Five Takeaways from the President's Final Budget

Moments ago, President Obama released the final budget of his presidency. In the coming hours, days, and weeks, CRFB will be publishing analysis of the Fiscal Year (FY) 2017 budget. Below, we start with five quick takeaways. Based on our first look, the President's budget includes:

1. A Stable Debt, But at Record High Levels

Under the President's budget, debt held by the public will grow from almost $13.7 trillion today to $21.3 trillion by the end of 2026. Yet as a share of the economy – the measure generally preferred by economists – debt under the President's budget is projected to remain relatively stable at about 75 percent of Gross Domestic Product (GDP). Stabilizing the debt is an important first step to putting it on a sustainable path and is certainly an improvement over current law, under which (according to the Office of Management and Budget's adjusted baseline) debt will rise to just under 88 percent of GDP. Yet even under the President's budget, debt would remain the highest it has been in American history other than around World War II at nearly twice the historic average over the past 50 years.

2. Serious Deficit Reduction and a Commitment to Pay for New Initiatives

The President's budget includes a number of new tax and spending initiatives, including over $300 billion of new infrastructure spending, over $150 billion of new education spending, and a significant expansion of the Earned Income Tax Credit (EITC). Encouragingly, the President not only pays for all of these new initiatives with tax increases and spending cuts but sets aside significant funds for deficit reduction. By the administration's own estimate, the budget would reduce deficits by $2.9 trillion over the next decade. Adjusting the treatment of "sequestration" to match CBO's estimating practices, the budget would save about $2.5 trillion.

3. More Taxes. A Lot More.

By our count, the President's budget proposes over $3 trillion of gross tax increases over the next ten years – about $1.3 trillion more than last year's budget – to help pay for new initiatives and deficit reduction. This includes a $10.25-per-barrel oil tax and a 14 percent tax on unrepatriated income held abroad to pay for infrastructure, an increase in the cigarette tax to pay for universal pre-K, a fee on financial institutions, a "Buffett rule" and limitation on major deductions and tax preferences for higher earners, an expansion of the estate tax, an increase in the capital gains tax and application of the tax at death, and changes to a number of tax expenditures and loopholes. The President's budget even includes $550 billion of revenue from corporations and pass-through businesses to help pay for last year's fiscally irresponsible tax extenders deal. As a result, revenue as a share of GDP will rise from just over 18 percent of GDP in 2016 to 20 percent by 2026, compared to 18.5 percent under OMB's baseline.

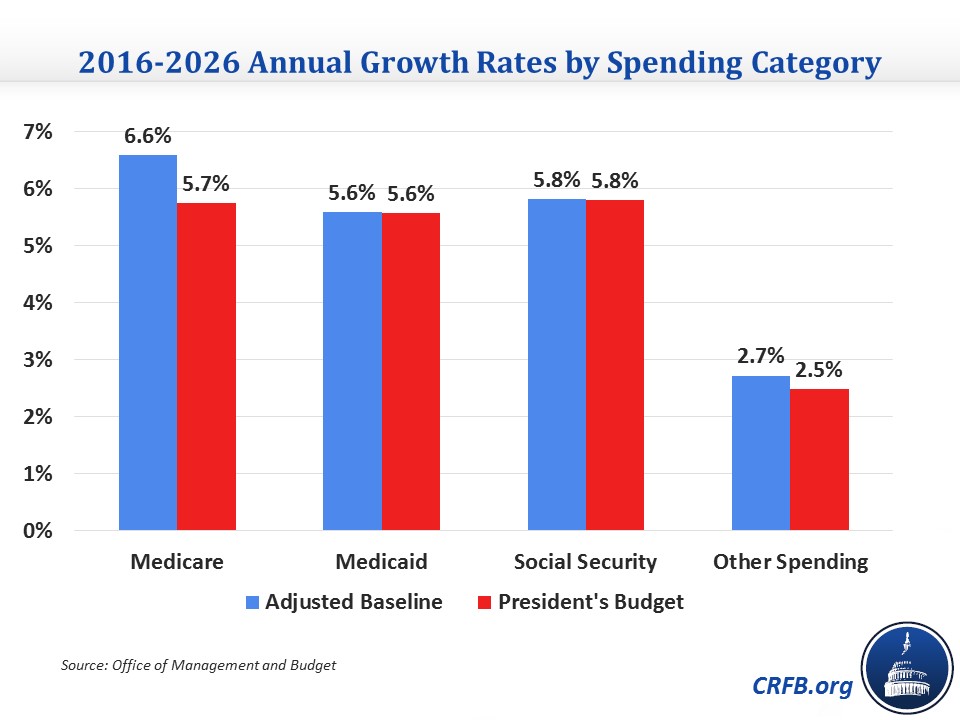

4. Slower Growth in Medicare Spending

As in previous budgets, the FY 2017 budget contains a number of reforms to slow Medicare cost growth to generate over $400 billion of deficit reduction. By reducing payments to post-acute care providers, requiring drug companies to offer lower prices, increasing premiums for high earners, cutting payments to Medicare Advantage, and making other changes, the budget reduces the average growth of Medicare from about 6.6 percent per year to 5.7 percent. A portion of these funds goes toward expanding Medicaid, particularly in the U.S. territories, while most would go toward deficit reduction. Given the unsustainable growth of Medicare, this is an important step to begin putting debt on a sustainable long-term path.

5. Almost Nothing to Save Social Security

The Social Security Disability Insurance (SSDI) trust fund is on course to exhaust its reserves within five years and the Old-Age and Survivors' Insurance fund is projected to be insolvent within 14 to 19 years. That means today's newest retirees will receive a 20 to 30 percent benefit cut as soon as age 76, and today's 53-year-olds could face a similar cut the day they reach the normal retirement age. Particularly because most politicians pledge not to change benefits for those near retirement, time is running out to enact thoughtful reforms to save the Social Security system. Yet disappointingly, the President's budget includes only minor policy changes to Social Security. Reforming Social Security will take presidential leadership, and it is disappointing that even in his final year in office the President does not put forward any real changes to improve Social Security's long-term solvency.

*****

President Obama deserves credit for proposing a budget that would prevent the projected rise in debt – not an easy task given the nation's current fiscal trajectory. But the budget should have gone much further to put debt on a downward path and strengthen entitlement programs. Moreover, while we realize that budgets are political documents, relying so heavily on revenue to reduce deficits is unrealistic in this political environment. We'll be releasing more analysis in the coming hours and days.