Major Budget Plans Deal With Extenders Responsibly

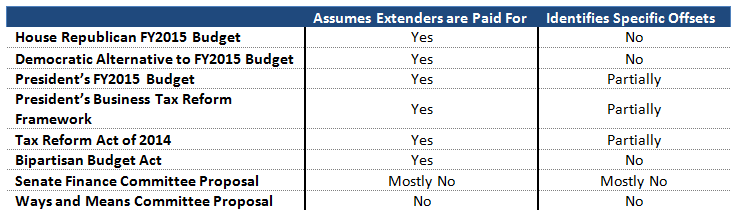

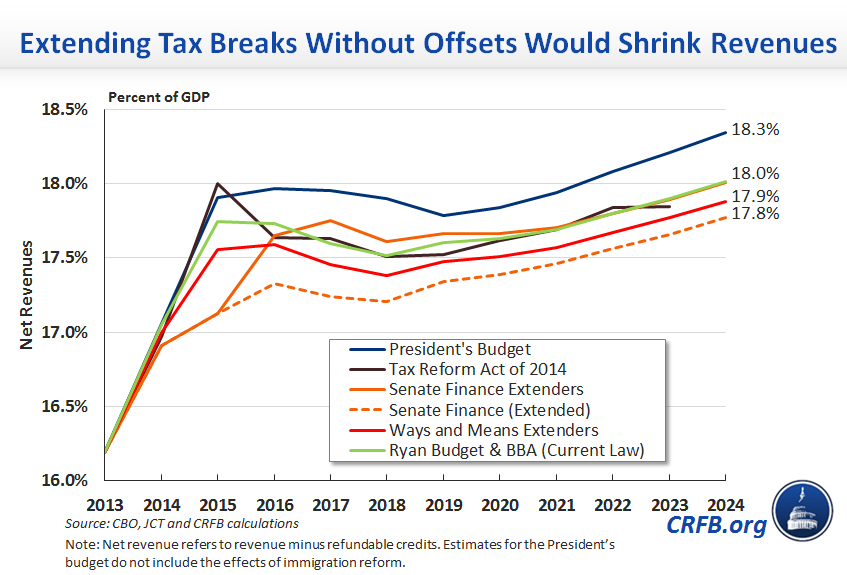

As Congress considers how to address the “tax extenders” that expired last year, it’s important to remember that many major proposals would allow these temporary tax breaks to expire or offset their cost. During the recent Ways and Means Committee mark-up of tax extenders legislation, it was suggested that the President’s budget did not pay for the temporary tax provisions that it extended. In fact, the President’s budget contained revenue-increasing provisions which more than offset the costs of continuing existing tax breaks. Similarly, the tax reform plan put forward by Ways and Means Committee Chairman Dave Camp included provisions increasing revenues, which offset the costs of tax extenders preserved in the plan, along with other revenue-reducing provisions. Moreover, major budget plans in Congress assumed that tax extenders would be allowed to expire or be offset. Passing a temporary or permanent extension of expiring tax breaks without offsets would represent a break from these plans and reduce revenues below the levels in all major Congressional budget plans, including the budget resolution passed by the House earlier this year and the Ryan-Murray budget agreement.

While the President did not pair each extension with a particular offset, his budget includes more revenue increases than revenue reductions. In that sense, the President effectively paid for all of the extenders he decided to renew. These critics may have been referring to the Administration’s decision to include several refundable tax credits scheduled to expire in 2017 in OMB’s budget baseline. This means that OMB does not score extending these provisions as adding to the debt, even though the full cost of extending them could be as high as $175 billion using a different baseline and assumptions. On net, however, the revenue increases in the President’s budget still outweigh the revenue reductions, regardless of the baseline used.

Many other major proposals implicitly promise to allow the extenders to expire, or to offset the cost of renewing them by raising revenue elsewhere. House Budget Committee Chairman Paul Ryan’s budget does not specifically mention how it would deal with extenders, but because the budget calls for revenue-neutral tax reform that keeps revenues at the CBO’s current law baseline (which assumes all temporary provisions expire on schedule), it technically assumes the extenders are either allowed to expire or are fully offset. Similarly, the Bipartisan Budget Act (BBA) passed last year would keep revenues at current law levels. And just this week, Chairman Ryan submitted committee allocations that set revenue levels for the next decade at exactly the levels projected in CBO's latest baseline. Importantly, any legislation extending tax breaks without offsetting their costs would violate the revenue levels set by the BBA, and would be subject to a point of order in the House and Senate under the Congressional Budget Act.

Yet while all of these proposals allow the extenders to expire or pay their full cost, Congress is currently considering legislation that would extend a number of temporary tax provisions without offsets, dramatically increasing the deficit. The proposal approved by the Senate Finance Committee would extend a package of over 50 tax provisions for two years, costing nearly $85 billion over the next decade. The Ways and Means proposal that expands and makes permanent six of the extenders would add even more to the debt, costing about $310 billion through 2024, or $380 billion including interest.

Lawmakers must recognize that continuing to extend temporary tax provisions would significantly shrink federal revenues and increase the debt. Any temporary or permanent extension should abide by pay-as-you-go rules, offsetting their cost with reduced spending or increased revenue elsewhere.