largest in History?

In their tax reform framework memo, the Trump Administration calls their plan "The Biggest Individual and Business Tax Cut in American History." And during their briefing, National Economic Council Director Gary Cohn said of the plan it's "...one of the biggest tax cuts in the American history."

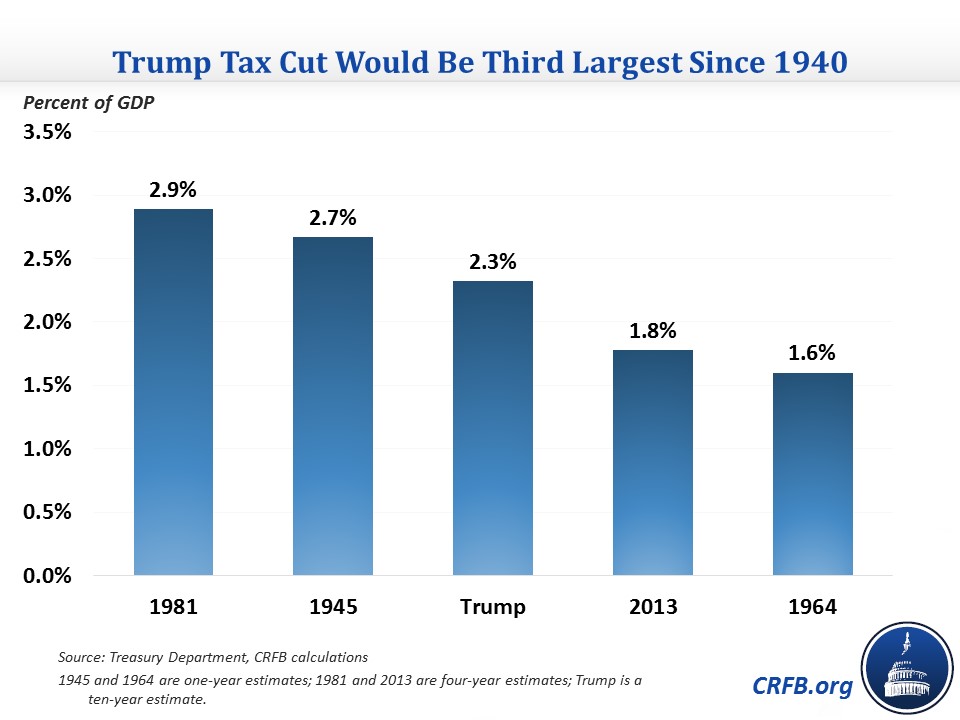

Though we don't know all the details of the plan, from our estimate it does appear to be quite large. In nominal dollars, it would almost certainly be the largest in history. But as a share of Gross Domestic Product (GDP), a few previous tax cuts would be larger. By our rough estimate, Trump's plan would be the third largest tax cut since 1940.

To evaluate this claim, we use a 2013 Treasury Department analysis that compares the projected revenue effect of major tax bills since 1940. The analysis uses one-year estimates for laws enacted between 1940 and 1967, two-year estimates for laws enacted between 1968 and 1977, and four-year estimates for laws enacted since 1978.

We also use our recent very rough estimate of the President's plan, which finds it could cost about $5.5 trillion over a decade. That's roughly 2.3 percent of GDP over ten years.

Since 1940, there have been two tax cuts that exceeded that amount. The first was in 1945 when lawmakers rolled back some of the revenue increases that had been enacted to fund World War II; this tax cut cost 2.7 percent of GDP in the year after its enactment. The second was the 1981 tax cut enacted at the beginning of the Reagan Administration. This tax cut cost 2.9 percent of GDP over four years with a cost that was growing significantly over time; in the fourth year, it cost 4.2 percent. It is worth noting that the 1981 tax cuts were partially undone in 1982 and on a few other occasions because they proved to be too expensive.

Trump's tax cut would be somewhat larger than two other notable tax cuts in 1964 (the "Kennedy tax cut") and 2013 (the permanent extension of most of the Bush tax cuts). These tax cuts cost 1.6 and 1.8 percent of GDP, respectively.

Our analysis is limited by the fact that the Treasury data don't go back before 1940, and official data on revenue as a share of GDP don't go back much further than that. The 1921 tax cut, which rolled back many of the tax increases enacted during World War I, could possibly also be larger than the Trump tax cut, since revenue declined by more than 40 percent in dollars between 1920 and 1923. However, it is difficult to know how large the tax cut itself was since other factors were in play (especially deflation following the war), and there isn't context for how large the revenue decline is as a share of GDP.

As it stands now, President Trump's tax cut would be among the largest in history, but it would not be the absolute largest.

Unfortunately, as we've explained elsewhere, that's bad news for the federal debt.