House Health Care Bill Would Accelerate Medicare Insolvency to 2023

Update (3/23/2017): These numbers are relevant for the original version of the American Health Care Act. An amended version was released on March 20. CBO scored the amended version on March 23.

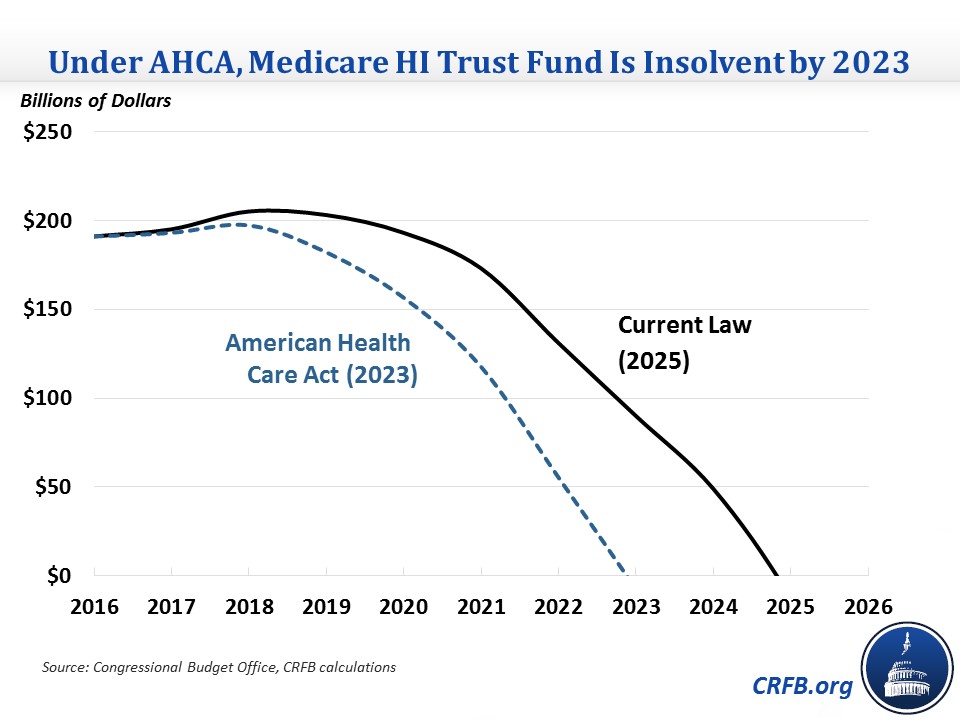

We have previously discussed the American Health Care Act (AHCA), the House Republican health care bill, and its overall effects on deficits and insurance coverage. Despite the fact that the AHCA would reduce deficits, it would prove fiscally harmful in one area: Medicare solvency. Based on Congressional Budget Office (CBO) projections, we estimate that the legislation would accelerate the insolvency date of Medicare Part A's Hospital Insurance (HI) trust fund from 2025 to 2023 and increase primary deficits in the trust fund by $150 billion through 2026.

The bill harms Medicare's finances in two main ways. First, it repeals the 0.9 percent HI surtax on people earning more than $250,000, which CBO estimates would cost $117 billion over ten years. In addition, the increase in the number of uninsured would boost Medicare Disproportionate Share Hospital (DSH) payments, which go to hospitals that serve a high percentage of uninsured patients, by $43 billion. Slightly offsetting these two factors is the fact that people losing employment-based coverage would get a higher share of their compensation in wages and salaries that are subject to the standard HI tax. We very roughly estimate this development would raise $5 billion for the HI trust fund.

Based on CBO's HI projection, these changes would increase HI's 2017-2026 cash flow deficits (deficits excluding interest from the trust fund) from about $350 billion to $500 billion.

Effect of American Health Care Act on HI Trust Fund Deficits

| Provision | 2017-2026 HI Cash Flow Deficits |

|---|---|

| Current Law HI Deficits | $350 billion |

| HI Surtax Repeal | +$117 billion |

| Medicare DSH Payments | +$43 billion |

| Indirect Income Effects | -$5 billion |

| AHCA HI Deficits | $500 billion |

| Memo: Total Effect of AHCA | +$150 billion |

Source: Congressional Budget Office, CRFB calculations

They would also accelerate HI's projected insolvency date from 2025 to 2023, based on CBO projections, which would give lawmakers just six years to prevent the trust fund from running out. In the year after insolvency, payments from the trust fund would be cut by about 14 percent to bring spending in line with revenue.

The Medicare Chief Actuary would likely estimate similar effects, as it had been previously reported that repealing just the HI surtax would accelerate HI insolvency from 2028 to 2025 (under the Medicare Actuary's estimate which is different than CBO's) and increase HI's 75-year shortfall from 0.73 to 1.12 percent of payroll. Incorporating the other elements would presumably increase the deterioration in HI's finances and in our rough estimation likely advance the insolvency date to 2024.

The worsening of HI's finances in this bill is not unavoidable. There are plenty of options to improve HI's finances, including broadening the payroll tax base, reforming Medicare cost-sharing, and reforming provider payments. Lawmakers can and should modify the AHCA to at the very least hold the HI trust fund harmless and ideally strengthen it.