JCT Estimates Over $1.2 Trillion in Tax Breaks in 2015

The Joint Committee on Taxation (JCT) recently released its latest estimate of tax expenditures covering the years 2015-2019. Based on the summed cost of each tax break, tax expenditures cost over $1.2 trillion in 2015, about two-thirds the size of total individual and corporate income tax revenue. This total is $50 billion higher than the 2014 total but also $65 billion lower than JCT had previously projected for 2015. The total is also about $100 billion lower than the $1.35 trillion of tax expenditures that the Treasury Department estimates for 2015.

Below are some interesting facts about the tax expenditure estimates and how JCT has changed them compared to previous tax expenditure data from August 2014. Note that these numbers were published before the tax deal was enacted, and that package should increase both the size and number of tax expenditures.

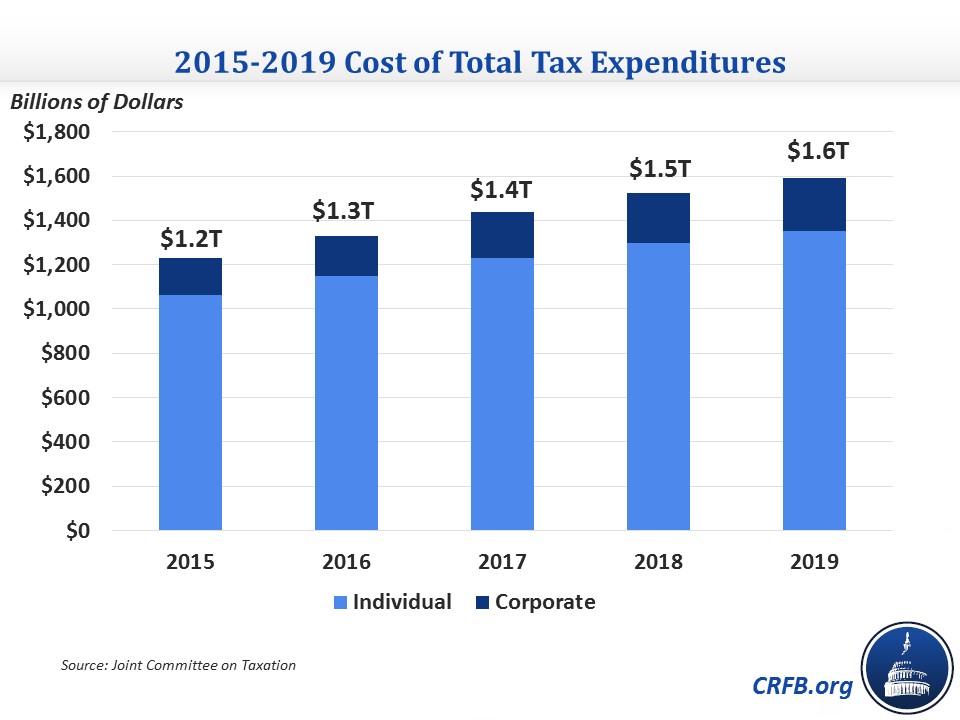

Total Tax Expenditures are $6.7 Trillion Over Five Years

JCT's estimate covers the 2015-2019 period, and the sum of each tax expenditure totals $6.7 trillion over that time period. This sum is 66 percent of income tax revenue for 2015-2019 and the 2019 total of is 68 percent of all the income taxes scheduled to be collected in that year. The cost of tax expenditures grows each year, from $1.2 trillion in 2015 to $1.6 trillion by 2019. Although these tax expenditure totals are the sum of each provision, so they do not account for interactions between multiple provisions and do not reflect the revenue that would be raised from repealing them.

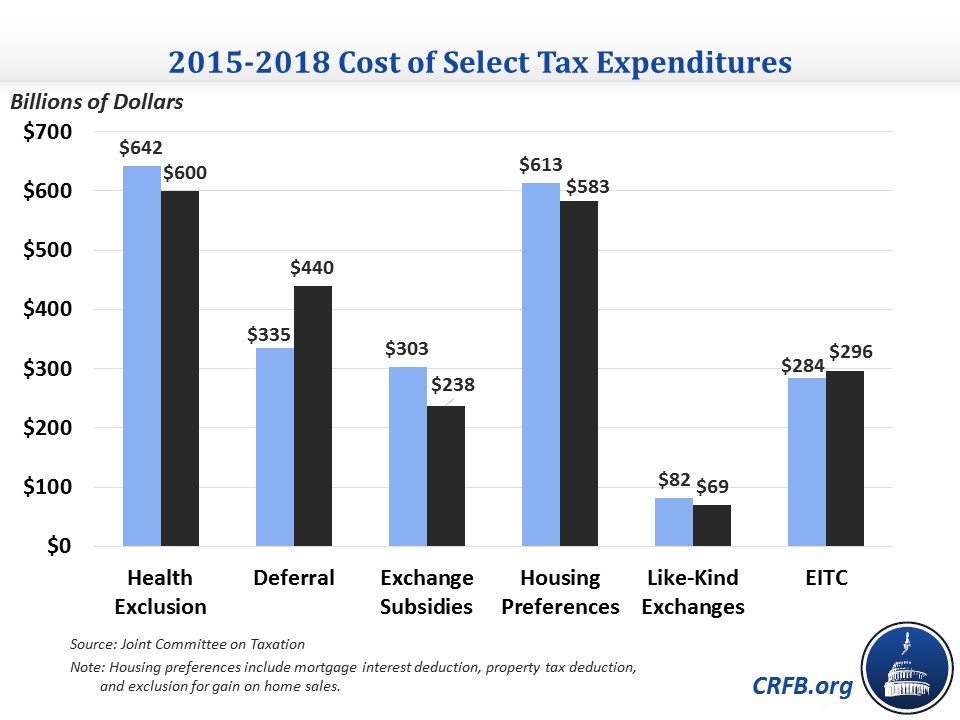

The Health Exclusion is the Largest Tax Expenditure – For Now

The exclusion for employer-provided health insurance is the largest tax expenditure in 2015 at $146 billion. JCT did revise down the 2015-2018 cost of the exclusion by $40 billion (6.5 percent) to $600 billion. Partially due to this revision, JCT estimates that the exclusions for contributions to pension plans will overtaking the health exclusion as the costliest tax expenditure by 2017.

Interestingly, JCT diverges significantly from the Treasury Department, who sees the health exclusion as costing much more: over $200 billion in 2015 and $860 billion for 2015-2018. Treasury also expects the health exclusion to continue being the largest single tax expenditure over the next decade.

Deferral for Multinational Corporations is More Expensive

U.S. multinational corporations may defer taxes on non-financial income earned abroad until they repatriate it to the U.S. JCT considers this deferral as a tax expenditure, counting the income loss compared to a pure worldwide system, where all overseas income is taxed in the year it is earned. JCT significantly revised up its estimate of deferral by one-third over the 2015-2018 period, meaning that it now costs $440 billion instead of $335 billion. It is not clear whether this estimate changed due to more companies holding income overseas, a change in JCT's accounting, or some other reason, but it could catch the eye of lawmakers and others who have been increasingly concerned about inversions.

Health Insurance Subsidies Are Less Expensive

JCT now expects that the subsidies used to purchase health insurance on the exchanges will cost one-fifth less over 2015-2018 at $240 billion rather than the previous $300 billion. This reflects factors we discussed earlier this year as CBO revised down projections of premium growth and enrollment based on recent data.

Housing Preferences Are Slightly Less Costly

Major housing tax breaks – specifically the mortgage interest deduction, property tax deduction, and $500,000 exclusion for gains on home sales – are relatively large tax breaks that collectively had their 2015-2018 cost revised down by 5 percent, from $613 billion to $583 billion. This revision could reflect lower than expected house prices, property tax cuts at the state and local level, and/or other factors.

On a related note, "like-kind exchanges," where taxes are deferred on an exchange of similar properties, were also revised down by 15 percent over 2015-2018 from $82 to $69 billion.

The Earned Income Tax Credit is Slightly More Expensive

JCT has revised up its estimate of the Earned Income Tax Credit (EITC) by 4 percent over the 2015-2018 period, increasing its cost from about $285 billion to $295 billion. This revision may be due to CBO now estimating lower wage and salary growth, meaning that more people qualify for the EITC. Note that a result of the tax deal, the EITC would cost more after 2017 as married couples and families with more than three children get larger credits in the expansions that have been extended.

JCT demonstrates the huge and growing amounts of revenue lost to tax expenditures, losses that are comparable to the revenue raised from the taxes they are attached to. The new data is just the latest reminder of the urgent need for tax reform. By reducing or eliminating some of the $1.2 trillion in tax expenditures and other provisions, policymakers could simplify the tax code, reduce rates, and raise revenue for deficit reduction. Unfortunately, policymakers seem to be going in the opposite direction with the year-end tax deal that increased the number and size of tax expenditures,