How Much Will the Essential Health Benefit Changes to AHCA Cost?

Yesterday, we showed the manager's amendment to the American Health Care Act (Obamacare replacement) would reduce its total deficit reduction from $337 billion over a decade to $150 billion. A new amendment currently under consideration could further change the cost of the bill. Though CBO is not likely to estimate the impact of these changes in time for today’s expected vote, this analysis offers some insights into what they might say.

The amendment under discussion would increase funding in the Patient and State Stability fund by $15 billion for purposes of mental illness and substance abuse treatment as well as maternity coverage and newborn care, delay the repeal of the 0.9 percent Medicare surtax until 2023, and require states to set the “Essential Health Benefit” (EHB) rules dictating what insurance plans must cover.

Of these recommendations, by far the most uncertain is the EHB changes. It is not yet clear either how much latitude these changes will give states, nor how aggressive states will be with this new latitude. These EHB changes may lead states to reduce the number of benefit categories that must be covered (currently there are ten), increase cost sharing, or both. In this case, insurers may be able to significantly reduce premiums for some plans (while also reducing the value of the benefit) – in many cases to as low as available tax credits. Lower premiums, even for less generous (but heavily subsidized) insurance, would tend to encourage more people to enroll in some type of health insurance package.

Importantly, the total effect of these changes on coverage is unknown at this point, and indeed this change may lead some people to purchase insurance packages that CBO does not view as sufficient to be considered “coverage”.

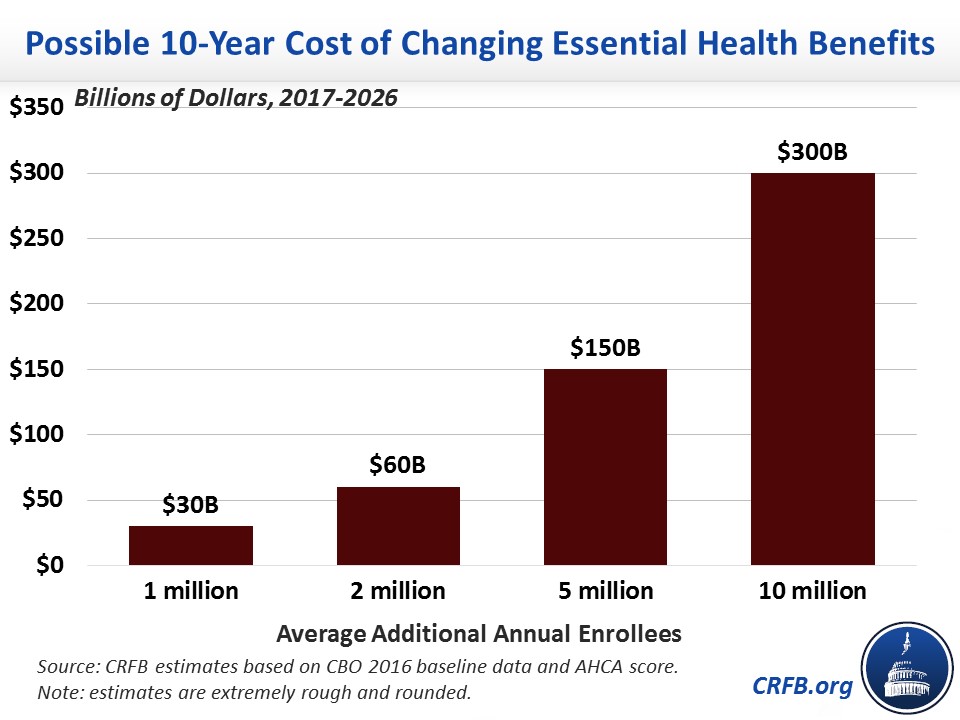

Setting aside the health policy implications of EHB changes, the fiscal implications could be significant. If more people purchase health insurance, more will be eligible for the AHCA’s tax credits. Assuming no change in employer coverage, we estimate an increase of 1 million enrollees would cost about $30 billion over a decade, 2 million would cost $60 billion, 5 million would cost $150 billion, and 10 million would cost $300 billion.

The two other policies under consideration would have much more straightforward fiscal implications. A $15 billion increase in the Patient and State Stability fund will likely cost $15 billion, though it could be slightly lower if states don't utilize all the additional money. Meanwhile, delaying the Medicare surtax repeal until 2023 would raise about $65 billion in revenue; it would also prevent the Medicare Part A trust fund from becoming insolvent in 2023 as we previously projected.

Taken together, that means the amendment would save $20 billion if an additional one million people enrolled in insurance each year. But it would cost $10 billion if two million more people enrolled, $100 billion if five million more enrolled, and $250 billion if ten million did. With 7 million or more additional enrollees, the entire legislation would likely increase rather than reduce deficits.

Budgetary Effect of New Amendment to American Health Care Act

| Provision | 10-Year Cost / Savings (-) Under Different Enrollment Assumptions | |||

|---|---|---|---|---|

| +1m enrolled | +2m enrolled | +5m enrolled | +10m enrolled | |

| Change Essential Health Benefits | $30 billion | $60 billion | $150 billion | $300 billion |

| Increase Patient and State Stability Fund | $15 billion | $15 billion | $15 billion | $15 billion |

| Delay Medicare Tax Repeal | -$65 billion | -$65 billion | -$65 billion | -$65 billion |

| Total Cost / Savings of Amendment | -$20 billion | $10 billion | $100 billion | $250 billion |

| Total Fiscal Impact of AHCA with Amendment | -$170 billion | -$140 billion | -$50 billion | $100 billion |

Source: CRFB estimates. Note: enrollment refers to any package of health insurance eligible for tax credits and represents an average from 2018 to 2026. Estimates are rough and rounded.

Until we know the impact of the EHB changes, we won’t know how much of the $150 billion in deficit reduction from the manager's amendment – if any – will remain. Members should wait for a new CBO analysis before voting on this legislation. As CRFB president Maya MacGuineas argued recently, “Congress should not have to pass the bill to find out how much it will cost.”