Health Care in CBO’s Long-Term Budget Outlook

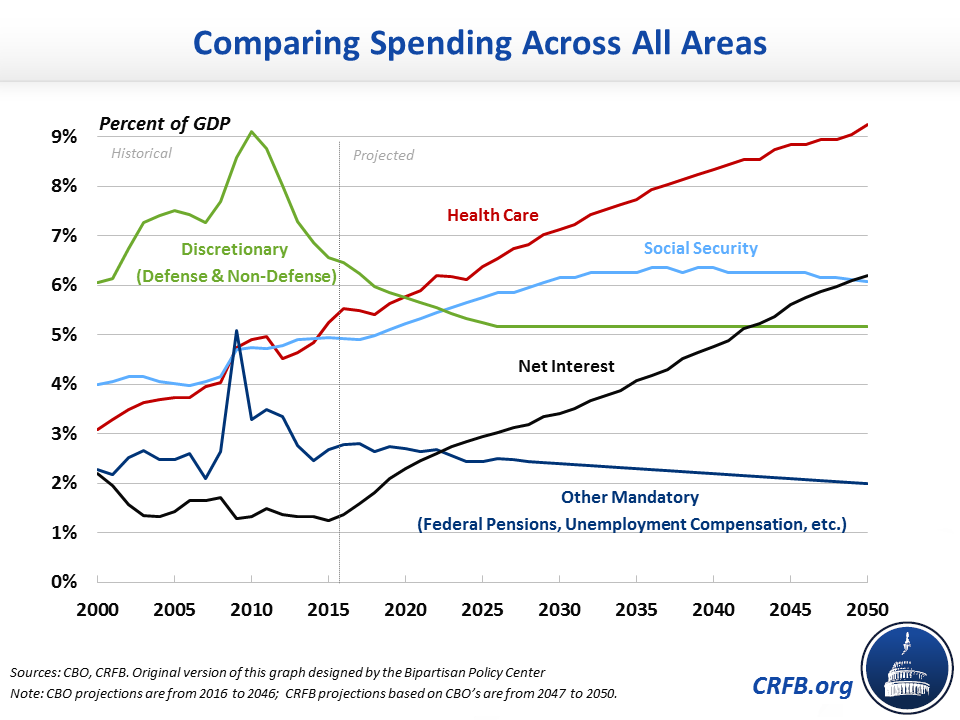

Federal health care spending is one of the most important projections in the Congressional Budget Office’s (CBO) recent Long-Term Budget Outlook since it is a key driver of the growing national debt. The government spends more on all federal health programs including Medicare, Medicaid, and Affordable Care Act (ACA) subsidies than on Social Security, defense, or anything else; aside from interest, federal health spending is the fastest growing part of the budget.

Spending on federal health care programs is projected to rise substantially over the next thirty years. Medicare spending is expected to increase from 3.2 percent of Gross Domestic Product (GDP) this year to 5.7 percent by 2046, while Medicaid, the Children's Health Insurance Program, and ACA subsides will grow from 2.3 percent of GDP to 3.1 percent. As a result, total federal health spending will increase by 3.4 percent of GDP over the next three decades.

CBO's latest projections are slightly higher than last year's: after three decades, federal health spending will be 8.9 percent of the economy under this year's projections (about 5.7 percent Medicare, 3.1 percent other health programs), whereas under last year's it would have been 8.7 percent (5.6 percent Medicare, 3.1 percent other health programs).

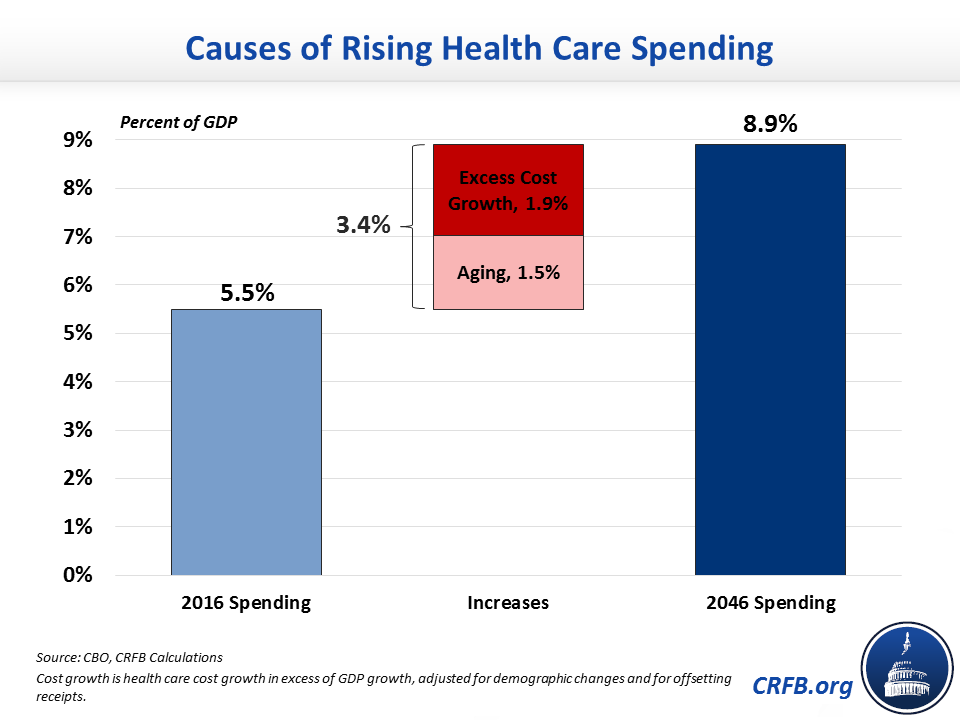

Two main drivers can explain the entire increase in federal health spending as a share of GDP. First, an aging population – due to the retirement of baby boomers, low birth rates, and rising life expectancy – is increasing enrollment in Medicare (generally available only for those age 65 and over) and in Medicaid's long-term care benefits. Older Medicare and Medicaid enrollees also tend to be more expensive. Second, per-person health care spending has historically grown faster than the economy, and this "excess cost growth" is projected to continue. CBO estimates that by the end of the third decade, private health spending and federal health spending will grow on average 1 percentage point faster than GDP.

Of the projected 3.4 percentage point increase in federal health spending over the next three decades, we estimate – based on CBO estimates of gross spending – 1.5 percent of GDP is attributable to aging and 1.9 percent to excess health care cost growth. Much of the total cost growth is from interaction effects that wouldn't exist if the two factors were evaluated independently. (E.g., If there were no aging, excess cost growth would also be smaller.)

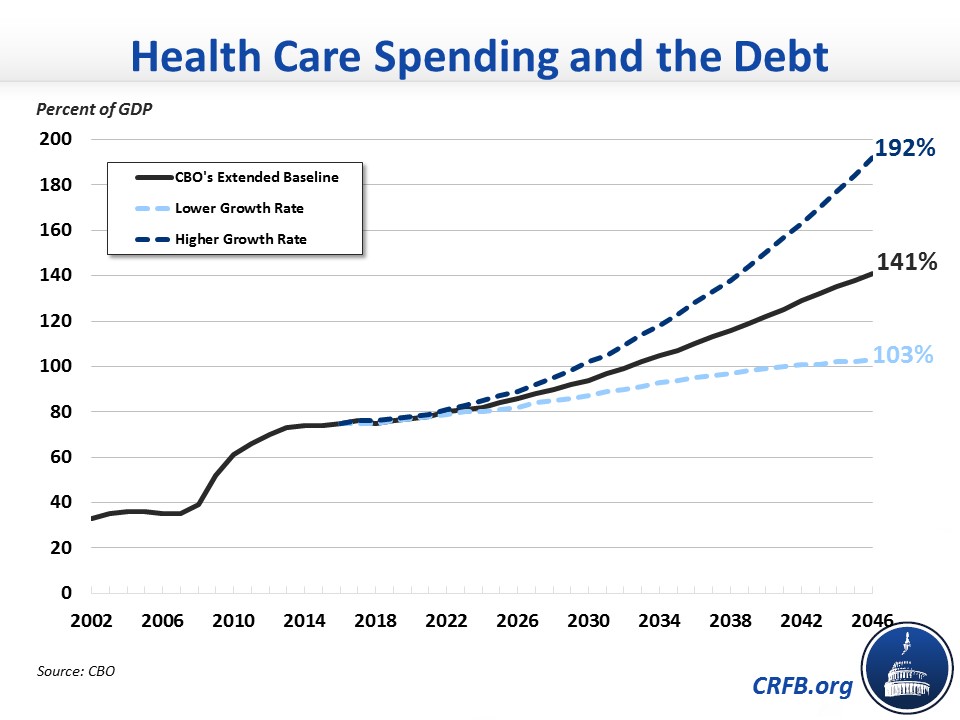

Because federal health care spending is such a large and rapidly growing part of the budget, its growth rate significantly impacts the debt. As a result, changes in health care cost growth would significantly alter CBO's debt projections.

In its baseline, CBO expects debt to nearly double from a post-war record high 75 percent of GDP today to 141 percent of GDP by 2046. Yet if per capita health care cost growth were to grow one percentage point slower per year (leading to average growth at about the pace of the economy), debt would rise to 103 percent of GDP. Conversely, were health care costs to grow one percentage point faster per year – implying excess cost growth of 2 percent, much closer to the average over the past forty years – debt would reach 192 percent of GDP by 2046.

These projections highlight the huge importance of controlling and slowing health care cost growth. Limiting health care cost growth to the pace of the economy will make it much easier to fix the debt through a combination of new revenue, targeted spending cuts, and reforms that save Social Security. On the other hand, allowing health care spending to grow more rapidly than current projections would create a much more challenging fiscal situation.

There are many options for curbing the costs of health care. Some – such as reforming cost-sharing rules, bundling provider payments, and reforming medical malpractice laws – can actually reduce costs while improving the overall value of health care. Others – such as reductions in provider payments, increasing income-related premiums, or placing restrictions on states trying to inflate their Medicaid matches – can ensure that scarce resources are being spent in the most effective way possible. And some, such as the "Cadillac tax" on high-cost health plans scheduled to go into effect in 2020 (but sadly, already once-delayed in implementation) raise revenue while encouraging the private sector to do its own part in controlling costs.

Evidence is clear that lawmakers need to make changes to rein in the growing cost of health care. Otherwise health care, along with the growing cost of Social Security and interest payments, will lead to higher debt and crowd out other federal spending. Lawmakers have many options for controlling the cost of federal health spending, and we encourage them to take action sooner rather than later.