CBO's Outlook for Long-Term Health Care Spending

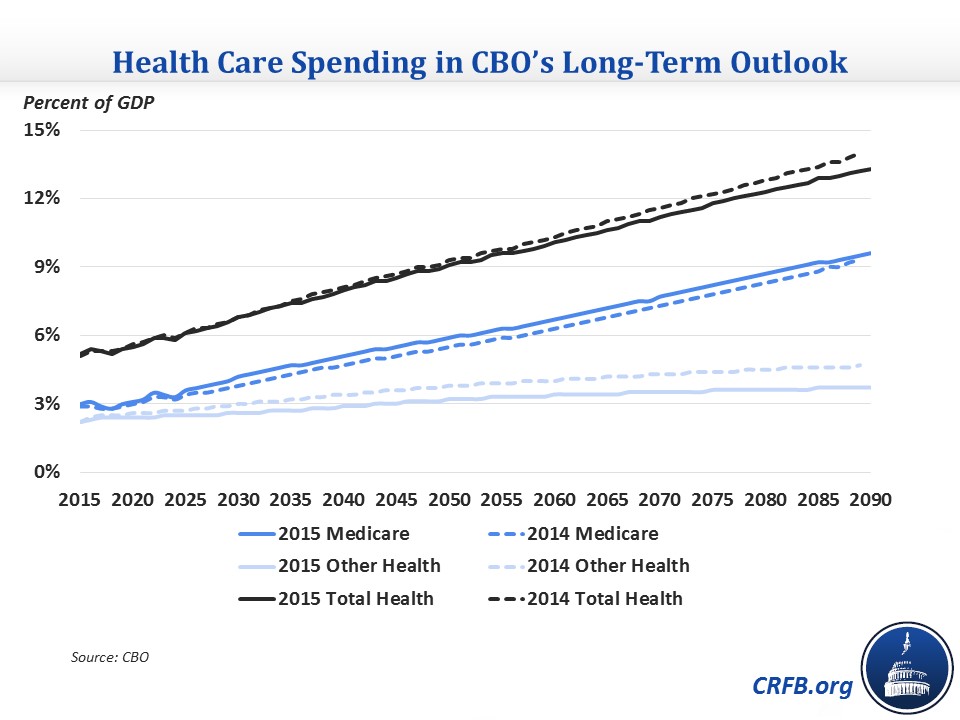

Health care spending is arguably the most important part of CBO's long-term outlook, being a key driver of our nation's growing debt over the long term. Little has changed, though, since CBO's outlook last year, with similar assumptions for excess health care cost growth but a small improvement towards the end of the 75-year period due to a change in an assumption about Medicaid.

As a result of the fiscally-irresponsible physician payment law passed this year and slightly higher assumed long-term cost growth, Medicare spending is projected to be higher than last year's outlook by about 0.1 percent of GDP per year for the next ten years and by increasing amounts in later years. CBO expects Medicare spending to grow from 3 percent of GDP this year to 5.1 percent by 2040 (about as much as all federal health care spending this year), 7.2 percent by 2065, and 9.6 percent by 2090.

Other major health care spending – including Medicaid, the Children's Health Insurance Program, and the Affordable Care Act's (ACA) health insurance subsidies – has improved both as a result of short-term revisions to spending in CBO's ten-year projections and a change in CBO's assumption about Medicaid eligibility over the long term. CBO now assumes that, since Medicaid eligibility is largely determined by the poverty line, which grows with inflation, as real wages increase, more and more of the currently eligible would eventually lose eligibility. In the past, CBO assumed that states would either expand eligibility, increase outreach to the currently eligible, or expand benefits in order to offset this effect, but now it assumes they will only offset one-half of the effect. This assumption reduces their Medicaid eligibility projections by 4 percent over the next 25 years.

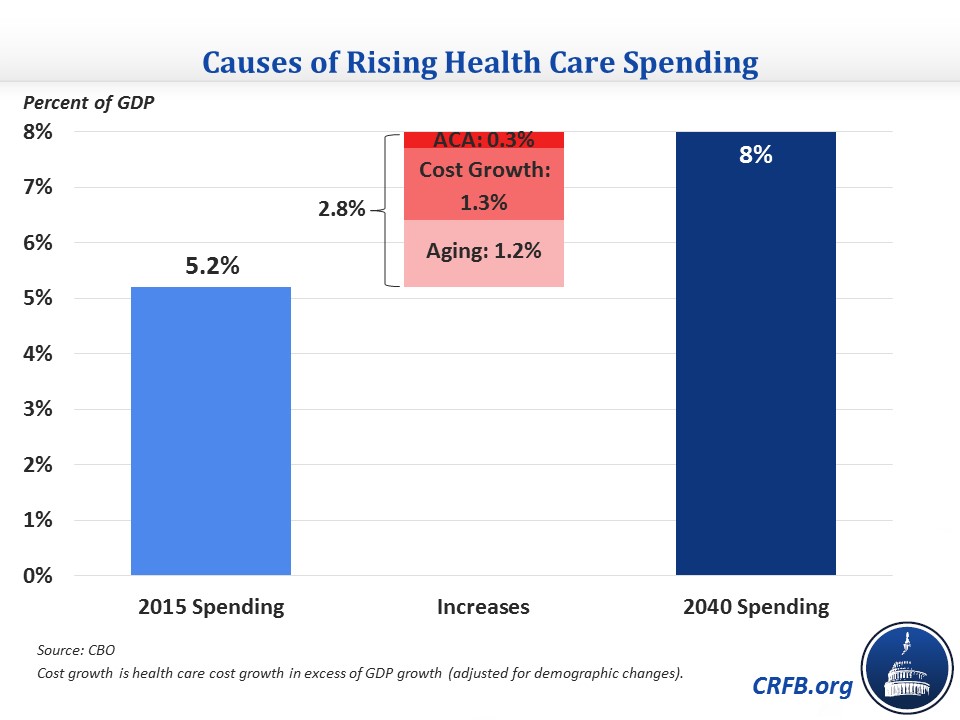

Overall, health care spending is projected to grow from 5.2 percent of GDP in 2015 to 8 percent by 2040 and over 13 percent by 2090. Growth over the next 25 years will mostly be driven by aging of the population (43 percent) and excess health care cost growth (45 percent), and also to a much lesser extent by the coverage expansions in the Affordable Care Act (12 percent). Interestingly, CBO attributes much less of the growth to the ACA than it did last year, when it saw the coverage expansions as being a more equal contributor with the other two factors.

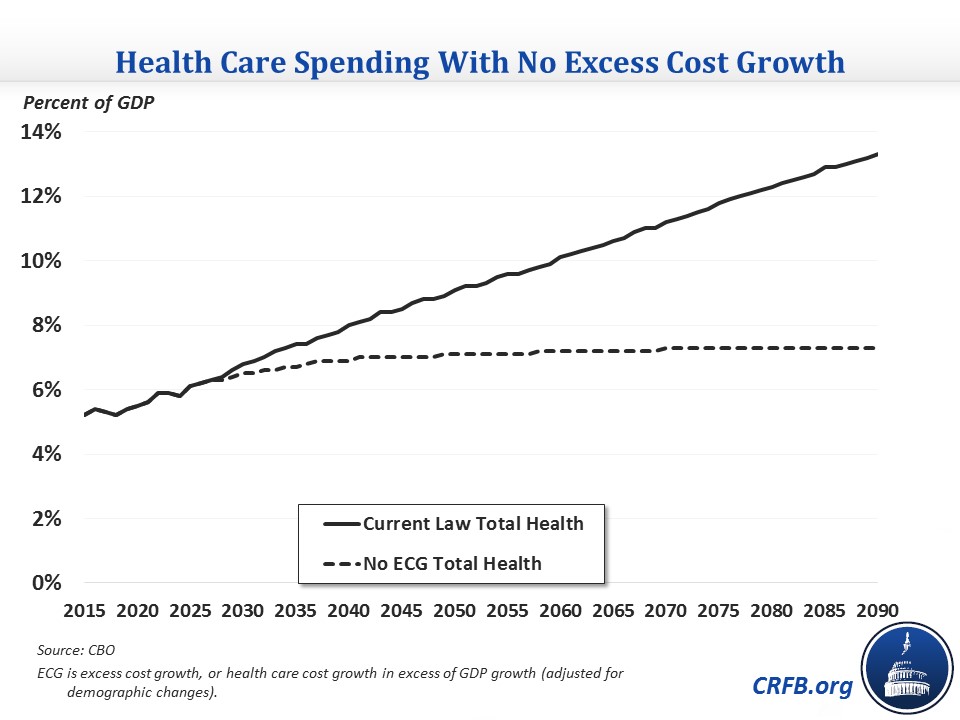

CBO also shows the large difference that controlling health care cost growth can have on spending. If lawmakers managed to eliminate excess health care cost growth (a very lofty goal given its history), meaning that spending per person grew with GDP (adjusted for demographic changes), health care spending would be more than 1 percent of GDP lower in 2040 and 6 percent of GDP lower by 2090. Between 2040 and 2090, health care spending would be nearly flat as a percentage of GDP if there were no excess cost growth, meaning that excess cost growth is almost entirely driving the health care spending increase after 2040, rather than aging and the ACA expansions.

With Medicare spending still projected to grow faster than the economy, CBO also hints at when the Hospital Insurance trust fund, which finances Medicare Part A, will run out of reserves, although no longer estimates a specific date. Because its long-term Medicare projections use the same growth rate for the entire program, CBO does not think including specific financial statistics for just Part A would be appropriate. Nonetheless, they do say that Part A insolvency would likely occur in the few years after 2025, and their ten-year numbers imply that insolvency would likely occur earlier than the 2030 date they projected last year.

The main conclusions about health care and the budget remain unchanged from last year's report. CBO still projects health care spending to grow significantly over the long term and be a major driver of the growth in debt. Thus, lawmakers need to focus on controlling health spending rather than undertaking counterproductive legislation.

This blog is part of a series examining aspects of CBO's 2015 Long-Term Budget Outlook. Click here to read our 6-page summary of CBO's paper, or here for other blogs in the series.