NYT's Tritch Misses the Mark on SSDI Funding Options

The New York Times Editorial Board's Teresa Tritch posted a piece last week on short-term solutions to avert next year's depletion of the Social Security Disability Insurance (SSDI) trust fund reserves. She opposes interfund borrowing that would loan money from the Old-Age and Survivors' Insurance (OASI) trust fund and instead supports reallocating tax revenue from one to the other. Although we don't have a stance on which is better, we couldn't help but notice that Tritch used many misleading claims to support her position, many of which we previously discussed in Dispelling Common Myths in the SSDI Debate and Debunking 8 Social Security Myths on its 80th Birthday.

Below, we correct the record where Tritch relied on myths:

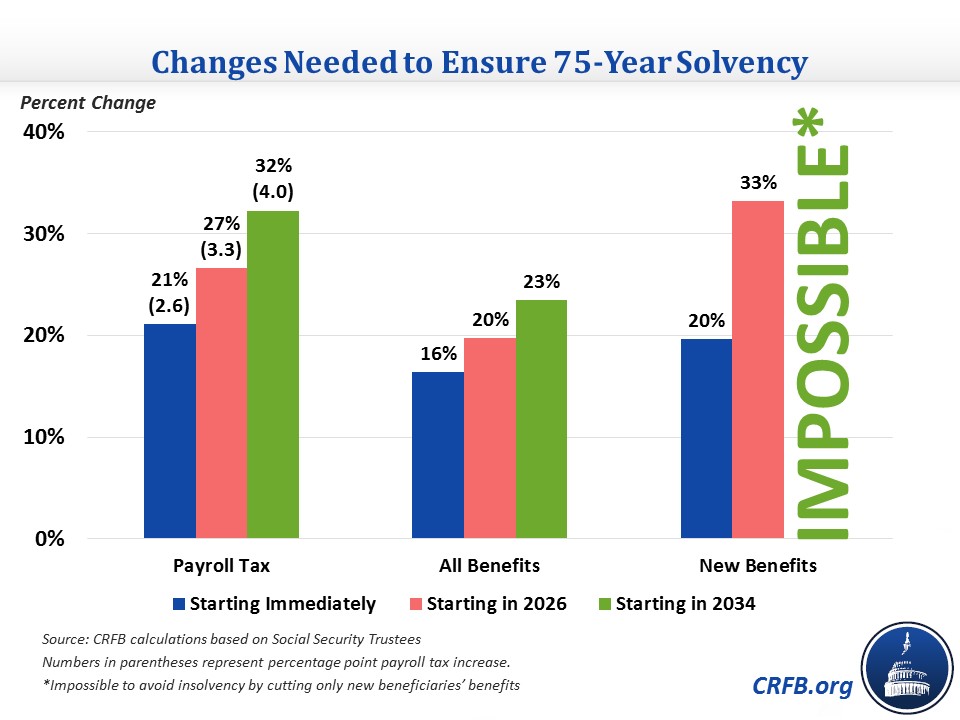

Tritch is basically correct that reallocation would ensure combined solvency for about 20 years, with the Social Security Trustees estimating insolvency in 2034 and the Congressional Budget Office estimating around 2029. But there is not "plenty of time" for long-term action. The earlier that a plan is enacted, the more it can protect vulnerable beneficiaries, introduce changes gradually, and give people time to prepare. As the deadline gets closer, it becomes more difficult to avoid steep benefit cuts or tax increases. As we explained in Delaying Social Security Changes Ties Policymakers' Hands, a shortfall that could be solved with a 2.6 point tax increase or 16 percent benefit cut today would require a 4.0 point tax increase or 23 percent benefit cut if delayed until the date of insolvency. Indeed, if lawmakers wanted to protect current beneficiaries, it would be impossible to achieve solvency – even with fully eliminating benefits for new beneficiaries – by 2034. Even waiting ten years will hamstring the ability of lawmakers to make gradual changes which give beneficiaries time to plan and adjust.

Twenty years after the tax reallocation that was intended to create the time and opportunity for such reforms, the Trustees reiterate the call for legislation to achieve long-range financial stability, though there are fewer reform options available now than there were in the 1990s, when the projected date of reserve depletion was more distant.

It's difficult to say that the 1983 changes delibrately left the system underfunded. The 1983 reallocation did shift payroll tax revenue from the disability program to the old-age program, but it was done based on what was known at the time. Since 1983, policy changes and other factors meant that SSDI costs grew faster than anticipated. Further, the 1983 reallocation was generally undone by the 1994 reallocation, which shifted payroll taxes in the other direction. Additionally, the disability program is not underfunded compared to the old-age program. Despite the fact that SSDI insolvency occurs first, the old-age program faces a larger actuarial deficit in absolute and relative terms than the disability program, and SSDI's share of revenue from payroll taxes is slighly larger than its cost.

Interfund borrowing actually began in 1981, and it wasn't "part of a process," it was the beginning of that process. The 1981 interfund borrowing legislation (accompanied by appointment of the Greenspan Commission) led to Congressional action on the 1983 Social Security amendments addressing solvency. It was followed by the cited 1982 legislation that extended borrowing authority so benefits could be paid through June 30, 1983. The 1983 changes to taxes and benefits allowed the OASI program to pay back its loan to the DI program by 1986. Today, a similar commission could be attached to any reallocation or interfund borrowing enacted to avoid trust fund depletion. We hope that whatever action is taken on reallocation or interfund borrowing would at least be accompanied by a path to reform, since it is needed desperately.

- Reallocation "would enable both funds to pay full benefits until 2033, plenty of time" for action on long-term program health.

-

The shortfall is "no surprise" and "was projected as far back as 1995."

We've tackled this claim before. The shortfall was projected after the 1994 reallocation. However, when the Social Security Trustees recommended the 1994 reallocation, they explicitly said it was intended to give policymakers time to address the entire program's financial imbalance, as noted in CRFB's Ed Lorenzen's testimony to the House Ways & Means Social Security Subcommittee in February. Policymakers were not supposed to delay action until the shortfall approached again. The fact that this deadline has been anticipated for two decades with no action taken should not be a talking point to avoid reforms; it should be a warning against again delaying action on Social Security without steps to improve solvency. As the Trustees noted in their 2015 report, a clean reallocaton would serve as just another excuse to delay reform:

- The shortfall is "due mainly to the aging of the population and to tax changes, made in 1983 and only partially reversed in later years, that have left the disability system underfunded."

- The "glib arguments"about the 1982 interfund borrowing should be discredited because that "was part of a larger process to revive the system."

Although we take no stance on whether Congress should use interfund borrowing or reallocation in order to solve the short-term SSDI funding shortfall, it is important that any debate about the options happens in a factual context. Regardless, some sort of action will be needed to prevent the impending exhaustion, and it ought to be accompanied by long-term solvency reforms that improve the program, such as those being proposed in the McCrery-Pomeroy SSDI Solutions Initiative.