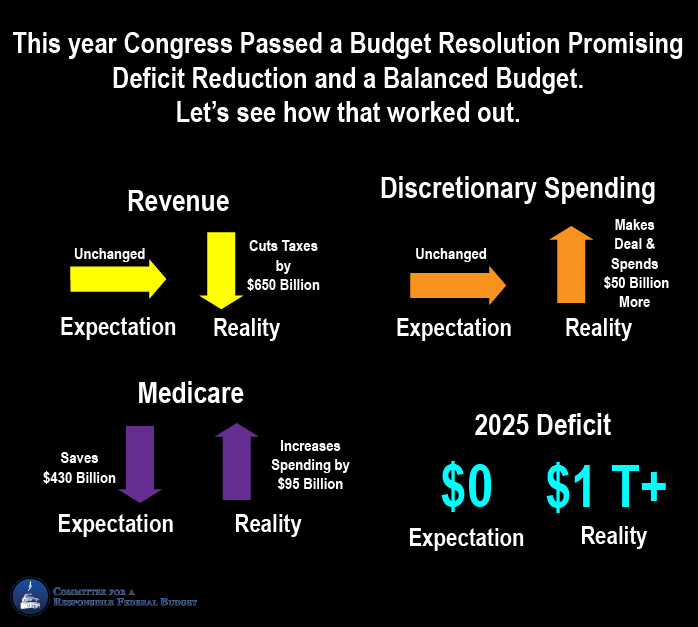

Expectations Vs Reality For the FY 2016 Budget

With the first session of the the 114th Congress rapidly drawing to a close and the big budget issues being settled, we will take a look at how the actual legislation enacted compared to the Fiscal Year (FY) 2016 Congressional budget resolution.

With a tax extenders deal that costs $680 billion (and over $2 trillion over 20 years), an unpaid-for doc fix, and gimmicks left and right, things did not turnout the way Congress had planned in their budget, which was supposed to save over $5 trillion over ten years and balance by 2024. Below we break out how badly Congress missed its targets.

| The FY 2016 Budget Resolution | The 114th Congress 1st Session | |

| Revenue | Kept at baseline | $680 billion less from tax extenders ($650 billion net with BBA 2015 revenue) |

| FY 2016 Discretionary Spending | Kept at the sequester-level spending caps | Raised 2016 discretionary budget authority by $50 billion |

| Medicare | $431 billion in net savings | $95 billion more net spending |

| The Affordable Care Act | Repealed | Delayed revenue raising measures |

| War Spending | $38 billion of defense slush fund | Included slush fund for defense and non-defense |

| Other Mandatory | $1.4 trillion in savings | $33 billion in savings* |

| Highway Trust Fund | Make solvent | Financed $70 billion transfer with $53 billion in gimmicks |

| 2025 Deficit | $24 billion surplus | On track for $1.1 trillion deficit |

| 2025 Debt | 56% of GDP | On track for 80% of GDP |

*$13 billion from the highway bill and $20 billion from the BBA 2015

For more of our coverage of the year-end tax extenders deal see our blog.