Making the Case for Fundamental Tax Reform

Today, the Campaign to Fix the Debt released a memo making the case for the “blank slate” approach to tax reform proposed by Senate Finance Chairman Max Baucus (D-MT) and Ranking Member Orrin Hatch (R-UT). The “blank slate” process would eliminate all of the $1.3 trillion in tax expenditures and put the burden of proof on lawmakers to justify adding them back at the cost of higher rates.

Getting rid of all tax expenditures would allow for a top individual tax rate of 23 percent and a corporate rate of about 27 percent. Re-introducing tax expenditures in the code will require higher rates or larger deficits and should encourage lawmakers to look for more efficient designs or do away with some tax expenditures entirely.

Some lawmakers may support overall tax reform but express concern when the conversation turns some of the more politically popular provisions in the code. But while some tax expenditures promote worthwhile goals, many could be redesigned to be better targeted and less costly. The memo goes through a few of the largest tax expenditures -- the mortgage interest deduction, the charitable deduction, the exclusion for employer-provided health insurance, education tax provisions, and corporate tax preferences -- listing their costs and possible ways to redesign these tax provisions.

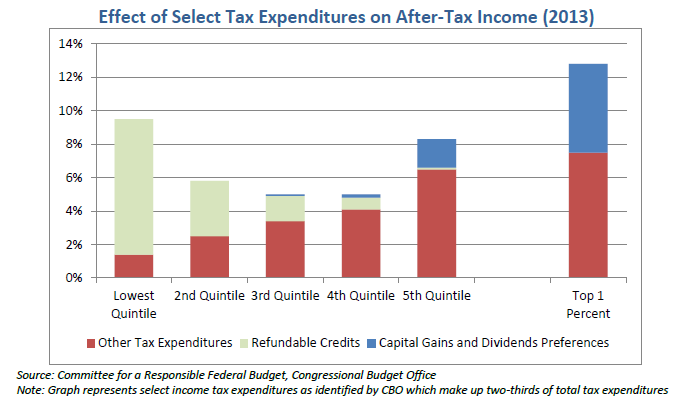

The memo highlights many of the redesigns we put forward in our recent blog, Retargeting Tax Expenditures. The mortgage interest deduction will cost more than $1 trillion over the next decade, but it could be redesigned to be less costly by putting a limit on the value of the deduction, turning it into a credit, preventing it from being used for second homes or home equity loans, or phasing it out entirely. The charitable deduction will cost over $600 billion over the next ten years, and the health exclusion will cost $2 trillion ($3.4 trillion including payroll tax), and they could also be replaced by less costly provisions. As the table below shows, overall tax expenditures tend to be regressive so the blank slate approach should encourage lawmakers to design these provisions to be more efficient and better targeted.

Source: CRFB

The memo also discusses a few tax expenditures not included in our previous blog. Education tax credits will cost about $400 billion over ten years and in 2012 rivaled Pell Grants in size but are much less targeted towards those who need them.

In addition, there are roughly 80 corporate tax expenditures, totaling about $2 trillion in forgone revenues. Corporate tax reform could lower marginal rates if many of those tax preferences are eliminated, and other aspects of the corporate tax code are examined as well.

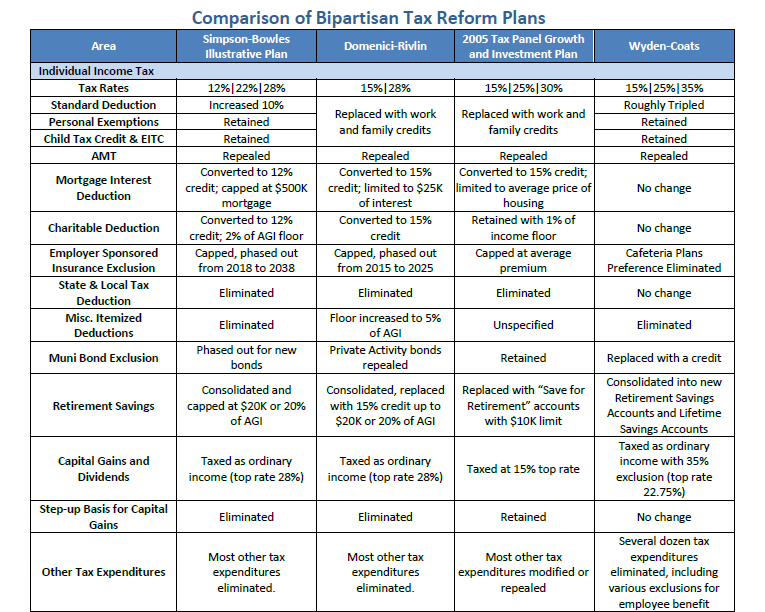

The opportunity to redesign or reduce these tax expenditures is one of the advantages of the "blank slate" approach. By putting the burden on lawmakers to justify "add-backs," lawmakers may be more careful about how tax preferences are reintroduced into the code. The table below shows how different tax reform plans handled major provisions of the tax code. In many cases, they did not simply choose to eliminate or keep them but rather modified them to make them more effective in achieving their goals.

Source: CRFB

The Fix the Debt memo should be useful as lawmakers move forward with the tax reform process. Hopefully, lawmakers will take advantage of this opportunity to make a tax code that better serves our revenue and economic needs.

Click here to see the full memo.