What CBO Says About the Updated AHCA

The Congressional Budget Office (CBO) just released their updated score of the American Health Care Act (AHCA) with the inclusion of manager's amendments being considered by the House Rules Committee. This does not include any changes still under consideration before the final vote, including changes to essential health benefits.

| Provision | 2017-2026 Cost / Savings (-) | |

|---|---|---|

| Original AHCA | Updated AHCA | |

| End Mandate Penalties | $210 billion | $210 billion |

| Reduce Spending and Tax Subsidies | -$1.66 trillion | -$1.62 trillion |

| Increase Spending and Tax Subsidies | $542 billion | $636 billion |

| Repeal ACA Taxes | $575 billion | $622 billion |

| Total Deficit Impact (Conventional Scoring) | -$337 billion | -$150 billion |

Among the key findings and differences from the original bill include:

- The updated AHCA would reduce deficits by $150 billion through 2026 under conventional scoring; the original bill would have reduced deficits by $337 billion.

- The updated AHCA’s $150 billion of savings is the result of a $1.62 trillion reduction in the cost of spending and tax subsidies with most of the funds used to pay for ending the mandate penalties ($210 billion), increasing spending in other areas while instituting new tax subsidies ($636 billion), and cutting taxes by $622 billion by repealing most of ACA's tax hikes beginning retroactively in 2017.

- On net, the updated AHCA would reduce outlays by $1.15 trillion and revenue by $1 trillion through 2026 (the prior version would have reduced outlays and revenue by $1.22 trillion and $883 billion, respectively).

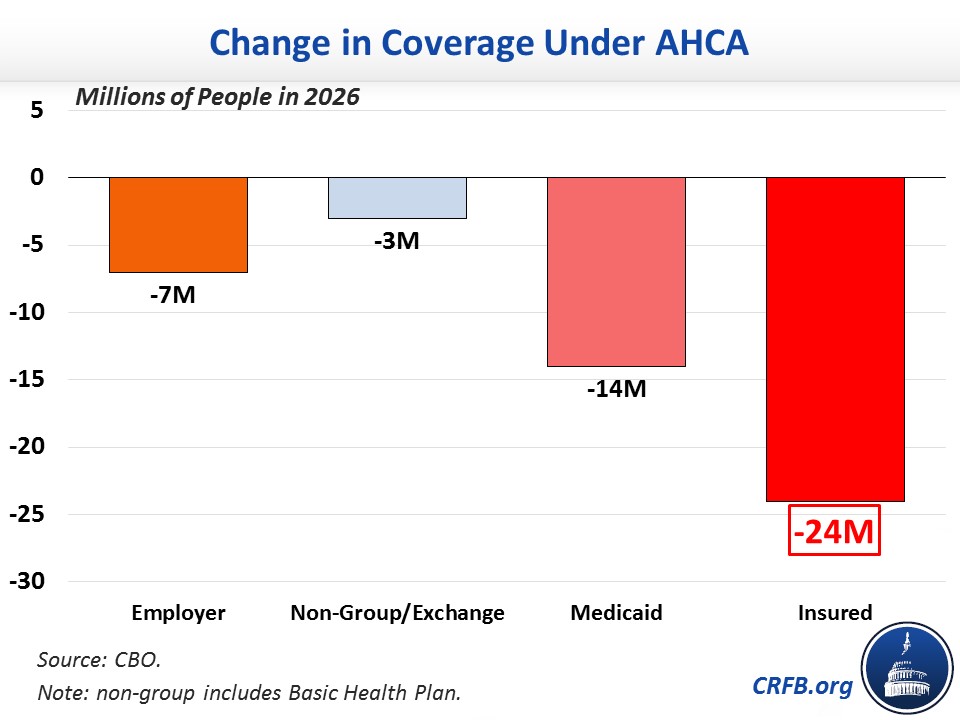

- CBO’s estimate of the bill’s coverage effects is essentially unchanged from the prior version. CBO projects the updated AHCA would reduce the number of Americans with health insurance by 14 million in 2018 and 24 million by 2026. The 24 million reduction is the result of 14 million fewer Medicaid beneficiaries, 7 million fewer individuals with employer coverage, and 3 million fewer in other coverage areas including the exchanges.

- CBO estimates that, like the prior version of the AHCA, the current version would cause premiums to rise in the short term by 15 to 20 percent on average in 2018 and 2019 and then fall by 10 percent relative to current law by 2026.

- CBO has still not completed an estimate of the macroeconomic effects of this version of the bill (or prior bill) or a second-decade estimate, though we estimate that the bill would continue to reduce deficits over the long term at a lower magnitude than the prior version. In our assessment, the legislation would likely produce modest increases in economic growth under CBO's model.

The table below breaks down the major elements of the CBO score.

| Provision | 2017-2026 Cost / Savings(-) | |

|---|---|---|

| Original AHCA | Updated AHCA | |

| Reduce Individual Mandate Penalty to $0 | $171 billion | $171 billion |

| Reduce Employer Mandate Penalty to $0 | $38 billion | $38 billion |

| Subtotal, End Mandate Penalties | $210 billion | $210 billion |

| Repeal ACA Premium and Cost-Sharing Subsidies in 2020 | -$673 billion | -$663 billion |

| Reduce ACA Medicaid Match to Base Medicaid Rate for “Expansion” Beneficiaries, Establish Per-Capita Caps, & Institute Optional Work Requirements* | -$880 billion | -$839 billion |

| Other Reductions | -$41 billion | -$47 billion |

| Coverage Interactions | -$70 billion | -$70 billion |

| Subtotal, Reduce Spending and Tax Subsidies | -$1.66 trillion | -$1.62 trillion |

| Establish Flat Age-Adjusted Health Care Tax Credits in 2020 | $361 billion | $357 billion |

| Reduce the Medical Expense Deduction Floor from 7.5% to 5.8% | n/a | $90 billion |

| Establish Patient and State Stability Fund | $80 billion | $80 billion |

| Repeal Disproportionate Share Hospital Payment Cuts (Medicare & Medicaid) | $74 billion | $79 billion |

| Expand Health Savings Accounts | $19 billion | $19 billion |

| Other Costs | $8 billion | $11 billion |

| Subtotal, Increase Spending and Tax Subsidies | $542 billion | $636 billion |

| Repeal ACA 3.8% Net Investment Income Tax (NIIT) | $158 billion | $172 billion |

| Repeal ACA Health Insurer Tax | $145 billion | $145 billion |

| Repeal ACA Medicare Hospital Insurance 0.9% Surtax | $117 billion | $127 billion |

| Delay ACA “Cadillac Tax” Start Date | $49 billion (delayed to 2025) |

$66 billion (delayed to 2026) |

| Repeal Most Other ACA Tax Increases | $106 billion | $112 billion |

| Subtotal, Repeal ACA Taxes | $575 billion | $622 billion |

| Total Deficit Impact | -$337 billion | -$150 billion |

Source: Congressional Budget Office and Joint Committee on Taxation. Note: numbers may not add due to rounding. *The work requirement did not exist in the prior version of the bill.

The biggest changes in the cost estimate of this version of the bill come from further changes to Medicaid (described in our blog on the manager's amendments), repealing the ACA's taxes effective for tax year 2017 (instead of 2018) for an additional cost of $48 billion, and reducing the medical expense deduction floor even further than the original bill – from 10 percent under current law to 7.5 percent under the original AHCA to 5.8 percent in the updated AHCA. The medical expense deduction change is considered to be a placeholder for alternative policies that the Senate could use the $90 billion price tag to enact, so CBO's estimate includes the deduction's effect on cost and coverage in spite of the likelihood that it will disappear if the Senate makes changes to the bill.

CBO's estimate of the coverage change from the AHCA did not change substantially from the previous version. The charts below shows how much coverage would change in 2026 as compared to current law under the ACA.

Here is how the AHCA compares to other "repeal and replace" scenarios:

Importantly, CBO’s estimates do not incorporate future changes that could be made to insurance market rules, either by regulation, further legislation, or further amendments to this bill that are still being discussed. Such changes have the potential to increase total insurance coverage relative to the AHCA. However, increasing coverage would also likely increase the total cost. Likewise, the coverage estimates will likely change if the Senate changes the bill.

Further Readings