Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Income Growth Would Slow By One-Third Due to Rising Debt

A new report from the Congressional Budget Office (CBO) finds rising national debt will slow economic growth and reduce projected incomes. Compared to...

CMS Finalizes Medicaid Rule Likely to Increase Spending

In a rule finalized at the end of April, the Centers for Medicare and Medicaid Services (CMS) introduced significant changes to financing and...

Maya MacGuineas: The grim future for Medicare and Social Security

Maya MacGuineas is president of the Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt. She recently wrote an opinion...

How Much will Biden’s Tariffs Raise?

President Biden recently announced increases to a number of tariffs on Chinese imports, including for lithium-ion batteries, electric vehicles, and...

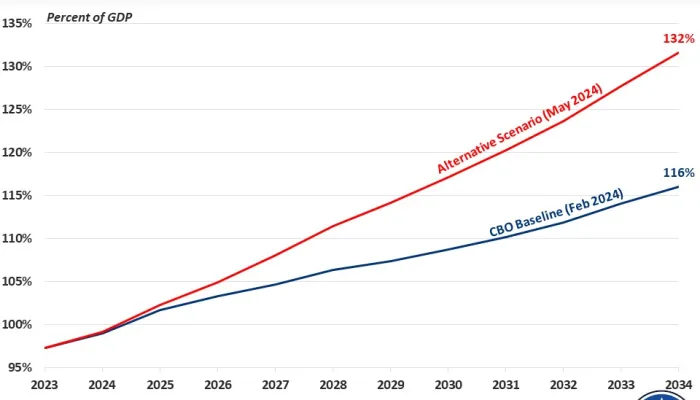

Debt Surges With Extensions

Based on new estimates from the Congressional Budget Office (CBO), debt could reach 132 percent of Gross Domestic Product (GDP) by Fiscal Year (FY)...

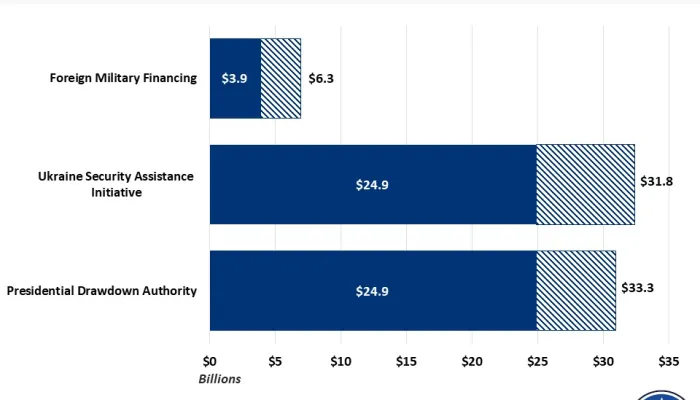

Congressionally Approved Ukraine Aid Totals $175 Billion

With the recent passage of the national security supplementals, Congress has now approved nearly $175 billion of aid and military assistance to...

Interest Costs Just Surpassed Defense and Medicare

In the first seven months of Fiscal Year (FY) 2024, spending on net interest has reached $514 billion, surpassing spending on both national defense (...

Event Recap: The Trustees' Reports on the Social Security and Medicare Trust Funds

On May 7, the Committee for a Responsible Federal Budget hosted a virtual event to discuss the status of the Medicare and Social Security Trust Funds...

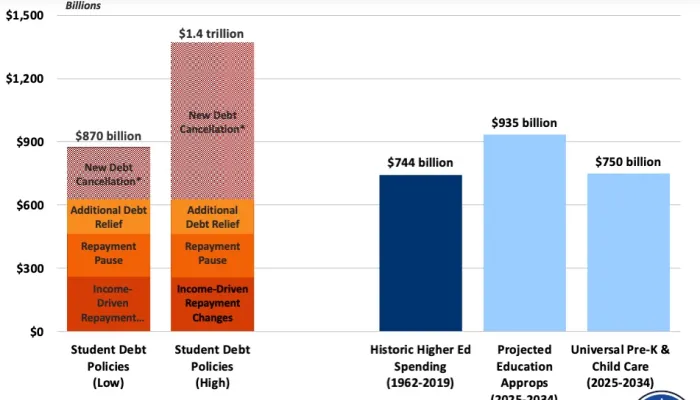

How Much Would Student Loan “Hardship” Provision Cost?

We recently estimated the President’s new student debt cancellation plan would cost between $250 billion and $750 billion over a decade, and have...

Social Security and Medicare Trustees Release 2024 Reports

The Social Security and Medicare Trustees just released their annual reports on the financial status of the Social Security and Medicare programs. The...

Maya MacGuineas on Fox News' "Special Report"

Committee for a Responsible Federal Budget President Maya MacGuineas recently joined Fox News' "Special Report" with Bret Baier to discuss the annual...

The Total Cost of Student Debt Cancellation

Including the Biden Administration’s new student debt cancellation plan, we estimate all recent student debt cancellation policies will cost a...