JCT Identifies $1.2 Trillion in Tax Breaks This Year

As lawmakers fight over whether to extend and expand expired tax breaks or create new ones, the Joint Committee on Taxation (JCT) this week updated its estimate of the already existing tax breaks for 2014-2018. Adding up the individual costs of tax expenditures shows a total of $1.2 trillion for 2014, more than two-thirds of total projected income tax revenue this year. These totals do not include the effect of tax extenders that expired at the end of the last year, so that total could grow depending on the actions of lawmakers (although those costs would likely be recorded in 2015 and beyond). JCT's total is slightly less than the $1.3 trillion that the Office of Management and Budget (OMB) estimates.

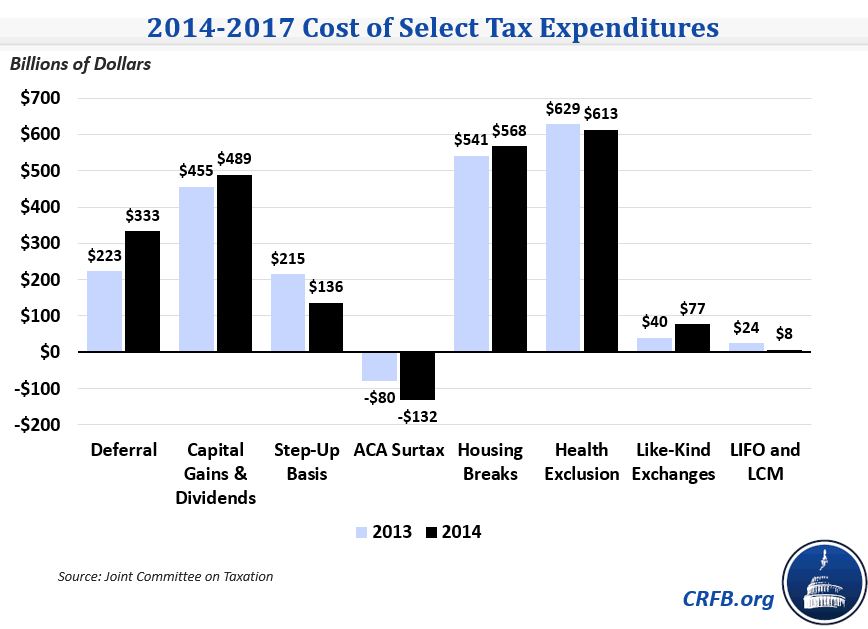

To some extent, changes in JCT's estimates of each tax expenditure over time can help point out broader economic trends. Here's some of the highlights of the changes between JCT's estimates last year and this year.

Total Tax Expenditures Are Slightly Smaller

Compared to last year's estimate, the 2014 estimate is slightly lower but similar; last year's was $1.22 trillion compared to $1.19 trillion this year. Over the 2014-2017 period, the two estimates are just about the same at $5.6 trillion. Note that these totals are simply the result of adding up individual tax expenditures, so they do not represent the revenue raised from repealing the provisions nor does it account for interactions between multiple tax breaks. Furthermore, the totals include some double-counting, so the true total would be about $100 billion less.

Deferral for Multinational Companies is Far More Expensive

U.S. multinationals may defer taxes on non-financial income earned abroad until they repatriate it to the U.S. While some policymakers would like to move to a territorial system where foreign-source income would be largely exempt from U.S. taxes, under the current system JCT considers deferral a tax expenditure. Over the comparable 2014-2017 period, JCT's estimate of the cost of deferral has risen by about half -- from $225 billion to $335 billion -- pushing it closer to what OMB estimates. This change also means that the government has more revenue to lose from the inversions that have garnered headlines lately, since an inverted company would not pay U.S. taxes on its foreign income.

The Cost of Investment Income Provisions Changed Significantly

The preferential rates for capital gains and dividends are among the largest tax expenditures in the code, and they grew in this year's estimate by 7 percent over the 2014-2017 period from $455 billion to $490 billion. However, these higher costs were more than fully offset by higher "savings" from the 3.8 percent surtax on investment income for high earners (counted as a negative tax expenditure), which was revised from -$80 billion to -$130 billion from 2014-2017. In addition, step-up basis for capital gains at death, which allows people to escape capital gains taxes on an asset's gain prior to the holder's death, was revised down by more than one-third -- from $215 billion to $135 billion.

Housing-Related Tax Expenditures Are Somewhat Larger

By far, the three largest tax expenditures for housing, totaling a combined $145 billion in 2014 alone, are the mortgage interest deduction, the property tax deduction, and the exclusion of capital gains from home sales. These breaks are also largely regressive, since higher income people are more likely to own a home, face higher tax rates, and itemize deductions. JCT has revised up the size of these breaks by 5 percent since last year to $570 billion from 2014-2017, and by about 10 percent in 2017 alone to $160 billion; most of this difference concentrated in the property tax deduction and capital gains exclusion. This change is likely due to house prices being higher than JCT previously anticipated.

The Health Exclusion is Slightly Smaller

The exclusion for employer-provided health insurance is the largest tax expenditure in the code, costing $143 billion in 2014. It is also an interesting reflection of both labor market and health care trends. As a result of lower-than-expected employment and health care cost growth, JCT has revised down the exclusion's 2014 cost by more than 10 percent since December 2010, from $161 billion to $143 billion. The change between 2013 and this year is smaller -- 2 percent for 2014-2017 ($629 billion to $613 billion) and 4 percent for 2017 ($171 billion to $164 billion) -- but considering the size of the tax break, just about any movement is significant news.

"Like-Kind" Exchanges Are Much Larger

A taxpayer may defer gains on a real estate sale if the property is exchanged for a similar one -- this is referred to as a like-kind exchange. This tax expenditure is not particularly large, clocking in at under $20 billion per year, but it nearly doubled in JCT's estimate this year, raising its 2014-2017 total from $40 billion to $77 billion. It is quite possible that this is closely related to the changes in housing tax breaks.

Accounting Methods Are Smaller (On Paper)

The last-in first-out (LIFO) and lower-of-cost-or-market (LCM) inventory accounting methods provide more favorable tax treatment than what JCT considers a normal method (first-in first-out [FIFO] accounting). As we explained previously, repealing these methods and using FIFO instead would raise significant revenue upfront from the transition, and only a small portion of that revenue would be permanent. JCT's current estimate is more than two-thirds lower than last year's. Although we are still investigating the reason for this drop, it may be due to a change in estimating methodology. The current cost, about $2 billion per year, appears consistent with the "steady state" revenue loss, whereas prior estimates may have included timing effects as well.

*****

JCT's tax expenditure estimate shows the vast pool of revenue lost to these tax breaks each year. On the flip side, it shows how much revenue there is to be had from reforming tax expenditures. Additionally, there is also room for reform in the deductions and exclusions that aren't considered tax expenditures.