House IPAB Repeal Vote Would Damage the Long-Term Outlook

Isn’t it ironic, mere days after the Congressional Budget Office (CBO) warns about our nation’s long-term fiscal challenges in its annual report, the House of Representatives is set to vote on repealing a key mechanism put in place to constrain the core driver of our growing debt?

The Independent Payment Advisory Board (IPAB), scheduled for a repeal vote tomorrow, is a 15-member board of Senate-confirmed experts created by the Affordable Care Act (ACA) for the purpose of controlling Medicare costs. If Medicare per-beneficiary cost growth is projected to exceed GDP per capita growth plus one percentage point (GDP+1%), IPAB (or the Secretary of Health and Human Services if no Board members have been appointed) must make targeted recommendations to provider payments – which cannot affect Medicare benefits, eligibility, or cost-sharing – to bring per-beneficiary spending back in line. These recommendations then automatically take effect unless a majority in Congress votes to replace them with equivalent savings or a three-fifths majority of Congress overrides them entirely.

This last protection is valuable given how difficult it is for lawmakers to enact fiscally-responsible reforms otherwise. That repealing IPAB now has broad support in Congress just reinforces its importance.

Yet, despite IPAB’s potentially huge impact on constraining Medicare spending growth in the long run, the House is proposing to offset only the $7 billion first-decade cost of repeal with a one-time rescission of money in the ACA-created Prevention and Public Health Fund, which funds initiatives and research aimed at promoting public health. Therefore, the bill’s offset will not save any money at all after 2025 (and if anything will actually cost money to the extent that foregone public health initiatives might have saved some money in the long-term from health improvements), while IPAB would have saved much more money in the second decade and beyond than it would in the first.

CBO makes that clear when it warns that the legislation would increase spending in subsequent decades, in violation of a new rule established in this year’s budget resolution.

In fact, the cost of repealing IPAB should generally grow over time as CBO predicts a higher probability of Medicare per-beneficiary costs growing faster than GDP+1% after this decade. To project the cost of repealing IPAB, CBO estimates the probability that spending growth would exceed that limit in each year, which is why the cost of repealing it is greater than the amount it is estimated to save -- the score also takes into account that spending growth could be higher than they think. By 2030, even CBO’s central estimate of per-beneficiary cost growth begins to exceed GDP+1%.

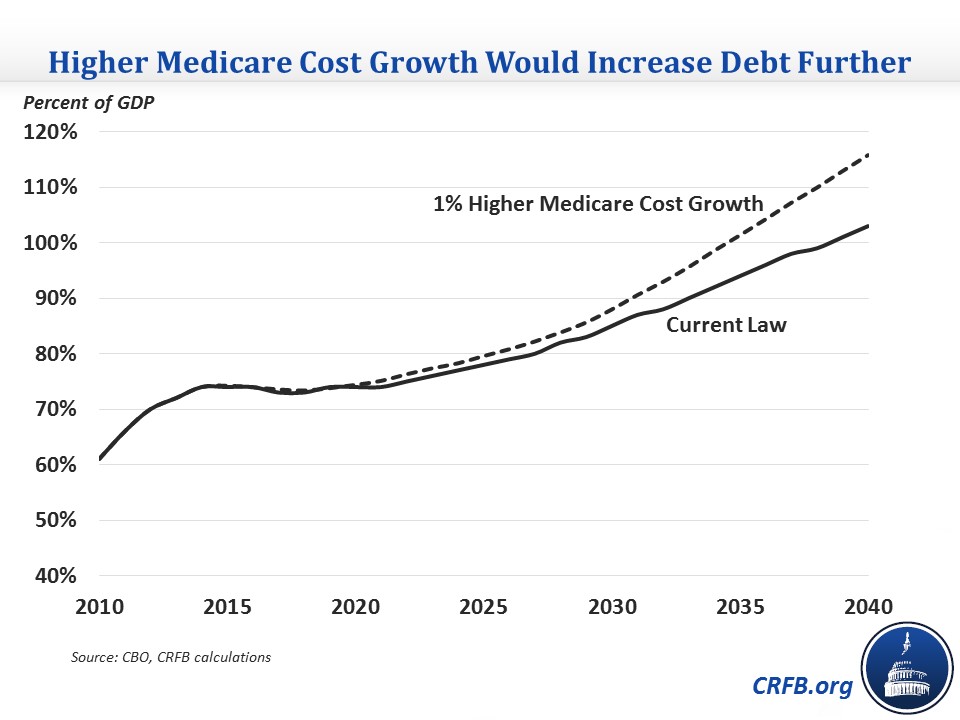

It is possible the current slowdown in Medicare spending lasts, and IPAB will never be needed, but the future of health care is highly uncertain and repealing IPAB creates a one-sided risk for taxpayers, with the potential to cost us far more even than CBO projects. Without IPAB, if Medicare spending grows just one percentage point faster annually than currently projected, debt would be 15 percent of GDP higher than expected by 2040. IPAB thus plays as an important role as a backstop in case Medicare spending growth rebounds. Due to its value in promoting fiscal responsibility, IPAB should not be repealed unless it is replaced with a new cap on Medicare spending growth or reforms that truly help bend the program’s cost curve.

On top of this irresponsibility, Congress is also voting today to repeal the ACA’s medical device tax without offsets, instead continuing the trend of exempting the costs from PAYGO. The medical device tax was included in the ACA to help pay for the law's new health coverage subsidies and to compensate in part for the financial gains device companies could expect as a result of increased coverage. At a time of already-high debt and with a myriad of options at lawmakers’ disposal to restrain health care spending or find new revenue, there is no reason to add the costs of repeal onto the nation’s credit card. We’ve previously highlighted many such options, and far more exist.

CBO’s recent report makes clear that our long-term debt problems are still far from solved, so now is not the time to backtrack on fiscal responsibility.